by Craig Basinger, Purpose Investments, David Benedet, Portfolio Manager, Purpose Investments

On a handful of occasions over the past 15 years, investors became excited about international equities, emboldened by brief spats of outperformance against the mighty S&P 500. And in all those cases, it faded quickly as S&P ‘exceptionalism’ reclaimed its spot at the top of the performance tables.

This wasn’t always the case, as there have also been extended periods when EAFE or international equities outperformed the U.S. Now, with EAFE up about 13% so far in 2025 and the S&P 500 down over 3%, folks are talking international once again. Will this be yet another false signal, or is this cyclical dance finally changing tunes?

Comparing the U.S. equity market with EAFE is not as different as apples to oranges, but certainly to different kinds of apples. The U.S. market is skewed to more technology and many globally operating companies. Japan, too, has a lot of technology, but certainly more consumer discretionary and less financials. Europe has more financials, less technology. This does help provide some diversification, from different mixes and exposures.

So could we be entering a long period of international outperformance versus the U.S.? The setup is in place, but it has been in place for many years. Valuations naturally favour international, but that is usually the case given the sector differences and the valuations of those relative sectors.

That being said, the valuation spread was very extreme at the end of 2024 – a bit less so today. And it is not earnings growth, as estimates for 2025 have come down more outside the U.S. We have a hard time believing investors are banking on 2026 estimates at this point with so much uncertainty.

Probably more important than the above fundamentals is the starting points and relative changes. The U.S. dominated the 2010s thanks largely to technology megacaps. This received a boost following COVID, as U.S. policy was much more stimulative, both monetarily and fiscally. This helped the U.S. economy grow faster than most others, which were more restrained in their stimulus and spending.

This may be changing. The U.S. is beginning efforts to grapple with its deficit. Meanwhile, more and more international countries are starting to increase spending or spending plans. Add to this that the market has such high expectations for the U.S. economy and market, while much lower expectations for many international economies and markets. The bar is set pretty low in many places.

Most would agree that the European consumer is in very good shape. Japan is finally making progress on reforms to encourage more investor-friendly company behaviours. Add some negative sentiment around U.S. policy.

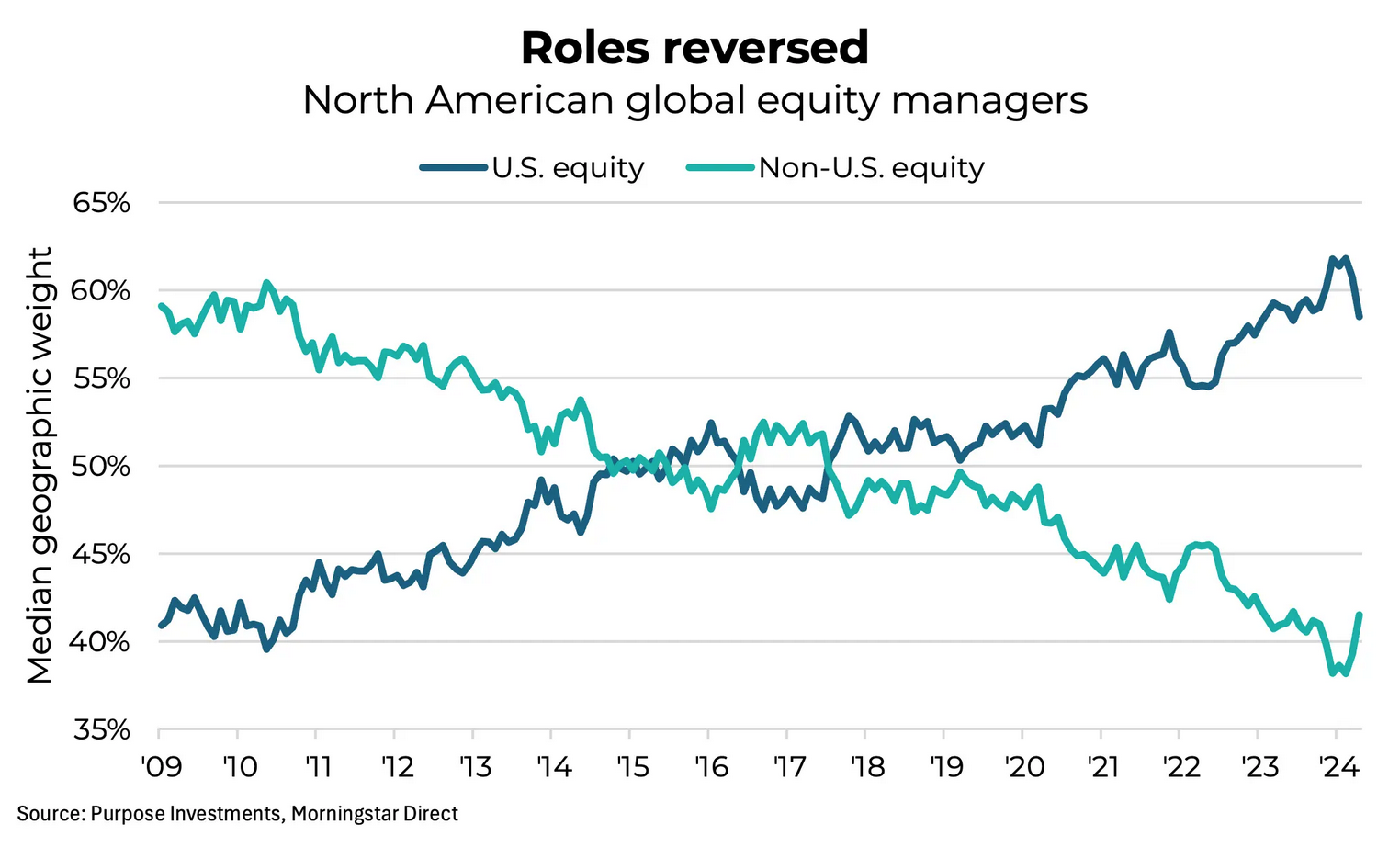

If the cycle has changed to favour international, the challenge for many portfolios will be a preponderance of U.S. equity overweights and subsequent international underweights. This isn’t just at the client portfolio level. A common theme in multi-asset portfolios today is to rely on global equity managers for international exposure, but these days “global” is often just shorthand for “mostly U.S.”

You actually have to go back a decade to find a time when non-U.S. equity made up the larger share of global equity products. Since then, the shift toward U.S. exposure has been steady and significant. Today, the median global equity manager in North America has roughly 60% of their portfolio in U.S. equities.

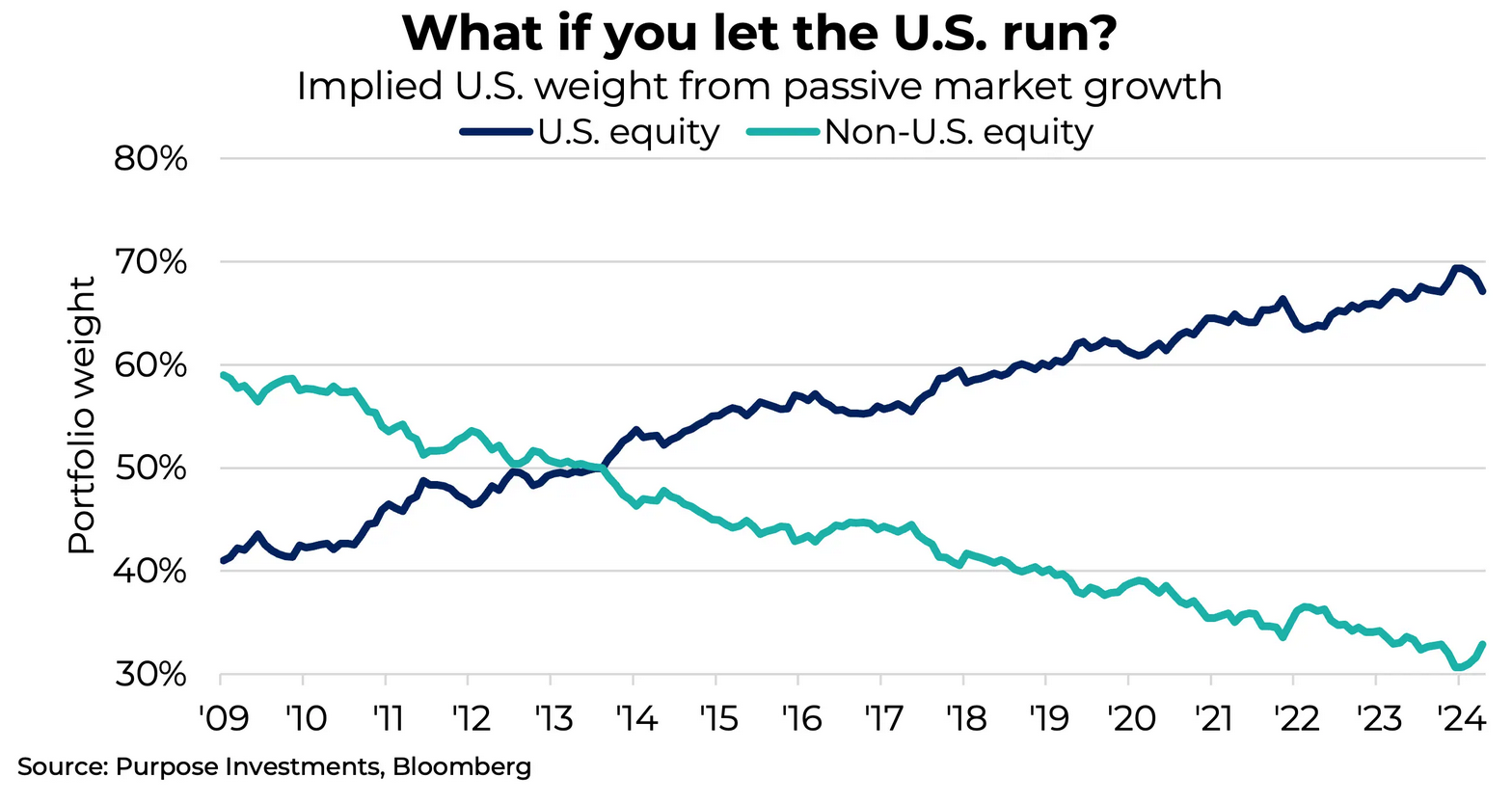

One could argue that, due to the U.S. massively outperforming international markets over the past 15 years, the U.S. weight would naturally increase even if trimmed a bit along the way. The chart below shows the original region weight and applied market growth, which looks pretty similar to the changing global manager weights above. In fact, all these charts look similar to the global market cap charts over time.

But now we have to ask: Is this the right portfolio positioning for what lies ahead? Just because global market caps favour the U.S. more these days doesn’t mean they’re right. In fact, focusing too much on global market caps is literally backward-looking.

There’s now more than $1.1 trillion invested in global equity mutual funds across North America. That’s a massive pool of mostly active capital tilted toward a region that has already had a historic run. And while the past decade rewarded U.S.-heavy allocations, the next one may not. Valuations are elevated. Market leadership is narrow. And global monetary and economic conditions are diverging in ways we haven’t seen in a very long time.

Final Thoughts

Today, we are larger fans of international markets compared to U.S. equities. Valuations help a little, but more from a risk/reward perspective. The U.S. equity market is awesome, and it could outperform in the years to come. But after this relative run, plus the fact that it is possibly over-owned by investors, it would take even more exceptionalism to continue the dominance.

Japan and Europe are like fixer-uppers. Even minor improvements go a long way after underperforming for so long. And they’re starting to make improvements, while one could argue the U.S. is doing the opposite.

— Brett Gustafson is an Associate Portfolio Manager, and Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L. P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Securities mentioned are for educational purposes and are not a recommendation to buy/sell.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.