by Patrick O'Connell, CFA, John Huang, CFA & Kathleen Dumes, CFA, AllianceBernstein

New research connects intensifying natural perils to their future implications for asset classes.

When it comes to measuring our vulnerability to nature's extremes, investors often lean on past data and simply assume that risks will rise. But new groundbreaking research has removed considerable guesswork, particularly among four key natural hazards facing the world this century.

Global Experts Unite to Predict Natural Hazard Threat Levels

New projections from Columbia Climate School build on its pioneering Natural Hazards Index (NHI), launched in 2016 to assess risk-level exposure from floods, drought and a dozen other extreme events nationwide. In 2023, we partnered with the university on a version 2.0 release, which includes an interactive map of natural hazard exposures for thousands of individual US communities.

2025’s upgrade broadens Columbia’s and AB’s collaboration among leading academic and public institutions, including NASA. Applying the latest weather science, climate research and sophisticated modeling, NHI 3.0 can now project the relative location, trajectory and magnitude of the four natural hazards it tracks at midcentury and end-of-century.

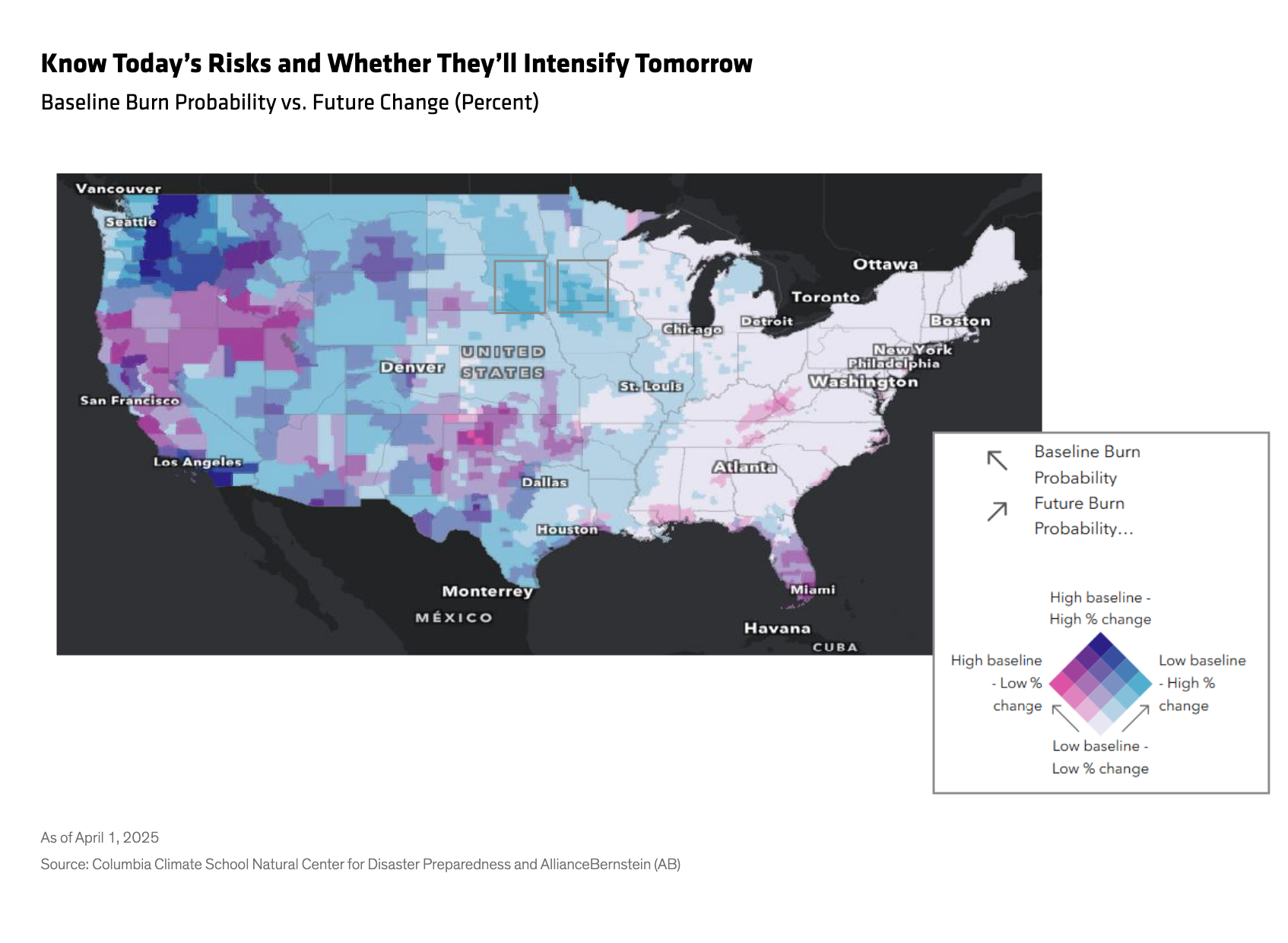

The NHI 3.0 not only tells us the ways a particular hazard has evolved, but also how it’s likely to evolve in the future. Wildfires, for example, have increased in frequency and intensity. New data not only predicts fires to worsen where they’re already commonplace, such as Southern California and Washington State, but also in areas where incidences are currently rare, like Minnesota and South Dakota (Display).

Newly forecasted tornado patterns are alarming too, with more outbursts likely stretching beyond the Midwest “alley” and much further east.

The NHI also anticipates where hazards will intersect. Sometimes, a disaster ebbs because of an equally disruptive event. The index shows that Louisiana, for instance, will likely suffer fewer wildfires but ties that to expected more frequent hurricanes, which lead to more flooding.

Tying Natural Hazard Vulnerabilities to Investable Assets

Columbia Climate School’s new data provide essential inputs for planning disaster responses and anticipating hazards’ long-range effects on people, the environment and economies. We believe it also can help investors see better around corners—which is particularly useful as climate change grows more unpredictable and hyperphysical.

With this in mind, we are incorporating key components of NHI 3.0 into our proprietary Physical Hazard Investment Risk (PHIR) tool, which overlays a financial element for each NHI hazard across more than 3,100 US counties. The expanded research now helps PHIR factor future local risk exposures to wildfires, hurricanes, tornadoes and rising sea levels in the US—considered the top four natural threats through 2050.

As an investment tool, the PHIR can assess hazard-risk exposure across municipal bonds and residential mortgage-backed securities. After all, homes, schools, hospitals, power plants and airports are all location specific, which means issuers and lenders are exposed to distinctly local trends in climate change.

Active equity investing can also benefit from the PHIR’s expanded data. Companies of all stripes can be just as exposed to local hazards—if not now, then in the coming decades. A company’s degree of risk could be exponential, since many operate in multiple locations that face elevated risk.

Wildfire projections offer a prime example of how a single company can reveal several risk profiles. A large utility with facilities in Minnesota and South Dakota may be situated in low-risk areas currently. But the wildfire outlook changes dramatically by midcentury. This region shows an increase in wildfire exposure of 88% (Display), a material factor that we believe the company—and those in similar situations—should address. In this case, we engaged the company’s leadership about applying lessons learned from its properties in wildfire-prone Colorado to their Midwest operations.

The Local Threats Are Clear, but Not Always Observed

The Local Threats Are Clear, but Not Always Observed

Not all risk scenarios will be as easily navigated. Add the rising threat of higher sea levels, tornadoes and hurricanes, and the future strain on businesses and industries is dire yet actionable. Investors don’t always take notice, however. Our expanded PHIR data set helps identify potentially mispriced investment opportunities where hazard exposure isn’t yet fully factored into market valuations.

Tomorrow's hazards won’t look like yesterday's, but they can inform today's decisions. Locally mapping future natural hazard intensity and addressing its implications will be important steps to dealing with disasters as the century plays out. We think the new predictive analysis will likely save lives and livelihoods. But this forward-looking lens can also help investors understand what natural hazard exposure means for physical assets, while motivating companies and bond issuers to offset such risks on their bottom lines.

About the Authors Patrick O'Connell, CFA

Patrick O'Connell, CFA

Patrick O’Connell is a Senior Vice President and Director of Responsible Investing Portfolio Solutions and Research for public markets. In this role, he develops strategies and tools that help integrate ESG considerations into the teams’ research, engagement and investment processes across AB’s Equities and Fixed Income businesses. From 2021 to 2024, O’Connell served as director of Fixed Income Responsible Investing Research. Earlier in his career, he served as a corporate credit research analyst, focusing on emerging-market corporates in Latin American and African countries. O’Connell joined the Emerging Markets research team in 2013 after working as a credit analyst covering US high-yield energy credits at AB. Prior to joining the firm in 2012, he was a desk analyst at UBS Investment Bank, where he helped allocate capital on the trading desk. O’Connell holds a BS in accounting and finance (magna cum laude) from Villanova University and is a CFA charterholder. Location: New York

John Huang is a Senior Vice President and AB’s Director of Responsible Investments, Data and Technology on the Responsibility team, where he partners with our Technology and Operations team to develop and execute on our strategy for ESG data, technology and analytics across the firm. This is an expansion of his role as director of Fixed Income Responsible Investing, Data and Technology. Huang previously spent eight years as a research analyst for Commercial Real Estate Credit Research within the Securitized Assets Research team, covering commercial mortgage-backed securities in support of the firm’s global fixed-income portfolios. Prior to that, he was an associate portfolio manager on the Fixed Income Multi-Sector team, serving US Core and Core Plus clients. Huang joined AB in 2005 as an attribution analyst and developed the firm’s proprietary fixed-income attribution platform. Prior to that, he worked as a performance analyst at UBS. Huang holds a BS in finance and information technology and an MBA from the State University of New York, Binghamton. He also holds a Series 7 and 63 license and is a CFA charterholder. Location: New York

Kathleen Dumes is a Vice President and Research Analyst on AB’s Responsible Investing Portfolio Solutions and Research team. In this role, she develops strategies and tools for equity and fixed-income teams, including integrating ESG considerations throughout the teams’ research, engagement and investment processes. Previously, Dumes was a research analyst on the Fixed Income Responsible Investing team. Prior to that she served as a portfolio analyst on the Global Multi-Sector Portfolio Management team, where she was responsible for the management and strategy implementation of the firm’s income-oriented credit strategies. Prior to joining the multisector team, Dumes was an associate portfolio manager on the Investment Grade Credit team, focusing on Global and US Credit portfolios. Before joining AB in 2015, she was an investment consultant at Bank of America Merrill Lynch in their Institutional Investment Strategy Group. Dumes holds a BS in finance (summa cum laude) from The College of New Jersey and an MBA with honors from The University of Chicago Booth School of Business. She is a CFA charterholder. Location: New York