by Vaibhav Tandon, Senior Economist, Northern Trust

The tortoise and the hare is a classic tale that teaches the importance of patience and perseverance over speed. The race between the two begins with the hare putting the tortoise at a large deficit; arrogantly, the hare takes a nap and wakes up to find that the tortoise has won.

In the late 1990s, The Economist magazine characterized the U.S. economy as the hare and the eurozone as the tortoise. Unfortunately for the euro area, its economic deficit with the U.S. remains wide, and the finish line is nowhere in sight.

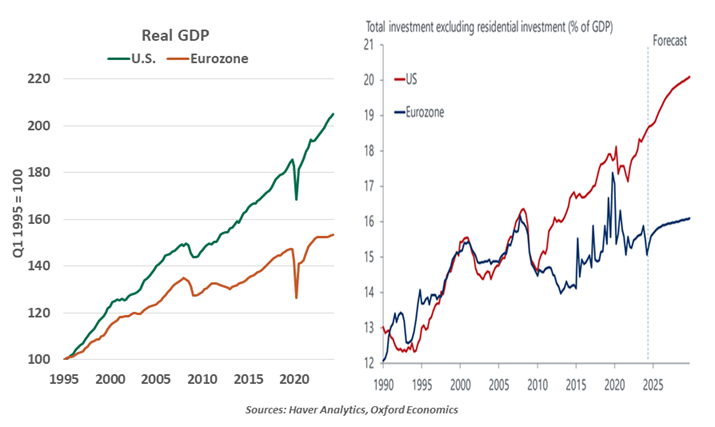

A central reason for the lingering underperformance is fiscal policy. The eurozone suffered a sovereign debt crisis shortly after the 2008 global financial crisis (GFC), which prompted a focus on austerity that limited the ability of the region to invest in economic growth. Annual real gross domestic product (GDP) growth in the common currency region averaged 2.4% in the decade before the GFC, but dropped to an average of 0.7% in the subsequent ten years.

Before the GFC, real non-residential investment (as a share of GDP) was broadly similar on both sides of the Atlantic. But since 2010, the U.S. ratio has been persistently higher, with the gap widening since the pandemic. Large European corporations invest far less than their American counterparts: a difference of about 60% in 2022, according to the McKinsey Global Institute.

The gap has become even wider following the twin shocks of the pandemic and the Ukraine war, which took a disproportionate toll on Europe. Since 2020, the U.S. has been pumping billions of dollars into expanding the nation’s infrastructure, semiconductor and clean energy industries. Meanwhile, eurozone member states are constrained in these areas by their debt and deficit limits.

Europe has lost its competitive edge.

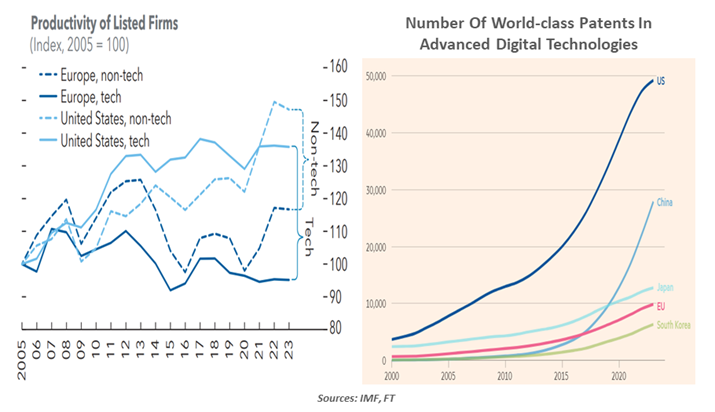

The eurozone’s productivity growth has been slower than most advanced economies. The divergence in productivity is particularly stark in the technology sector, which has been largely stagnant since 2005 across Europe. Since the 2008 crisis, the Europeans have also fallen behind on several measures of competitiveness and research and development.

Poor productivity in Europe stems from low business start-up rates and slow rates of growth among existing firms. European businesses lack dynamism, access to capital and the scale to compete globally. Europe’s venture capital industry is only a quarter the size of its American counterparts. Europe’s financial markets are fragmented. Structural rigidities, such as high tax rates and a stringent regulatory environment continue to hinder the bloc’s prospects even today. The region’s firms have also been slow in the adoption of artificial intelligence and lack innovation, reflected in the low number of world-class patents in advanced digital technologies.

The disparities with the U.S. are also a result of cultural variations. Half the gap in per-capita GDP between the broader European Union (EU) and the U.S. is explained by the Europeans working fewer hours, on average, over a lifespan. German train workers were recently granted a deal that would see their working week reduced from 38 hours to 35 hours by 2029 without having their pay cut. Steel workers are pushing for a four-day workweek. Europe’s demographics are also unfavorable, with the working-age population shrinking.

Europeans tend to save more than Americans. Households have been saving an even bigger proportion than normal since the pandemic, over 14% of what they earn. By contrast, Americans have spent almost all of the excess savings accumulated during COVID-19, adding to the strength of the current cycle.

The International Monetary Fund’s October 2024 projections suggest that the growth gap between America and Europe is going to widen further. The Fund predicts the eurozone’s real GDP growth to average around 1.1% in the decade ending 2029, as compared to 2.3% in the U.S. Average per capita income in the euro area is about 30% lower than it is in the United States.

Closer integration could help the euro area keep pace with the United States.

The Europeans are taking measures to keep up. The Green Deal Industrial Plan to speed the energy transition was passed this year. The policy makes €250 billion available from existing EU funds for the greening of industry and offers tax breaks to businesses investing in clean technologies. For the first time, a new industrial defense strategy is being proposed to enhance the bloc’s military readiness.

But these efforts are not enough. Creating a single capital market could help boost investments in areas like energy and supercomputing to compete effectively. As stressed by the former European Central Bank President Mario Draghi in his recent report, the EU also needs to invest €750 to €800 billion and issue common bonds to restore the continent’s competitive edge and boost growth. Other recommendations in the report included reducing the regulatory burden, facilitating cross border innovation and moving to an international financial union of capital markets and banking.

Unsurprisingly, Draghi’s proposals have found little support. Issuing joint debt was immediately opposed by frugal member states like Germany. There is also strong resistance against closer integration or a fiscal union. The fractious outcomes of this year’s elections in Europe will make continental consensus more difficult to achieve.

The fable of the tortoise and the hare is a great vehicle for teaching patience and persistence. But the U.S. economy is not going to lay down for a nap anytime soon. For the eurozone, slow and steady growth is not enough to win this race.

Copyright © Northern Trust