by Stephen Vanelli, CFA, Knowledge Leaders Capital

Today was a disaster for Chinese economic data. In the table below, we can see that every single data point missed consensus expectations in the wrong direction. Activity undershot expectations across the board.

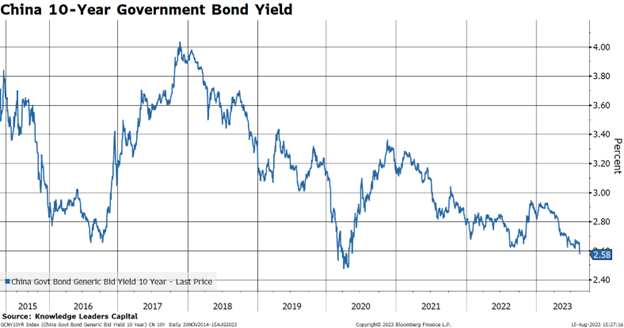

Data for China has been trending down for most of the year, and this weak data has been driving market prices for China. It is no surprise that bond yields are 10bps from breaking out to 10-year lows.

And, the currency is breaking out to new 10-year lows.

In a quirky move, China today announced it would stop publishing youth unemployment rates. While the official rate is around 20%, many China watchers think it is closer to 50%.

Dysfunction in China, manifest through a lower currency, has historically been like a cool breeze, blowing deflation through the world. With many developed 10-year sovereign bond yields about to break out to new highs on the back of unacceptably high inflation, China’s dysfunction could be a welcome deflationary breeze across the overheated (ex-China) global economy.

Copyright © Knowledge Leaders Capital