Pre-opening Comments for Friday July 28th

U.S. equity index futures were higher this morning. S&P 500 futures were up 28 points at 8:35 AM EDT

Index futures were unchanged following release of economic news at 8:30 AM EDT:

June Core PCE Price Index was expected to increase 0.2% versus a gain of 0.3% in May. Actual was an increase of 0.2%. On a year-over-year basis, the Index was expected to increase 4.2% versus a gain of 4.6% in May. Actual was an increase of 4.1%.

June Personal Income was expected to increase 0.2% versus a gain of 0.4% in May. Actual was an increase of 0.3%. June Personal Spending was expected to increase 0.4% versus a gain of 0.1% in May. Actual was an increase of 0.5%

May Canadian GDP released at 8:30 AM EDT on Friday was expected to increase 0.3% versus unchanged in April. Actual was an increase of 0.3%. On a year-over-year basis, May GDP was expected to increase 1.9%. Actual was an increase of 1.9%. The Canadian Dollar was unchanged at US75.70 cents following the news.

Intel gained $1.95 to $36.50 after reporting higher than consensus second quarter earnings. The company also raised guidance for the third quarter.

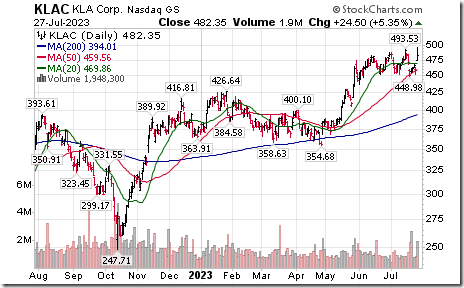

KLA Corp advanced $14.64 to $469.99 after reporting higher than consensus fiscal fourth quarter results. The company also raised guidance for its fiscal first quarter.

Canadian Pacific Kansas City slipped $0.08 to US$83.00 after reporting less than consensus second quarter results.

EquityClock’s Daily Comment

Headline reads “As the extreme heat increases the demand of electricity for cooling purposes, Natural gas stockpiles just recorded one of its smallest injections for the month of July on record”.

http://www.equityclock.com/2023/07/27/stock-market-outlook-for-july-28-2023/

Technical Notes

Australia iShares $EWA moved above $23.46 resuming an intermediate uptrend.

Walgreens Boots $WBA a Dow Jones Industrial Average stock moved above $31.10 completing a bottoming pattern.

Dupont $DD an S&P 100 stock moved above $77.60 extending an intermediate uptrend.

Check Point $CHKP a NASDAQ 100 stock moved above $132.13 resuming an intermediate uptrend.

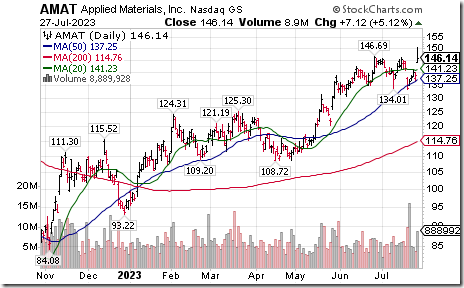

Applied Materials $AMAT a NASDAQ 100 stock moved above $146.69 extending an intermediate uptrend.

American Express $AXP a Dow Jones Industrial Average stock moved below intermediate support at $164.66.

Trader’s Corner

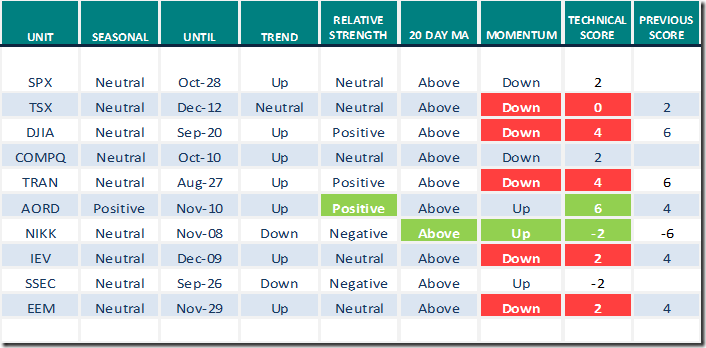

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 27th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for all positive seasonality ratings: www.EquityClock.com

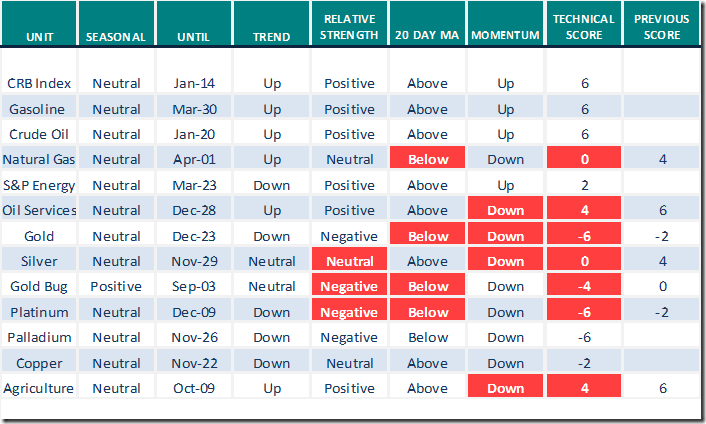

Commodities

Daily Seasonal/Technical Commodities Trends for July 27th 2023

Green: Increase from previous day

Red: Decrease from previous day

Sectors

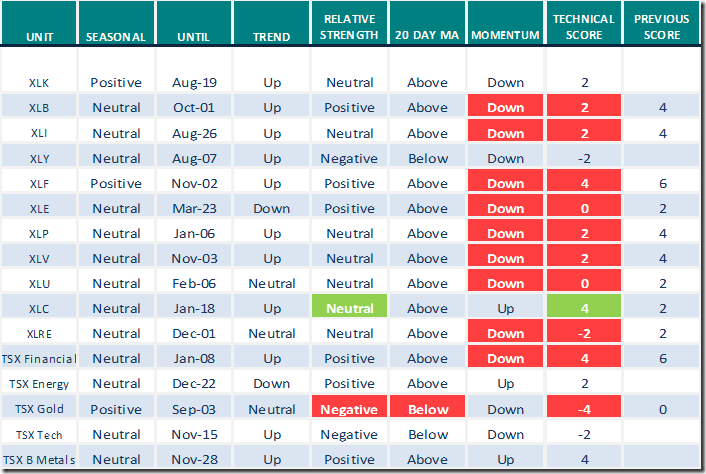

Daily Seasonal/Technical Sector Trends for July 27th 2023

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Are the Markets Having a HEAVY METAL Surge Phase? | Market Buzz (07.26.23)

Are the Markets Having a HEAVY METAL Surge Phase? | Market Buzz (07.26.23) – YouTube

BIG SURPRISE (Not)! The Fed Does Exactly What They Said They Would | The Final Bar (07.26.23)

Major Trend Reversal Appears Near At Hand | Your Daily Five (07.27.23)

Major Trend Reversal Appears Near At Hand | Your Daily Five (07.27.23) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 6.40 to 80.80. It remains Overbought. Daily trend has turned down.

The long term Barometer dropped 3.00 to 73.20. It remains Overbought. Daily trend has turned down.

TSX Momentum Barometers

The intermediate term Barometer plunged 10.96 to 60.96. It remains Overbought. Daily trend has turned down.

The long term Barometer plunged 6.14 to 58.77. It changed from Overbought to Neutral on a drop below 60.00. Daily trend has turned down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed