Pre-opening Comments for Wednesday June 14th

U.S. equity index futures were higher this morning. S&P 500 futures were up 8 points at 8:35 AM EDT.

Index futures were unchanged following release of the May U.S. Producer Price Index at 8:30 AM EDT. Consensus was a drop of 0.1% versus a gain of 0.2% in April. Actual was a drop of 0.3%. On a year-over-year basis May PPI was expected to increase 1.5% versus a gain of 2.3% in April. Actual was an increase of 1.1%. Core May PPI was expected to increase 0.2% versus a gain of 0.2% in April. Actual was an increase of 0.2%. On a year-over-year basis, Core May PPI was expected to increase 2.9% versus a gain of 3.2% in April. Actual was an increase of 2.8%.

Focus today is on the FOMC’s announcement on monetary policy at 2:00 PM EDT. A press conference to explain the latest policy is offered at 2:30 PM EDT. FOMC members have unofficially broadcasted that the Fed Fund Rate is likely to remain unchanged at this meeting at 5.00%-5.25%. Attention will be given to guidance offered for the next FOMC meeting scheduled on July 25th-26th.

Logitech dropped $1.65 to $62.25 after the company’s chief executive officer resigned.

Tesla advanced $5.29 to $263.75 after announcing a $250 increase in the U.S. starting price for its model Y car.

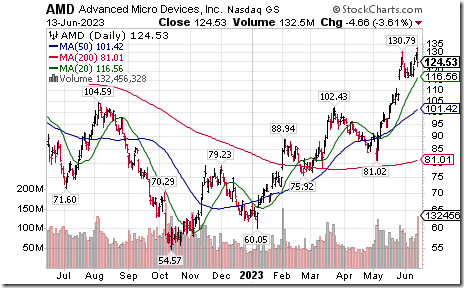

Advanced Micro Devices gained $3.82 to $128.36 on news that Amazon is considering use of the company’s AI chips.

EquityClock’s Daily Comment

Headline reads “It is almost unprecedented to see the S&P 500 Index stretched well above its 200-day moving average, but still less than two-thirds of constituents holding this same hurdle as a level of support”.

http://www.equityclock.com/2023/06/13/stock-market-outlook-for-june-14-2023/

Technical Notes

Industrial SPDRs $XLI moved above $103.75 extending an intermediate uptrend.

Lithium ETN $LIT moved above $63.69 resuming an intermediate uptrend.

Wal-Mart $WMT a Dow Jones Industrial Average stock moved above $154.35 extending an intermediate uptrend.

Pfizer $PFE a Dow Jones Industrial Average stock moved above $40.14 completing a reverse Head & Shoulders pattern.

Intel $INTC a Dow Jones Industrial Average stock moved above $33.70 extending an intermediate uptrend.

JD.com a NASDAQ 100 stock moved above intermediate resistance at $38.20.

NetEase $NTES a NASDAQ 100 stock moved above $94.51 extending an intermediate uptrend.

NXP Semiconductor $NXPI a NASDAQ 100 stock moved above $195.51 extending an intermediate uptrend.

Trader’s Corner

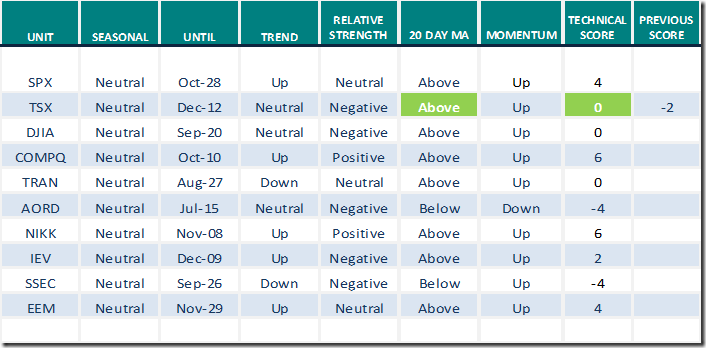

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 13th 2023

Green: Increase from previous day

Red: Decrease from previous day

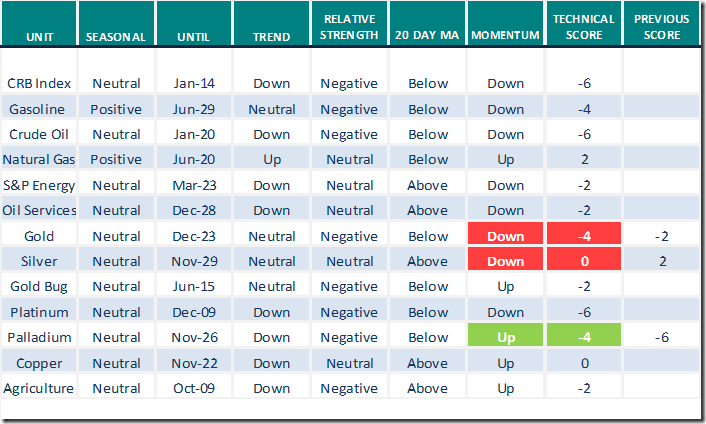

Commodities

Daily Seasonal/Technical Commodities Trends for June 13th 2023

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for June 13th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

Links offered by valued providers

S&P 500 Soars Past Resistance! | Tom Bowley | Trading Places (06.13.23)

S&P 500 Soars Past Resistance! | Tom Bowley | Trading Places (06.13.23) – YouTube

5 Strong Price Patterns | Joe Rabil | Your Daily Five (06.13.23)

5 Strong Price Patterns | Joe Rabil | Your Daily Five (06.13.23) – YouTube

The Fed is well positioned for a soft landing, says economist Paul McCulley

The Fed is well positioned for a soft landing, says economist Paul McCulley – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer added 5.80 to 64.20. It changed from Neutral to Overbought on a move above 60.00. Daily trend is up.

The long term Barometer added 3.00 to 61.00. It changed from Neutral to Overbought on a move above 60.00. Daily trend is up.

TSX Momentum Barometers

The intermediate term Barometer added 3.88 to 40.09. It changed from Oversold to Neutral on a recovery above 40.00.

The long term Barometer added 2.16 to 52.59. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed