by Vincent Gonzales, David Daigle, Jerry Solomon, Fixed Income Portfolio Managers, Capital Group

KEY TAKEAWAYS

- A resilient U.S. economy underpins the bond market.

- Consider shifting into high-quality bonds to help offset equity market risk.

- Credit spreads reflect the benign economic outlook, but security selection is key.

The era of TINA or “there is no alternative” to stocks may be over. Bond income potential is at its highest level in decades, and investors now have more options to diversify their portfolio.

“The United States economy is solid going into 2025,” says fixed income portfolio manager Vince Gonzales. “Consumers continue to spend, corporate fundamentals are healthy, and interest rates are declining. That backdrop is supportive of fixed income and comes at a time when yields remain elevated, even as the U.S. Federal Reserve lowers rates.”

President-elect Donald Trump’s policy priorities of tax cuts, tariffs and deregulation could have implications for growth, inflation expectations and interest rates. For example, Capital Group economist Jared Franz notes that Trump policies could help sustain U.S. GDP in 2025 in a range of 3% to 3.5% but also cause inflation to settle above the Fed’s 2% target to a level of 2.5% to 3%. Bond markets could influence Trump’s economic policies since the 10-year U.S. Treasury underpins borrowing costs for governments and consumers. Investors have pushed U.S. Treasury yields toward the middle of 2024’s range, with the 10-year at 4.18% on December 3, 2024, compared to its level of 3.78% on September 30, 2024.

Investors shouldn’t lose the plot. After years of lagging, the yield on the Bloomberg U.S. Aggregate Bond Index was higher than the S&P 500 Index earnings yield as of November 30, 2024. Bonds have reclaimed their traditional role as providers of income and can also help lower overall risk in a portfolio.

Bond yields have surpassed the S&P 500 Index earnings yield

Sources: Bloomberg Index Services Ltd., FactSet, Standard & Poor’s. As of November 30, 2024.

With the Fed in cutting mode, short-term yields are expected to gradually decline over the next year, Gonzales says. However, potential inflationary impulses stemming from the prospect of higher fiscal deficits and tariffs may keep 10-year and 30-year U.S. Treasury yields elevated.

“In today’s rate environment, investors can capture a healthy level of income within high-quality bonds,” Gonzales explains. Moreover, bonds can again be viewed as a ballast when equity markets falter and can help investors navigate potential volatility.

Fundamentals remain healthy

Sustained consumer spending despite inflation and high interest rates has kept corporate earnings and credit fundamentals in good condition.

Companies broadly reported healthy earnings and operated their businesses conservatively over the past few years amid concerns of a recession, says fixed income portfolio manager David Daigle. “Although there are weak spots emerging, Fed rate cuts may help mitigate the pace of a potential economic slowdown.”

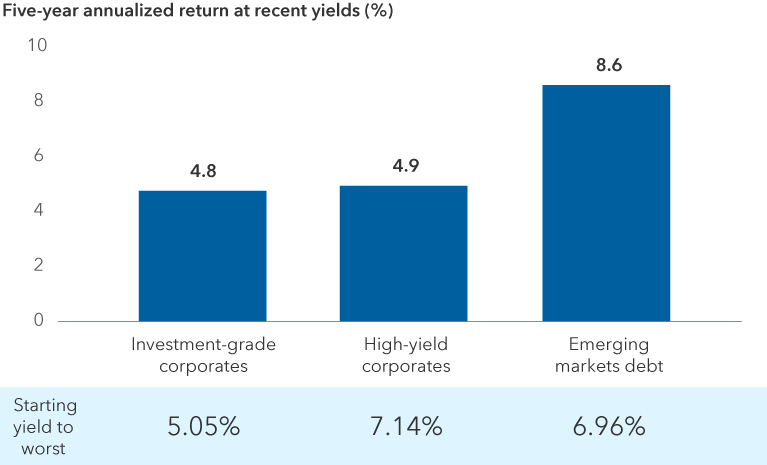

Current yields have typically led to attractive returns

Sources: Capital Group, Bloomberg, Bloomberg Index Services Ltd., J.P. Morgan, Rimes. Yields and monthly return data as of November 30, 2024, going back to January 2000 for all sectors except for emerging markets debt, which goes back to January 2003, and high-yield municipals, which go back to June 2003. Based on average monthly returns for each sector when in a +/- 0.30% range of yield to worst shown. Sector yields above include Bloomberg U.S. Investment Grade Corporate Index, Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index, 50% J.P. Morgan EMBI Global Diversified Index/50% J.P. Morgan GBI-EM Global Diversified Index blend.

Despite generally stable corporate fundamentals, security selection remains an important driver of returns. “Inflation has been challenging for lower income consumers, so certain retailers and consumer cyclical businesses may run into trouble,” Daigle adds. “I think economic growth may slow a year from today, so it’s important to identify which businesses could be most impacted.”

Credit spreads largely reflect a benign economic outlook, but investors can still benefit from the higher yields offered by corporate investment-grade and high-yield bonds compared to Treasuries. The U.S. Federal Reserve’s historic campaign to combat inflation lifted rates and, by extension, yields across bond sectors. This indicates that strong income may finally persist after decades of low rates. The Bloomberg U.S. Investment Grade Index yielded 5.05% on November 30, 2024, while the Bloomberg U.S. High Yield Corporate Bond 2% Issuer Capped Index yielded 7.14%.

The total return of a bond consists of price changes and interest paid. The higher interest component compared to the post-global financial crisis period means that it may be easier to achieve a positive total return even amid modest volatility.

Historically, starting yields have been a good indicator of long-term return expectations. “Income potential remains strong relative to history, and exposure to these sectors should be considered as part of an overall diversified portfolio,” Daigle says.

In short, opportunities exist, and they exist across sectors — including beyond the U.S. market. Other fixed income markets such as emerging markets debt have weathered high interest rates and are considered well-equipped to handle potential volatility, says Kirstie Spence, portfolio manager for Capital Group Multi-Sector Income Fund™ (Canada).

Bonds should offer balance in the years ahead

The economy remains resilient, with underlying inflation easing and job markets healthy. Still, there is uncertainty ahead. “There are some weak spots that could turn into something more, so the range of outcomes is wide,” Gonzales says. For example, manufacturing and housing have struggled under high interest rates.

Moreover, the potential impacts of Trump 2.0 policy priorities have yet to play out. “Given the uncertainty, it’s important to remain flexible, which includes investing in bonds that can offer diversification benefits should growth stall and equity markets decline,” Gonzales adds. This means maintaining a core bond allocation that expresses a bias toward higher quality bonds in today’s environment where investors are not well compensated for taking incremental risk.

Diversification from equities appears to have returned for high-quality bonds

Sources: Capital Group, Morningstar. Periods of equity volatility from 2010 to 2023 are based on price declines of 10% or more (without dividends reinvested) in the S&P 500 with at least 75% recovery. The period of volatility during 2024 refers to July 15, 2024, through August 4, 2024. Returns are in USD.

“The U.S. Federal Reserve is focused on supporting labour markets now that inflation is near target,” says Capital Group Canadian Core Plus Fixed Income Fund™ (Canada) portfolio manager Tim Ng. “All else being equal, lower policy rates should be positive for risk assets and the economy.”

Nevertheless, investors are likely to appreciate bonds most for the relative stability they can provide when stocks decline.

“Bonds are in a position to offer diversification benefits again given higher yields and a supportive Fed,” Ng says. For example, when the S&P 500 plunged 7.9% from mid-July to early August 2024, the Bloomberg U.S. Aggregate Bond Index posted a 2.6% gain. While there are no guarantees that will happen again, it’s a good reminder of the importance of high-quality bonds as part of a diversified portfolio.

The Fed has ample room to cut rates aggressively — more than current market expectations — if a growth shock occurs or recession risk escalates. Those rate cuts can help lead bonds to appreciate and offer diversification from equity markets. Historically, periods of rate cuts have led to strong returns for high-quality core bonds since bond prices rise as yields fall.

“Now is a good time for investors to evaluate their portfolios for unintended risks, which includes potentially holding excessive exposure to stocks or lower quality bonds,” Gonzales says. “Bonds are back to their basic but essential roles of providing income, return potential and diversification from equities should the market become volatile.”

Vincent J. Gonzales is a fixed income portfolio manager with 16 years of investment industry experience (as of 12/31/2023). He holds an MBA from Harvard and a bachelor’s degree in management science & engineering from Stanford University.

David Daigle is a fixed income portfolio manager with 29 years of investment industry experience (as of 12/31/2023). He serves as the principal investment officer of American High-Income Trust®. He holds an MBA from the University of Chicago and a bachelor’s degree in business administration from the University of Vermont.

Jerry Solomon is a fixed income portfolio manager with 31 years of investment industry experience (as of 12/31/2023). He holds an MBA from the University of Virginia and a bachelor’s degree in economics from Temple University. He also holds the Chartered Financial Analyst® designation.