Pre-opening Comments for Friday August 4th

Index futures were higher this morning. S&P 500 futures were up 8 points at 8:35 AM EDT.

Index futures were unchanged following release of July Non-farm Payrolls released at 8:30 AM EDT. Consensus calls for an increase of 184,000 versus a gain of 209,000 in June. Actual was an increase of 187,000. Consensus calls for the July Unemployment Rate to be unchanged from June at 3.6%. Actual was 3,5%.. Consensus calls for July Average Hourly Earnings to increase 0.3% versus a gain of 0.4% in June. Actual was an increase of 0.4%

The Canadian Dollar was unchanged at US74.78 cents following release of Canada’s July employment report at 8:30 AM EDT. Consensus was an increase of 25,000. Actual was a drop of 6,400. Consensus for the Unemployment Rate was unchanged at 5.5%. Actual was 5.5%

Amazon.com advanced $8.10 to $137.01 after reporting higher than consensus second quarter revenues and earnings.

Apple dropped $3.45 to $187.64 after reporting less than consensus quarterly revenues.

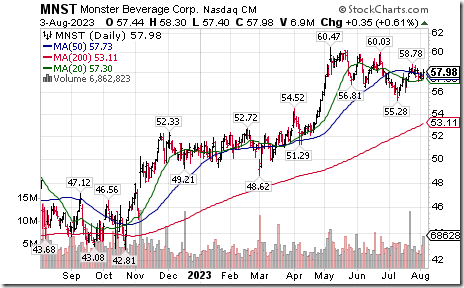

Monster Beverages dropped $1.50 to $56.49 after reporting less than consensus second quarter revenues.

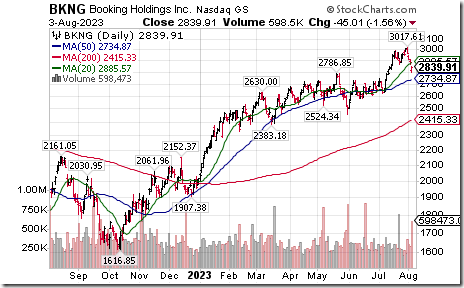

Booking Holdings advanced $317.09 to $3150.00 after reporting higher than consensus second quarter revenues and earnings.

EquityClock’s Daily Comment

Headline reads “While the trend of aggregate factory orders remains impressive, consumer goods orders just recorded the weakest first half of the year performance, outside of the pandemic, on record”.

http://www.equityclock.com/2023/08/03/stock-market-outlook-for-august-4-2023/

Technical Notes

ANSYS $ANSS a NASDAQ 100 stock moved below intermediate support at $317.25.

PayPal $PYPL a NASDAQ 100 stock moved below intermediate support at $65.62

NextEra $NEE an S&P 100 stock moved below $70.85 extending an intermediate downtrend.

Pfizer $PFE a Dow Jones Industrial Average stock moved below $34.96 extending an intermediate downtrend.

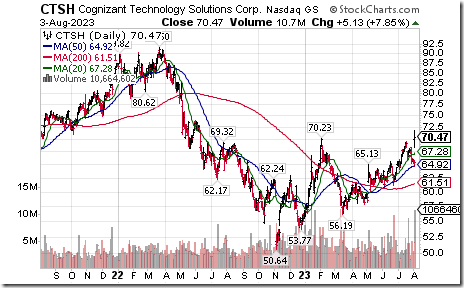

Cognizant Technology $CTSH a NASDAQ 100 stock moved above $70.23 extending an intermediate uptrend.

Fortis $FTS.TO a TSX 60 stock moved below Cdn$54.96 extending an intermediate downtrend.

Metro $MRU.TO a TSX 60 stock moved below Cdn$69.61 extending an intermediate downtrend.

Dollarama $DOL.TO a TSX 60 stock moved below Cdn$85.01 completing a double top pattern.

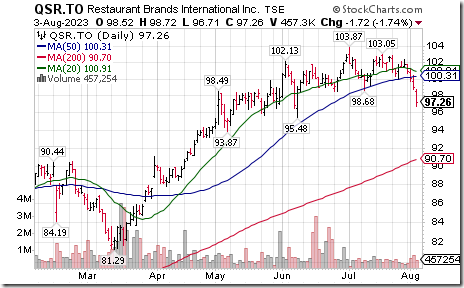

Restaurant Brands International $QSR.TO a TSX 60 stock moved below Cdn$98.68 extending an intermediate downtrend.

Shopify $SHOP.TO a TSX 60 stock moved below intermediate support at Cdn$80.36.

U.S. Treasury 7-10 year Treasury Bond iShares moved below $94.12 extending an intermediate downtrend.

Trader’s Corner

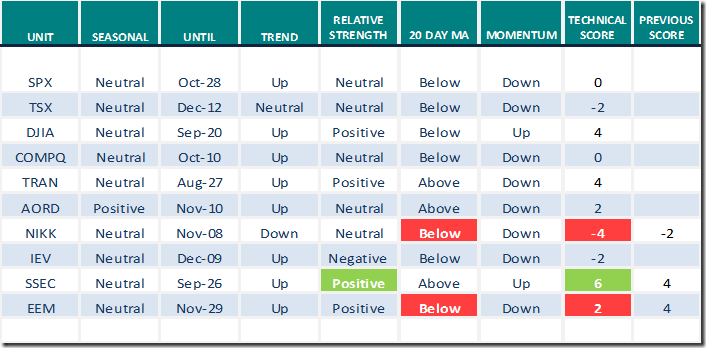

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 3rd 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for all positive seasonality ratings: www.EquityClock.com

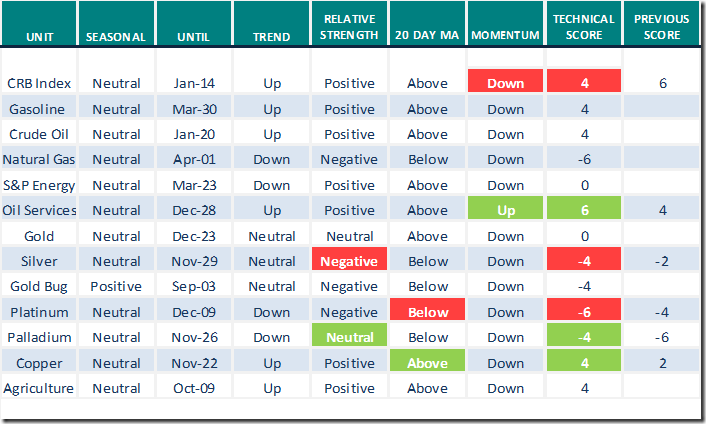

Commodities

Daily Seasonal/Technical Commodities Trends for August 3rd 2023

Green: Increase from previous day

Red: Decrease from previous day

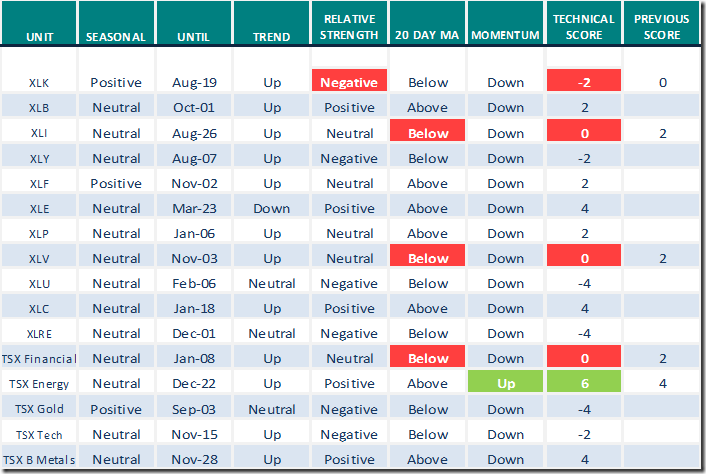

Sectors

Daily Seasonal/Technical Sector Trends for August 3rd 2023

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

VIX Breaks Out as NASDAQ Selloff Accelerates | Trading Places (08.03.23)

https://www.youtube.com/watch?v=qUkFbMBhI6s

Growth Stocks Are PLUNGING Now? Blame Fitch Downgrade! | The Final Bar (08.02.23)

https://www.youtube.com/watch?v=h0o1Zna-Pl4

Fitch Downgrade Sends TLT Closer to Target Set Months Ago | Halftime by Chaikin Analytics (08.03.23)

https://www.youtube.com/watch?v=CvLcvvqk5XE

Why the MACD Pinch Play is so Valuable | Stock Talk (08.03.23)

https://www.youtube.com/watch?v=4LVyjjrT5nw

Does A BIG Changing of the Guard Signal More Trouble for Tech Stocks? | GoNoGo Charts (08.03.23)

S&P 500 Momentum Barometers

The intermediate term Barometer dropped another 7.20 to 66.20. It remains Overbought. Daily downtrend was extended.

The long term Barometer dropped another 2.80. It remains Overbought. Daily downtrend was extended.

TSX Momentum Barometers

The long term Barometer dropped another 3.07 to 52.19. It remains Neutral. Daily downtrend was extended.

The long term Barometer dropped another 1.75 to 50.88. It remains Neutral. Daily downtrend was extended.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed