What You Need To Know

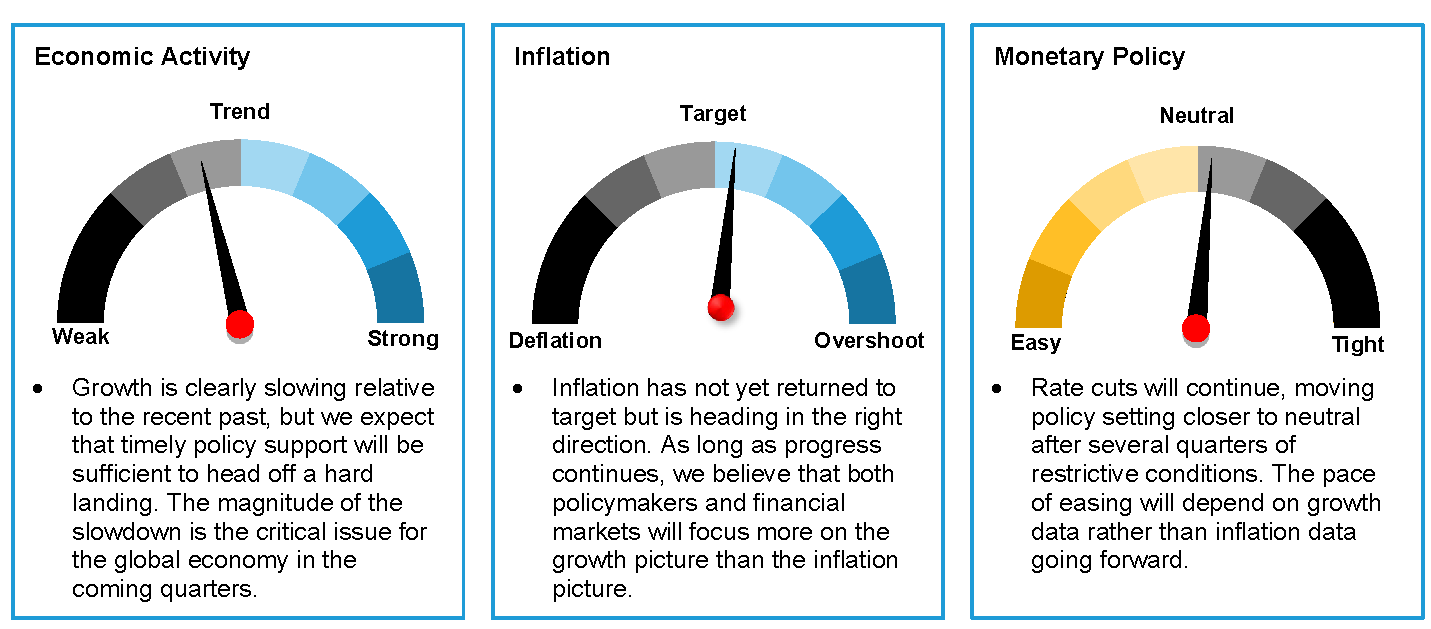

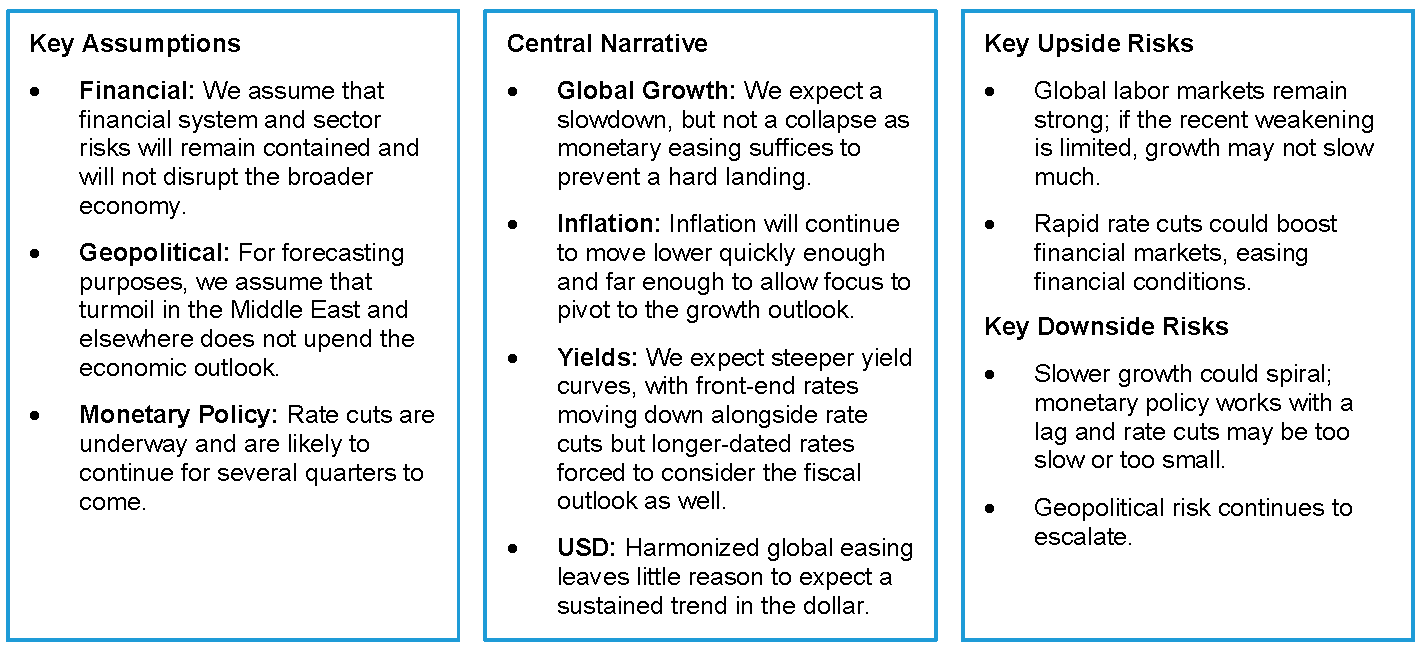

Monetary policy began to transition from restrictive to neutral last quarter, and we’re optimistic that continued easing can prevent a hard landing. Labor market direction, however, will provide the real answers to how far and quickly easing will move from here. Non-economic risks could factor large, too, such as excess leverage and market weakness, not to mention uncertainty surrounding the US election.

Download PDF

Key Forecast Trends

- Cooling price pressures this summer helped an overall pivot toward a more balanced view of the growth/inflation trade off.

- Central banks are well into easing, but not to fix as much as prevent economic weakness.

- We see more Fed easing ahead, with cuts of 0.25% at each meeting well into next year.

- Where rates end up will much depend on job growth, which has weakened but still at levels aligned with a growing backdrop.

- China’s woes are influencing developments beyond its borders, so we’re closely watching how recent measures will address a potential deflationary spiral.

- The US election outcome is a tossup, but just the uncertainty in the leadup could impede growth and some capex spending in the coming months.

Global Macro Outlook: The Next Six Months

Global Forecast

Copyright © AllianceBernstein Research