by Vaibhav Tandon, Senior Economist, Northern Trust

The Red Sea is one of the saltiest and warmest seas on the planet. In recent weeks, current events are catching up with oceanography, as temperatures and tensions are on the rise.

Recent attacks on commercial vessels in the Red Sea by Iran-linked rebels amid the Israel-Gaza war have sparked concerns of a rise in broader regional tensions, with shipping lanes in the center.

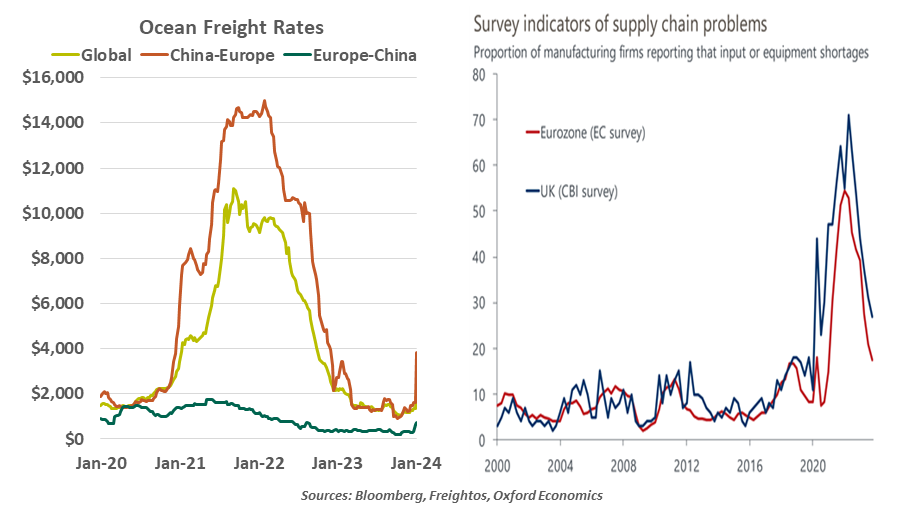

The Red Sea is a critical channel for trade between Asia and Europe. Though recent attacks are occurring at a time when trade volumes tend to be lower, violence is causing delays, diversions and soaring shipping costs. Freight rates from China to Europe have more than doubled to around $4,000 per 40-foot container in just two weeks. Multiple major shipping companies have paused transit through the Red Sea and the Gulf of Aden until further notice. Several carriers are rerouting from the Red Sea to the Cape of Good Hope, adding to costs and delays of up to four weeks.

The COVID experience brings inflation risks to mind, but the likelihood of another severe bout of inflation on the back of shipping costs is low. While rates have spiked, they are still far below the pandemic peaks of $15,000 per 40-foot container from China to Europe. Large retailers tend to lock in freight costs ahead of time and hedge their exposure, which limits the impact of temporary swings in shipping rates. Since ports and ships are operating without any restrictions, the current shock is unlikely to become as bad or as prolonged as what was endured during the pandemic.

The current wave of disruptions is unlikely to materially alter the path of inflation.

According to European Central Bank research, international shipping costs make up only 1% of final consumer goods prices, implying a limited impact on inflation from higher shipping costs. According to an International Monetary Fund study covering 143 nations, “when freight rates double, inflation picks up by about 0.7 percentage point” and the peak impact occurs around a year later. A more extended period of disruption will add to inflation, but not enough to prevent European central banks from pivoting later this year.

An escalation in conflict, involving more regional or global powers, could be a bigger threat to progress on inflation than the disruptions caused by sporadic maritime attacks on commercial vessels. Calmer geopolitics will be needed to prevent a further rise in temperatures surrounding transit through the Red Sea. Unfortunately, a warm wind is blowing through the region, which could result in additional heat on Europe’s inflation rates.

Copyright © Northern Trust