Pre-opening Comments for Thursday August 17th

Equity index futures were higher this morning. S&P 500 futures were up 10 points at 8:35 AM EDT

Index futures were unchanged following release of the August Philly Fed Index at 8:30 AM EDT. Consensus was a further drop to -13.5 from -10.0 in July. Actual was an increase of 12.0.

Walmart added $2.61 to $161.87 after reporting higher than consensus second quarter earnings.

Cisco gained $1.56 to $54.52 after reporting higher than consensus fiscal fourth quarter earnings.

Avnet advanced $3.55 to $48.50 after reporting higher than consensus fiscal fourth quarter earnings. The company offered positive guidance.

Synopsys added $9.78 to $437.99 after reporting higher than consensus fiscal third quarter earnings.

EquityClock’s Daily Comment

Headline reads “A spike in the put-call ratio into the end of the day could be conducive to a short-term low in stocks ahead of the typically strong period surrounding the Labor Day holiday”.

http://www.equityclock.com/2023/08/16/stock-market-outlook-for-august-17-2023/

Technical Notes

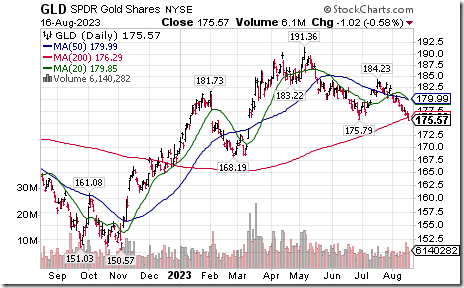

Gold ETN $GLD moved below $175.79 extending an intermediate downtrend.

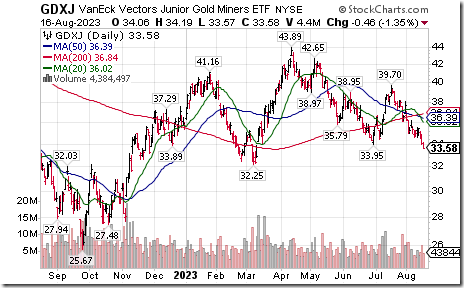

Junior Gold ETF $GDXJ moved below $33.95 extending an intermediate downtrend.

Pacific ex Japan iShares $EPP moved below $40.22 extending an intermediate downtrend.

Automobile ETF $CARZ moved below intermediate support at $53.34

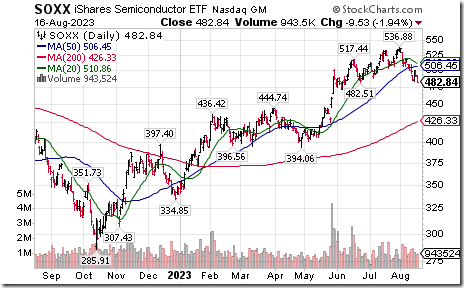

Semiconductor iShares $SOXX moved below intermediate support at $482.51.

Altria $MO an S&P 100 stock moved below $42.81 completing a double top pattern.

Capital One $COF an S&P 100 stock moved below intermediate support at $104.59.

Enbridge $ENB.TO a TSX 60 stock moved below $46.80 extending an intermediate downtrend.

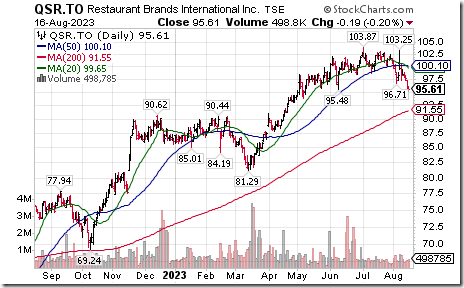

Restaurant Brands International $QSR.TO a TSX 60 stock moved below Cdn$95.48 extending an intermediate downtrend.

Trader’s Corner

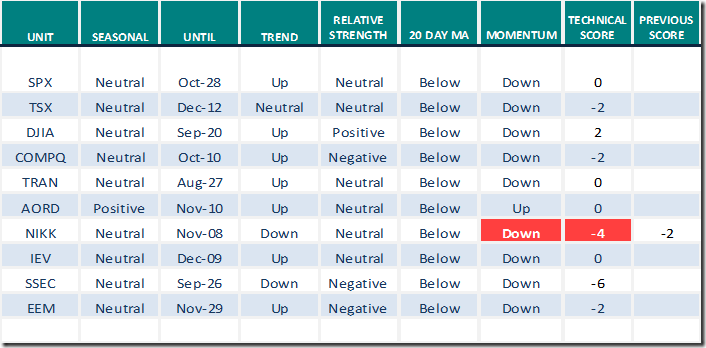

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 16th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for all positive seasonality ratings: www.EquityClock.com

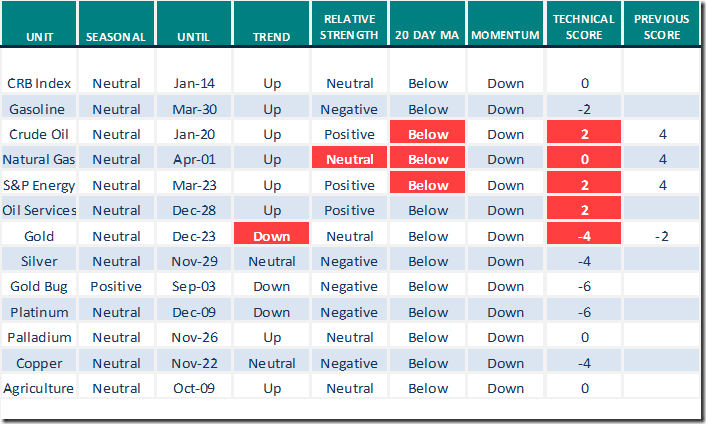

Commodities

Daily Seasonal/Technical Commodities Trends for August 16th 2023

Green: Increase from previous day

Red: Decrease from previous day

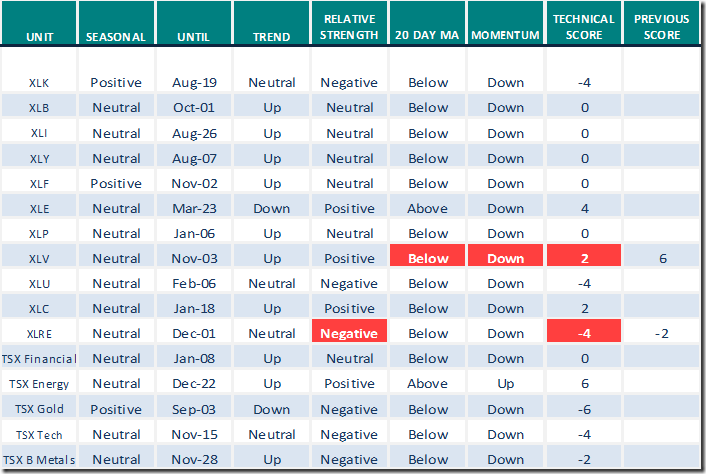

Sectors

Daily Seasonal/Technical Sector Trends for August 16th 2023

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Stars are Aligning for Uranium and Nuclear Energy

Sprott Uranium Report: Stars are Aligning for Uranium and Nuclear Energy

Top Three Things I Wish I Knew Before I Started Trading | The Final Bar (08.15.23)

Top Three Things I Wish I Knew Before I Started Trading | The Final Bar (08.15.23) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer dropped another 5.00 to 41.40. It remains Neutral. Daily trend remains down.

The long term Barometer dropped 2.20 to 56.00. It remains Neutral. Daily trend remains down.

TSX Momentum Barometers

Intermediate term Barometer was unchanged at 42.73. It remains Neutral. Daily trend remains down.

The long term Barometer slipped 0.88 to 49.34. It remains Neutral. Daily trend remains down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed