by Jeffrey Rosenberg, Managing Director, Systematic Fixed Income, BlackRock

Key points

- Opportunities in high yield: High yield credit offers the potential for higher income and lower interest rate exposure than other fixed income asset classes. A resilient US economy and company earnings outlook helps to offset fears of credit stress from higher financing costs, leading to a more benign default rate outlook.

- A systematic approach to high yield credit: The iShares High Yield Systematic Bond ETF (HYDB) seeks to track an index seeking to outperform the broad high yield market by systematically managing credit risk and identifying issuers with attractive valuations.

Elevated all-in yields in high yield credit present an attractive opportunity for income-seeking investors to lock in higher levels of income. Of course, that comes with a much higher degree of risk as compared to sitting in cash. As a result, allocations to high yield in a portfolio context can be considered relative to both equity exposures (based on risk level) and cash and fixed income holdings (for income).

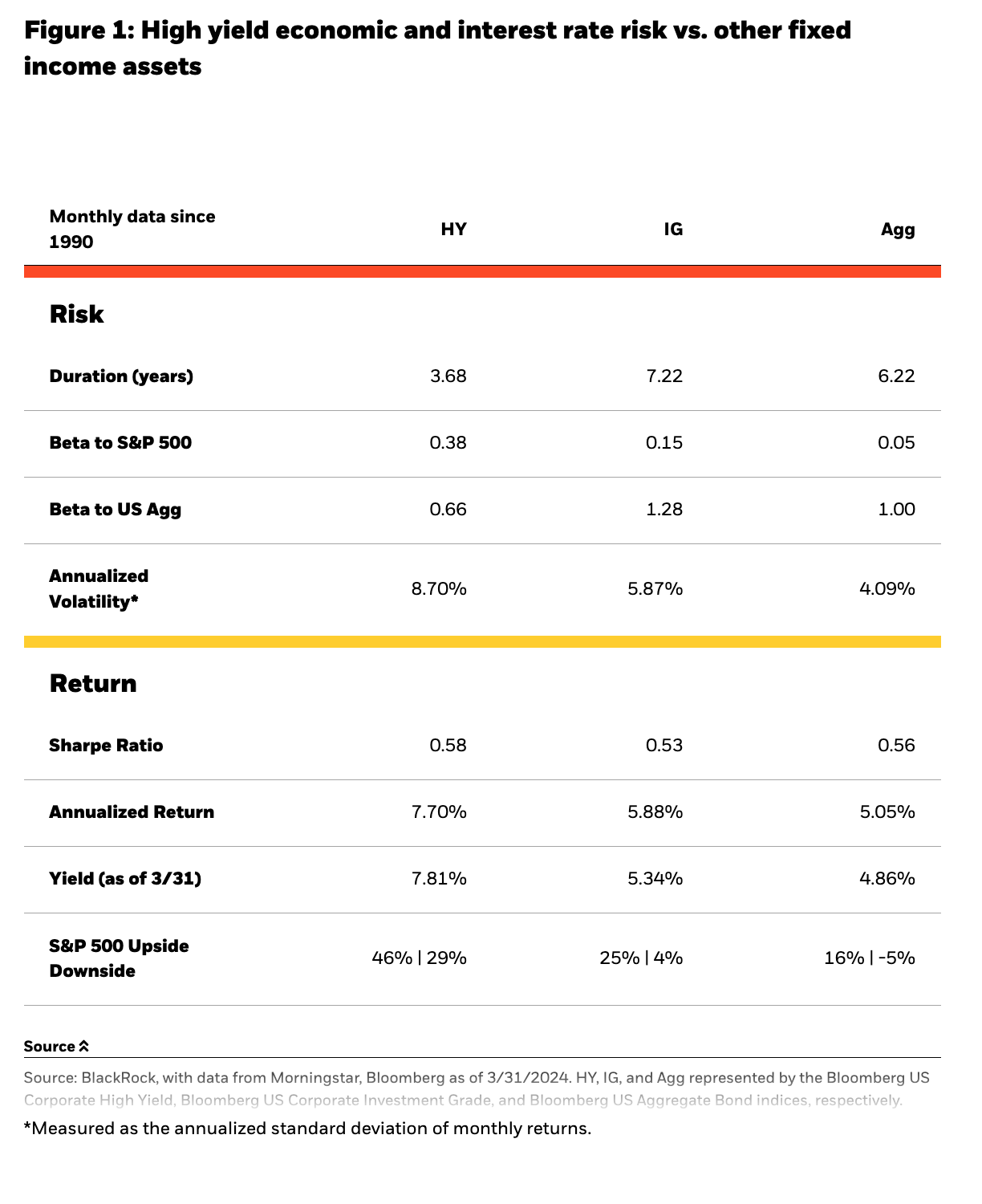

As compared to equity risk, high yield returns historically offer a degree of equity upside return capture with lower volatility and lower downside. But compared to fixed income risk, high yield has also exhibited lower interest rate sensitivity (Figure 1). High yield offers a combination of greater equity risk (and income) at the same time as it offers lower duration risk as compared to other fixed income alternatives.

Source: BlackRock, with data from Morningstar, Bloomberg as of 3/31/2024. HY, IG, and Agg represented by the Bloomberg US Corporate High Yield, Bloomberg US Corporate Investment Grade, and Bloomberg US Aggregate Bond indices, respectively. Duration measures the sensitivity of the indices to interest rate moves. Beta is a measure of risk in relation to the stock market (S&P 500 Index) and bond market (Bloomberg US Aggregate Bond Index). Sharpe ratio measures index return per unit of risk. A higher Sharpe Ratio implies greater efficiency. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

*Measured as the annualized standard deviation of monthly returns.

Out of sync cycles

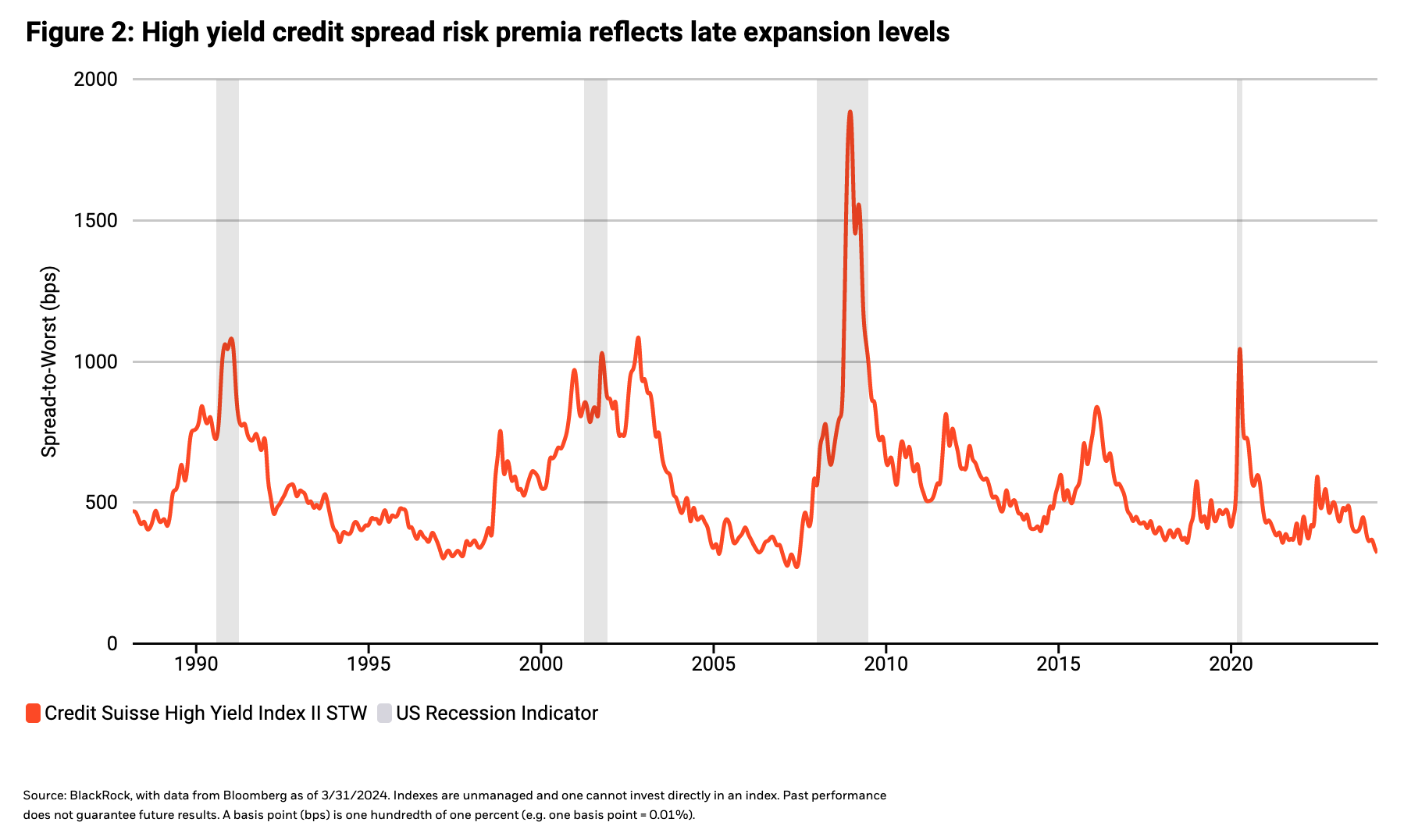

Recent economic performance not only avoided last year’s consensus expectations for recession, but recent strength in growth shows signs of a mid-cycle slowdown reverting back into expansion. This macroeconomic development supports the case for a benign default cycle and the outlook for considering an investment in high yield. Yet, while the economic cycle shows signs of expanding and all-in yields appear historically attractive, the pricing of credit risk shows very full valuations—more akin to late economic expansion levels of high yield credit spreads.

Managing the risks, reaping the rewards – a systematic approach

Managing the risks in high yield investing has long been about avoiding the downside of defaults. When faced with less accommodating valuations, managing these risks becomes even more important to forward looking returns. While passive investing in high yield offers benefits of low costs and transparency, actively managing default risks and considering relative valuations has the potential to lead to meaningful outperformance in higher risk asset classes like high yield—which is especially important at this point in the credit cycle and considering current credit risk premia valuations.

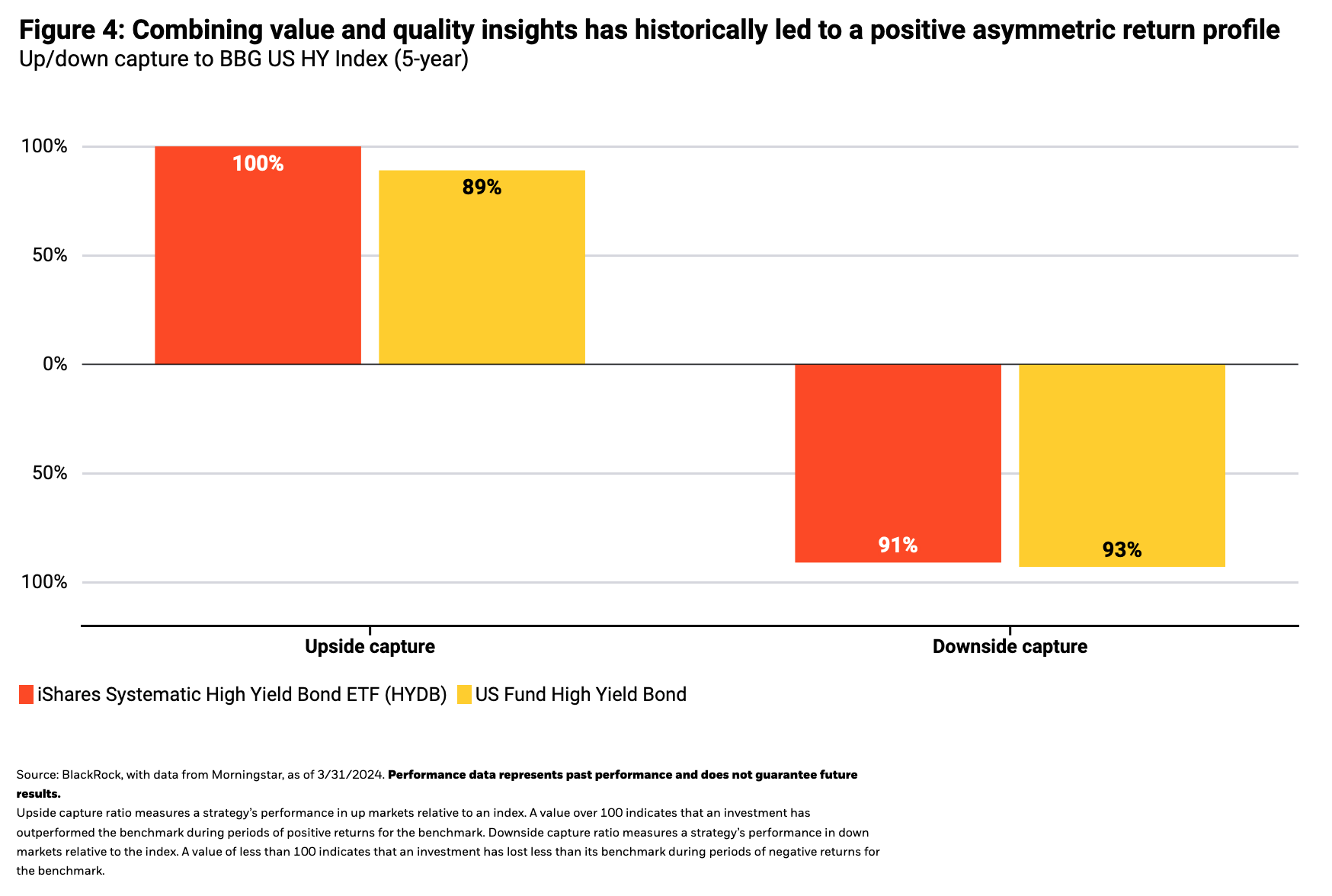

The iShares High Yield Systematic Bond ETF (HYDB) pursues income and enhanced total return relative to the high yield bond market through a systematic process designed to manage credit risk by avoiding the most default prone issuers while attempting to maximize returns by identifying issuers with attractive valuations relative to those risks. And though past performance does not predict future performance, throughout its nearly seven-year history, this combination of systematically screening on quality and selecting for value has delivered higher absolute and risk-adjusted returns relative to the Bloomberg US Corporate High Yield Index with average annual outperformance equaling 0.63% (Figure 3).

Performance data represents past performance and does not guarantee future results. Investment return and principal value will fluctuate with market conditions and may be lower or higher when you sell your shares. Current performance may differ from the performance shown. For most recent month-end performance and standardized performance, click here.

A systematic approach to capturing high yield opportunities and managing risks

The index strategy of mitigating risks and identifying attractive opportunities has resulted in outperforming the broad high yield market and active peer group in both absolute and risk adjusted terms—illustrating the long-run differentiation that HYDB has shown in practice.

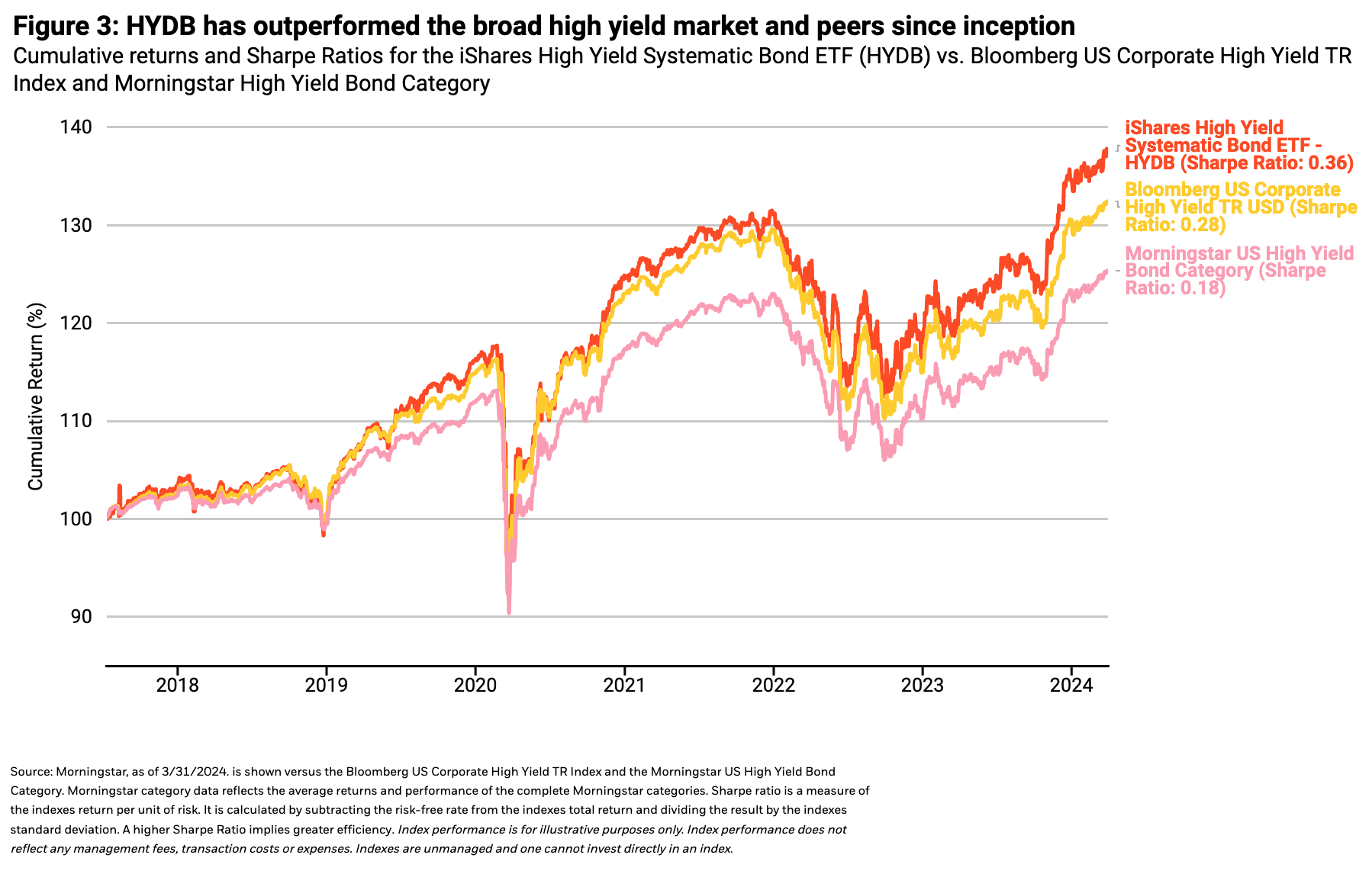

Through an investment process that focuses on avoiding companies with higher credit risk and prioritizing issuers with attractive valuations across the portfolio, HYDB seeks to manage the tradeoffs between upside participation, maximal income, and downside risk mitigation.

This is done first by seeking to reduce downside risk using a proprietary probability of default model. This screens out the riskiest bonds from the starting investible universe. Next, the remaining bonds are weighted to prioritize credits with the most attractive valuations. Finally, the portfolio is optimized to benefit from the diversification characteristics of the broader market with regard to credit quality, sector, and maturity. Shown in Figure 4, this has resulted in an asymmetric return profile compared to the average high yield fund, capturing greater market upside and generating more resiliency in down markets.

The bottom line

The potential for higher coupon income in a world where policy rates no longer lead to rising yields on holding cash can make locking in yield in fixed income more attractive. Yet doing so also entails adding duration risk—the risk to higher term interest rates. High yield bonds offer a combination of higher income through exposure to economic risk (at a time of decreasing economic risks) that also offers less sensitivity to rising interest rates than other fixed income assets. Investors allocating to high yield may want to consider the repeatable, rules based, investment process employed in HYDB that seeks to systematically screen out riskier companies while identifying issuers with attractive valuations to maintain upside participation. This time-tested approach has the potential to target better outcomes in the asset class as investors navigate a more volatile rate regime particularly at a time of historically low credit risk compensation.

Jeffrey Rosenberg, Sr. Portfolio Manager, Systematic Fixed Income

Jeffrey Rosenberg, CFA, Managing Director, is a senior portfolio manager within BlackRock Systematic. He is the co-lead portfolio manager for several investment products including the Systematic Multi-Strategy Fund and iShares High Yield and Investment Grade Systematic Bond ETFs (HYDB and IGEB).

Copyright © BlackRock