In the context of this macro-economic climate, BCA Research says that investors will need to become more tactically involved in asset allocation, than they needed to be during the initial period of the equity rally, and that technical signals will become very important as far as the timing of moves is concerned.

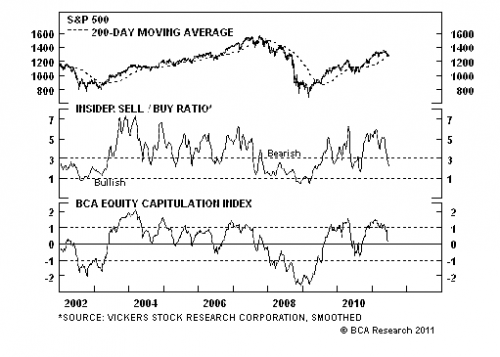

BCA's U.S. Equity Strategy service has watched numerous key technical measures during the current correction. It appears sentiment has retraced back to levels that indicate previous bull market troughs. More NYSE stocks are currently reaching new lows than highs, indicating that selling or 'distribution' pressure is advancing.

BCA has two proprietary indices, the Intermediate Equity Indicator, and the Capitulation Index, and both have dropped sharply and are getting close to neutral territory. In past corrections, both of these slipped slightly into negative territory by the time broader markets hit the floor.

According to BCA, when you combine these technical signals, what shines through is that the bulk of the corrective phase may be over as far as magnitude, though none of these indicators has been fully played out, especially if you consider the VIX has yet to 'spike.'

In conclusion, BCA says that while the market has already experienced an advanced correction, where price is concerned, its duration still has room to run.

Copyright © BCA Research