Listen on The Move

This episode features the discussion between Pierre Daillie, Managing Editor at AdvisorAnalyst.com, and Brooke Thackray, a distinguished research analyst at Global X ETFs Canada, and advisor to the Global X Seasonal Rotation ETF (HAC). They discuss the current state of the market, with a focus on seasonal trends and their impact on equity and bond markets.

Key takeaways include:

- Seasonal trends are back in rhythm: After a period of disruption due to COVID-19, seasonal trends in the markets are returning to their typical patterns.

- Macro factors still dominate: Interest rates, the Federal Reserve's balance sheet, and liquidity remain crucial drivers of the market.

- Sell in May and the six-month cycle: The traditional "Sell in May" seasonality is still relevant. Historical data shows that the period from October 28th to May 5th has consistently outperformed the following six months.

- The S&P 500 has broken its upward trend: This is a bearish signal, and Brooke expects a weaker market in the next six months.

- Government bonds could perform well: Despite rising yields, the seasonal trend for government bonds favors a positive performance from May to October, particularly in August and September.

- Defensive sectors are in favor: As investors become more cautious, money is flowing into defensive sectors like utilities, consumer staples, and healthcare.

- The market is adjusting to economic realities: Investors are paying more attention to economic factors like inflation and interest rates, leading to a shift in market dynamics.

- Seasonality can be a valuable tool: It provides a framework for understanding market behavior and identifying potential opportunities.

The conversation ends with Brooke noting that seasonality is becoming more recognized in the investment community but that many investors still struggle to apply it effectively. He emphasizes the importance of robust data and a disciplined approach to capitalize on these trends.

Thank you for listening!

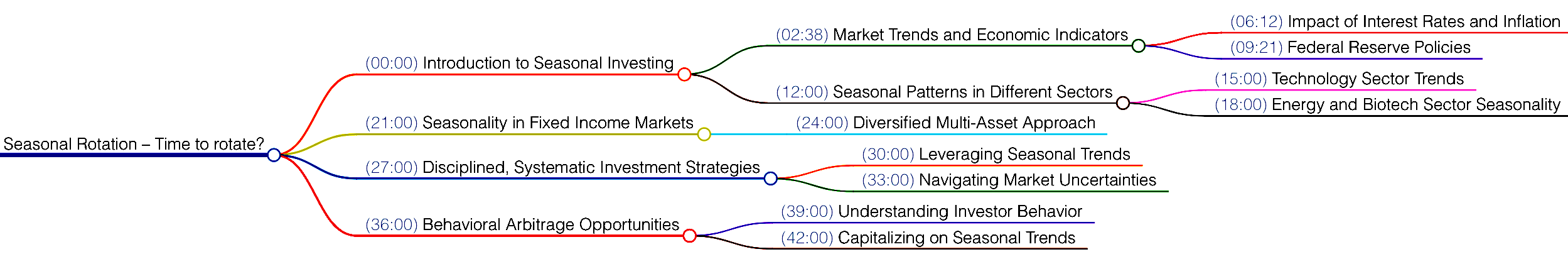

Timestamped Highlights

00:00 Market signals mixed, economy struggles with inflation.

06:15 Economy has a rich-poor divide, different news.

14:23 Seasonal trends and market performance post-COVID.

16:04 Investors' shifting interest from trends to analysis.

22:57 Global X Seasonal Rotation ETF chart impressive.

32:10 Discussing the challenge of simplifying stock strategy.

35:21 Adhere to rules. E.g. gold sector showing strength.

38:32 Tech sector's strong performance suggests market caution.

44:32 Economy slowing, technicals show bond strength. Yield rising or remaining high.

50:35 Stock market trend uncertain, potential opportunities ahead.

55:34 Investing in mystery and history, a seasonal strategy.

01:00:15 Market behavior varies with seasonal elements.

01:05:04 Improving processes for future market changes.

Copyright © AdvisorAnalyst