Pre-opening Comments for Monday April 17th

U.S. equity index futures were mixed this morning. S&P 500 futures were unchanged at 8:35 AM EDT.

Index futures were unchanged following release of the April Empire State Manufacturing Survey at 8:30 AM EDT. Consensus was a decline of 15.0. Actual was a gain of 10.8

Shanghai Composite Index advanced 47.46 in overnight trade to a 10 month high at 3,385.61.

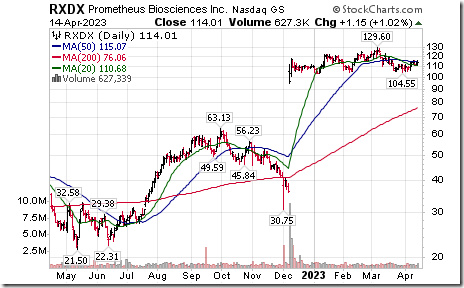

Prometheus Bioscience $RXDX jumped $79.49 to $193.50 after Merck offered to acquire the company for $200 per share. Value of the offer is $10.8 billion.

M&T Banks $MTB added $2.61 to $119.20 after reporting higher than consensus first quarter results.

Delta Airlines $DAL gained $0.05 to $33.82 after Deutsche Bank upgraded the stock to Outperform. Target price was set at $47.

EquityClock’s Daily Comment

Headline reads “The trend for retail sales has yet to show a path that is representative of the looming onset of an economic recession”.

http://www.equityclock.com/2023/04/15/stock-market-outlook-for-april-17-2023/

The Bottom Line

Focus this week shifts to first quarter earnings reports. Financial services dominate the list of reporting companies. Responses to results released by JP Morgan and Citigroup on Friday were encouraging. As Jim Cramer noted on Fast Money on Friday, “I think that we will see a pleasant surprise”.

Consensus for Earnings and Revenues for S&P 500 Companies

Source: www.Factset.com

Better than expected first quarter reports prompted analysts to increase slightly their first quarter earnings and revenue estimates: Six percent of S&P 500 companies have reported to date. Consensus calls for a year-over-year drop in first quarter earnings of 6.5% (up from a drop of 6.8% last week) and an increase in first quarter revenues of 2.0% (up from a gain of 1.8% last week).

Estimates for the remainder of the year recorded minor changes. Consensus for the second quarter calls for a drop of 4.6% in earnings (unchanged from last week) and a drop of 0.1% in revenues (unchanged from last week). Consensus for third quarter earnings calls for a 1.9% increase (down from 2.1% last week) and a 1.5% increase in revenues (up from 1.4% last week). Consensus for the fourth quarter calls for an 8.8% increase in earnings (down from 9.0% last week) and a 3.7% increase in revenues (unchanged from last week). For all of 2023, consensus calls for an increase of 0.9% in earnings (down from 1.2% last week) and a 2.1% increase in revenues (unchanged from last week).

Economic News This Week

Source: www.Investing.com

March U.S. Housing Starts released at 8:30 AM EDT on Tuesday are expected to slip to 1.420 million units from 1.450 million units in February.

Canadian March Consumer Price Index released at 8:30 AM EDT on Tuesday is expected to increase 0.6% versus a gain of 0.4% in February. On a year-over-year basis, March CPI is expected to increase 4.3% versus a gain of 5.2% in February. On a year-over-year basis, core CPI is expected to increase 4.8% versus a gain of 4.7% in February.

Beige Book is released at 2:00 PM EDT on Wednesday.

April Philly Fed Index released at 8:30 AM EDT on Thursday is expected to improve to -20.0 from -23.2 in March.

March Existing Home Sales released at 10:00 AM EDT on Thursday are expected to slip to 4.50 million units from 4.58 million units in February.

March Leading Economic Indicators released at 10:00 AM EDT on Thursday is expected to drop 0.4% versus a decline of 0.3% in February.

Canadian February Retail Sales released at 8:30 AM EDT on Friday are expected to drop 0.6% versus a gain of 1.4% in January.

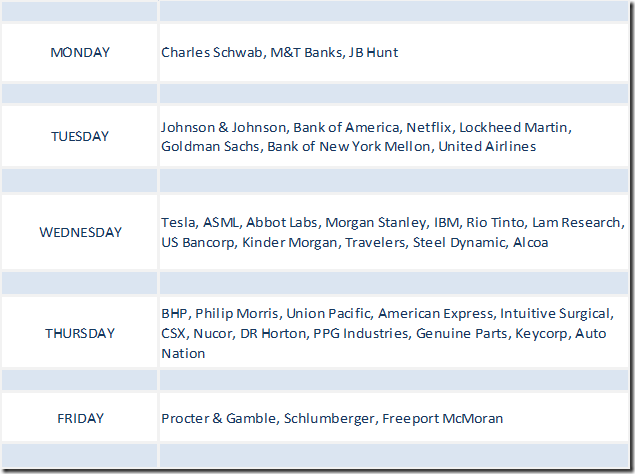

Selected Earnings News This Week

Source: www.Investing.com

Another 60 S&P 500 companies are scheduled to release quarterly results this week (including six Dow Jones Industrial Average companies). No TSX 60 companies are scheduled to report.

Trader’s Corner

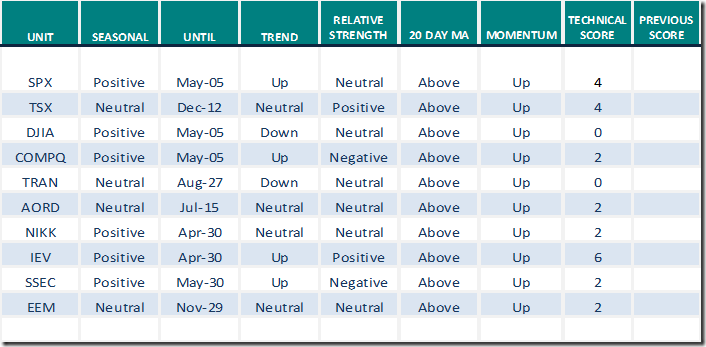

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 14th 2023

Green: Increase from previous day

Red: Decrease from previous day

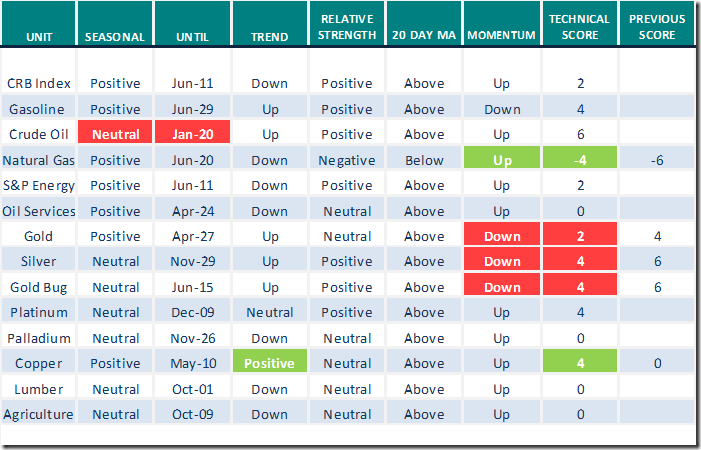

Commodities

Daily Seasonal/Technical Commodities Trends for April 14th 2023

Green: Increase from previous day

Red: Decrease from previous day

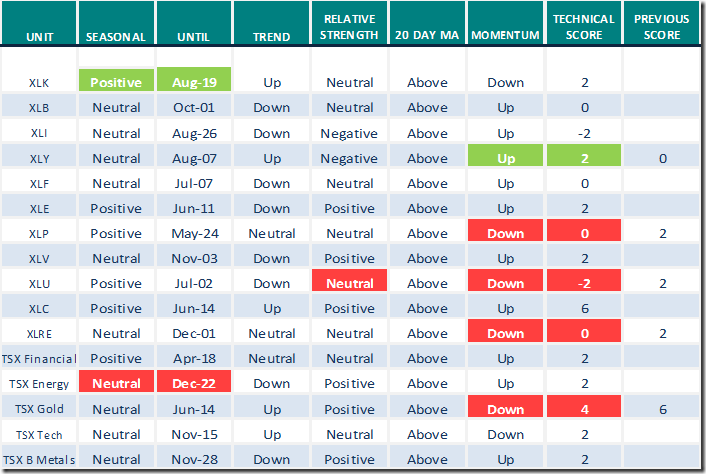

Sectors

Daily Seasonal/Technical Sector Trends for April 14th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for Friday

Berkshire Hathaway $BRK.B an S&P 100 stock moved above $321.32 extending an intermediate uptrend.

Visa $V a Dow Jones Industrial Average stock moved above $233.84 extending an intermediate uptrend (excluding the phantom trades in late January).

Canadian Natural Resources $CNQ.TO a TSX 60 stock moved above Cdn$82.62 to an all-time high extending an intermediate uptrend.

Brookfield Infrastructure $BIP.UN.TO and $BIP moved above Cdn$47.71 and US$35.68 extending an intermediate uptrend.

Links offered by valued providers

Mark Leibovit’s interview on April 13th

Whatever Floats Your Boat: Greg Schnell: April 14, 2023 at 05:03 PM

Whatever Floats Your Boat | The Canadian Technician | StockCharts.com

Five Uptrend Ideas You Should Keep an Eye On | Larry Tentarelli | Your Daily Five (04.14.23)

https://www.youtube.com/watch?v=AmMRpkXz8sU

Michael Campbell’s Money Talks for April 15th

Michael Campbell’s MoneyTalks – Complete Show (mikesmoneytalks.ca)

Why Market Conditions Are Not Yet Bullish: David Keller April 14, 2023

Why Market Conditions Are Not Yet Bullish | The Mindful Investor | StockCharts.com

The Bull Case–Why We’re Likely to See Stocks Move Higher John Hopkins April 14, 2023

The Bull Case–Why We’re Likely to See Stocks Move Higher | Top Advisors Corner | StockCharts.com

Brand Name Breakouts Amid a Mixed Market: Mary Ellen McGonagle April 14, 2023

Brand Name Breakouts Amid a Mixed Market | The MEM Edge | StockCharts.com

Whatever Floats Your Boat: Greg Schnell April 14, 2023

Whatever Floats Your Boat | The Canadian Technician | StockCharts.com

Banks Bounce as Bonds Break | David Keller, CMT | The Final Bar (04.14.23)

Banks Bounce as Bonds Break | David Keller, CMT | The Final Bar (04.14.23) – YouTube

April 14, 2023 | Small Business Hit by Wave of Bankruptcies: Bob Hoye

Small Business Hit by Wave of Bankruptcies – HoweStreet

Victor Adair’s Trading Desk Notes for April 15th

Trading Desk Notes For April 15, 2023 – HoweStreet

Link offered by Mark Bunting and www.uncommonsenseinvestor.com

Why Brookfield & Big Banks "Look Very Interesting." – Uncommon Sense Investor

David Rosenberg comment on Friday on BNNBloomberg

Technical Scoop from David Chapman and www.EnrichedInvesting.com

S&P 500 Momentum Barometers

The intermediate trend Barometer slipped 0.80 on Friday, but gained 10.22 last week to 54.20. It remains Neutral. Daily trend is up.

The long term Barometer slipped 2.20 on Friday, but gained 4.80 last week to 60.20. It changed from Neutral to Overbought on a move above 60.00. Daily trend is up.

TSX Momentum Barometers

The intermediate term Barometer added 0.43 on Friday and gained 10.99 last week to 60.78. It changed from Neutral to Overbought on a move above 60.00. Daily trend remains up.

The long term Barometer slipped 0.86 on Friday, but gained 4.15 last week to 67.24. It remains Overbought. Daily trend remains up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed