by William Smead, Smead Capital Management

Dear fellow investors,

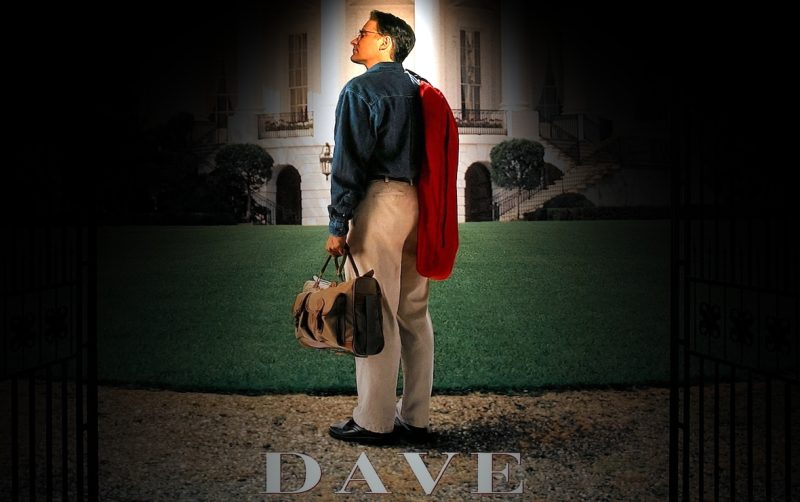

Back in 1993, a brilliant satirist by the name of Ivan Reitman produced a movie called Dave. It was the story of a life-threatening stroke besetting the President of the United States of America. His handlers, not wanting to shake up the country, hid his critical condition by making him a hospital bed below the White House. They then scoured the country looking for a doppelgänger to stand in for the President during his recovery. They found the owner of a temp agency in Boston, played by Kevin Kline, whose name was Dave.

Eventually, Dave got sick of watching the President’s handlers run the country. They needed to cut the Federal Budget and were getting nowhere with Congress. Finally, Dave threatened the handlers with exposure for their deception. Dave brought his accountant down from Boston, and they worked out an across-the-board 3% budget cut.

Why are we bringing this up? First, I am 66 years old, Smead Capital Management is 17 years old, and nobody has ever seen the Federal government budget get cut like in the movie Dave! We’ve run massive fiscal deficits for years, and there are three ways to balance the budget. You can cut the budget, raise taxes, or inflate your way out by paying it back in devalued American dollars.

Secondly, since the budget hasn’t been cut across the board in my lifetime, that doesn’t appear to be a choice. Raising taxes to balance a federal budget requires wealthy folks and high-income people to refuse to do what they always do. They pay a great deal of money to organize around avoiding taxes. We saw that in the 1970s and 1980s and it created a bull market in the accounting industry. Just ask the people who left California about that subject. If property taxes weren’t capped by Prop 13, many would have left a long time ago.

Lastly, this leaves us with the choice that has always worked in the past: inflating our way out of the problem and paying the debt back in cheaper dollars. You have to be my age to remember the 1970s, which was the last time we inflated our way out of the Vietnam War/Johnson Great Society debt of the late 1960s. The COVID-19 Federal debt is larger as a percentage of GDP now than it was in the 1960s and 1970s!

Now, before you pick on President Biden, realize that this was true in just about every administration for the last 60 years, regardless of party. So, how do we navigate a stock market that has feasted on low interest rates and the disinflation of globalization? What stocks do you invest in to make money when inflation (like in the 1970s) is the primary concern, and Dave is not brought in to cut the budget?

The great stock picker, T Rowe Price, dropped everything in 1968-1969 to invest in inflation beneficiary stocks like oil and gas, commodities and gold via his T Rowe Price “New Era Fund.” The greatest growth stock picker of the 1950s and 1960s looked at the monetized Federal debt and wrote this:

“Given the unpopular, increasingly expensive, out‐of‐control war in Vietnam, the huge costs of the Great Society program, and the large ensuing budget deficits, Mr. Price’s sensitive antennae were up. His concerns began to increase about the country’s future and the outlook for the stock market. He believed that economic history continually repeated itself because it was driven by human nature. As he had written in the 1937 pamphlet Change: The Investor’s Only Certainty: “The basic social, economic, and political currents flow as long as human beings remain in control.”

We assume the S&P 500 Index is going nowhere for 10 to 15 years and the inflation “zeitgeist” is here to stay. Therefore, we must pivot like Price did toward inflation beneficiary stocks. In other words, there is no Dave in real life, and we intend to make money in an era of ongoing inflation as scarce resources inflate in value!

Fear Stock Market Failure,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2024 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com