by Larry Adam, CIO, Raymond James

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Consumer spending fog is rolling in

- Still calling for lower long-term Treasury yields

- Modest upside for equities is expected from current levels

Sailing on Strange Seas! Traditional indicators have been flashing warning signals for some time now, but the economy continues to defy expectations. Nearly 18 months into the tightening cycle, growth has remained surprisingly resilient—supported by record low unemployment and a consumer that keeps on spending. The unusual nature of this economic cycle and pandemic-induced policy interventions have made it challenging for policymakers to calibrate the right amount of restraint needed to bring inflation back down to target. While considerable progress has been made, the last mile is fraught with uncertainties. It’s no wonder Federal Reserve (Fed) Chairman Jerome Powell mentioned that the Fed was “navigating by stars under cloudy skies.” But as we prepare to set sail into the final quarter of the year, we believe the strong macro backdrop over the last few months is likely to become more challenged. Here’s what it means for the economy and the financial markets.

- Consumer Spending Fog Is Rolling In | Consumer spending has remained remarkably robust. For most of the year, the strong labor market, solid wage gains and excess savings from the pandemic fueled a consumption binge, particularly on travel and leisure-related activities. But the good times are likely coming to an end. While inflation has come down, consumers are becoming increasingly cautious and more discerning with their spending plans—a trend we’ve heard repeatedly in company earnings calls this summer. And with job growth now slowing (and expected to turn negative in early 2024), excess savings fully depleted, student loan repayments resuming on October 1, gas prices climbing and soaring borrowing costs, the outlook for the consumer and overall economy is becoming considerably more fragile.

- The Fed Wants To Avoid Shipwrecking The Economy | Inflation has declined considerably from last year’s peak of ~9.0% to ~3.7%. However, policymakers still think they have more work to do and have signaled that one additional rate hike is likely. Stronger than expected growth and rising oil prices remain near-term risks; however, restrictive policy rates and tight lending standards should cool down the pace of economic activity and keep the disinflationary trend intact. We do not agree with some market pundits’ assessments that the economy is less interest rate sensitive than it has been in the past. And as a result, we think it is premature to predict a soft, non-recessionary landing. With multiple headwinds building on the horizon, a mild recession is more likely. That is why our economist is forecasting a mild recession, starting in the first quarter of 2024. However, if the Fed loses its patience or overstays its welcome, the downturn could be more protracted than we expect.

- Still Calling For Lower Long Term Treasury Yields | While inflation is trending in the right direction, stronger than expected growth and delayed recession calls have pushed interest rates higher over the last few months. However, we don’t expect the recent uptrend in yields to last. Why? First, the economic outlook is likely to become more challenged in the months ahead as mounting headwinds on the consumer push the economy into a mild recession. Second, inflation should moderate as the lagged impact of lower rental prices start to feed into the shelter component (the biggest weight) of the inflation index in the coming months. And finally, the end of the Fed’s tightening cycle is now in sight. And historically, yields tend to move lower once the Fed delivers its final rate hike. In addition, we anticipate the Fed will start cutting interest rates in the middle of next year. While the higher yielding sectors of the market offer attractive yields, we do not think their spreads adequately compensate investors for the risk. Thus, we continue to prefer higher quality bonds like Treasurys and investment grade bonds.

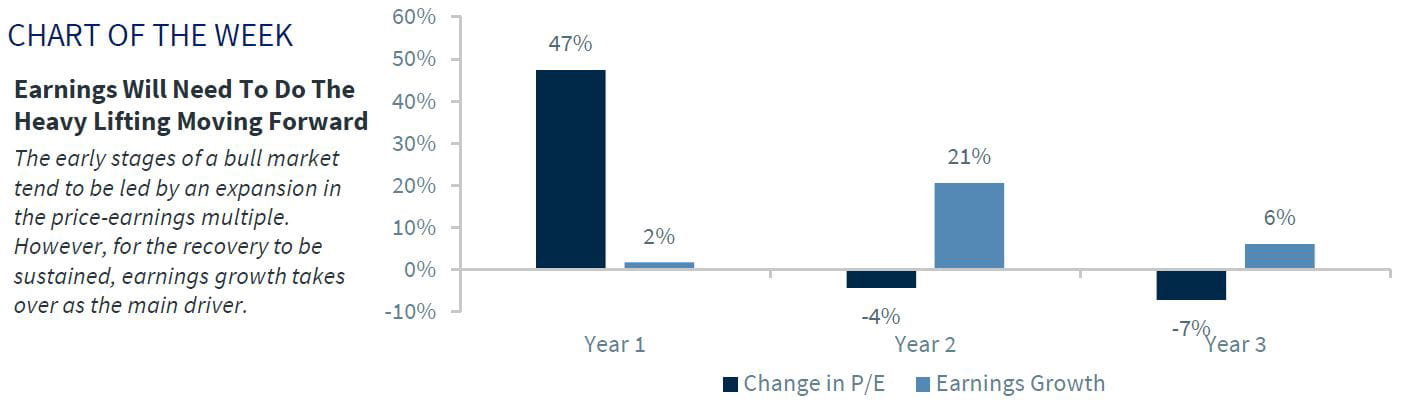

- Modest Upside Expected For Equities in 2024 | Much of the improvement in the equity market this year has come through an expansion in the price-earnings multiple. We think the good news reflected in the multiple expansion has largely run its course. Earnings will need to move higher from here for equities to deliver the next big uptrend in the market. However, our call for a more challenging macro environment over the next few quarters suggests that earnings are more likely to tread water in 2024 ($220 EPS forecast). As a result, companies are likely to have difficulty maintaining their top line sales growth and delivering improving margins in a mild recessionary environment. The good news: earnings are not likely to fall precipitously from here. The bad news: upside between now and year end is likely limited as our 4,400 2023 year-end target for the S&P remains intact. Longer term, we remain more optimistic and see upside potential over the next twelve months (4,650 12-month S&P 500 target).

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.