Pre-opening Comments for Monday April 10th

U.S. equity index futures were lower this morning. S&P 500 futures were down 22 points at 8:30 AM EDT.

Moderna added $3.39 to $161.66 after JP Morgan raised its target price from $127 to $145.

Weyerhaeuser gained $0.40 to $30.25 after DA Davidson raised its rating from Neutral to Buy.

Tupperware dropped $0.22 to $2.20 after the company warned that it may adjust fourth quarter results.

Cinemark added $0.29 to $15.50 after B. Riley raised its target price from $15 to $20.

EquityClock’s Daily Comment

Headline reads “The rotation that is playing out in the market is keeping the large-cap benchmark supported, but, in a recession scenario, a break below the long-term rising range would be expected”.

http://www.equityclock.com/2023/04/06/stock-market-outlook-for-april-10-2023/

The Bottom Line

The calm before the storm! Frequency of first quarter reports by S&P 500 companies starts slowly this week and ends in a rush on Friday. Initial focus is on reports released by major U.S. banks. Consensus calls for a year-over-year drop in first quarter earnings by S&P 500 companies of 6.6%. Responses to initial reports will set the stage for performance by North American equity indices for the next three weeks.

Economic reports also are a focus. U.S. March CPI and PPI report are expected to confirm a declining trend in inflation. On the other hand, another drop in monthly Retail Sales indicates at least a mild slowdown in the U.S. economy. Response by U.S. equity indices on Friday morning to the March Employment Report was mildly positive: Non-farm Payrolls increased 236,000 versus an estimate of 238,000, Unemployment Rate slipped to 3.5% from 3.6% in February and Average Hourly Wages increased 0.3% in line with consensus. On a year-over-year basis, Average Hourly Wages in March dropped to 4.2% from 4.6% in February. Next official response to these reports is released after the next FOMC meeting announcement on May 3rd .

Seasonal influences for North American equity indices currently are favourable until the first week in May for U.S. equity indices and frequently until the last week in May for the TSX.

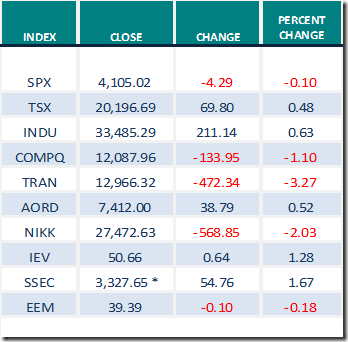

Note gain by the Shanghai Composite Index last week (including the gain on Friday). On a seasonal basis Far East equity markets continue to appear as an interesting alternative to North American equity markets into July.

Economic News This Week

Source: www.Investing.com

March Consumer Price Index released at 8:30 AM EDT on Wednesday is expected to increase 0.3% versus a gain of 0.4% in February. On a year-over-year basis March Consumer Price Index is expected to increase 5.2% versus a gain of 6.0% in February. Excluding food and energy, March Consumer Price Index is expected to increase 0.4% versus a gain of 0.5% in February. On a year over year basis, core CPI is expected to increase 5.6% versus a gain of 5.5% in February.

Bank of Canada updates monetary policy at 10:00 AM EDT on Wednesday. The Bank of Canada’s lending rate to Canada’s major bank is expected to remain unchanged from February at 4.50%.

March Producer Price Index released at 8:30 AM EDT on Thursday is expected to increase 0.1% versus a decline of 0.1% in February. On a year-over-year basis, March PPI is expected to increase 3.1% versus 4.6% in February. Excluding food and energy, March PPI is expected to increase 0.2% in February. On a year-over-year basis, core PPI is expected to increase 3.1% versus a gain of 4.4% in February.

March Retail Sales released at 8:30 AM EDT on Friday are expected to drop 0.4% versus a drop of 0.4% in February. Excluding auto sales, March Retail Sales are expected to slip 0.3% versus a drop of 0.1% in February.

March Capacity Utilization released at 9:15 AM EDT on Friday is expected to slip to 79.0 from 79.1 in February. March Industrial Production is expected to increase 0.2% versus a gain of 0.3% in February.

April Michigan Sentiment released at 10:00 AM on Friday is expected to increase to 62.7 from 62.0 in February.

Selected Earnings News This Week

Source: www.Investing.com

Quiet week until Friday! Focus is on major U.S. banks.

Trader’s Corner

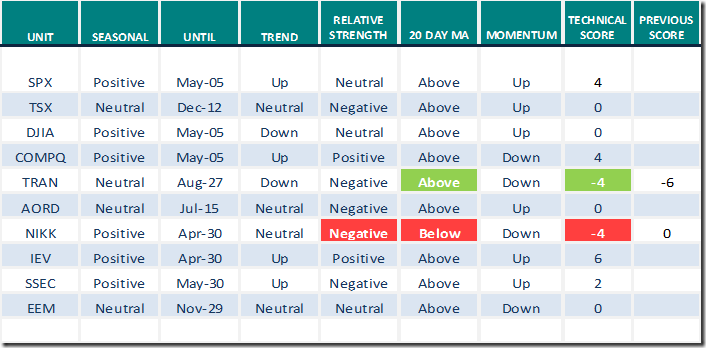

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 6th 2023

Green: Increase from previous day

Red: Decrease from previous day

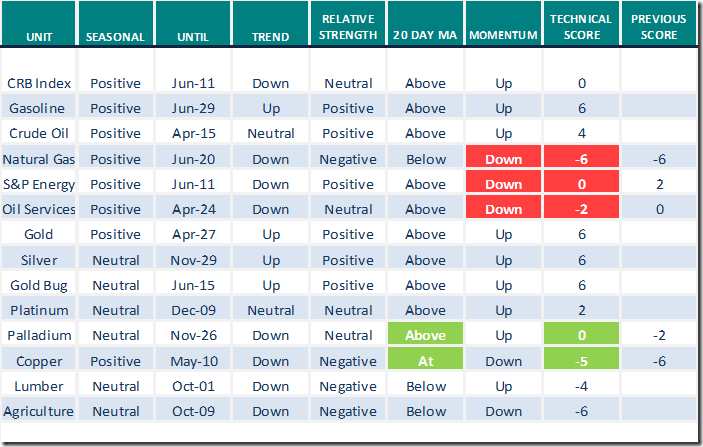

Commodities

Daily Seasonal/Technical Commodities Trends for April 6th 2023

Green: Increase from previous day

Red: Decrease from previous day

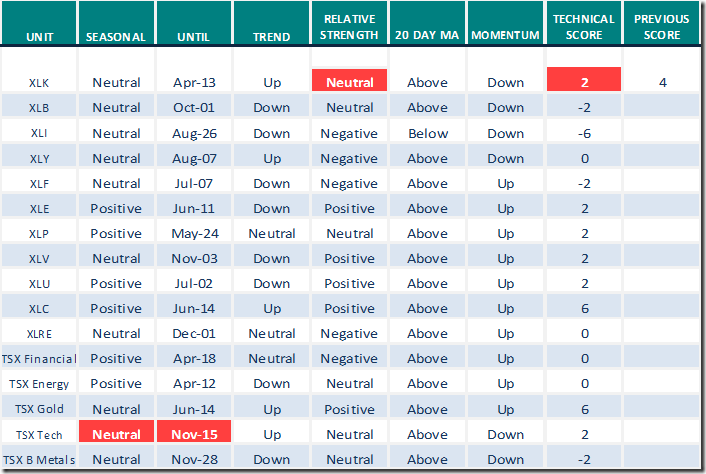

Sectors

Daily Seasonal/Technical Sector Trends for April 6th 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive seasonal ratings: www.equityclock.com

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

* Includes Friday close

Technical Notes for last Thursday

Italy iShares $EWI moved above $30.96 extending an intermediate uptrend.

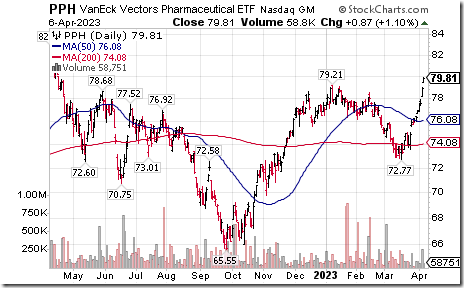

Pharma ETF $PPH moved above $79.21 extending an intermediate uptrend.

Alphabet a NASDAQ 100 stock moved above resistance extending an intermediate uptrend: GOOG moved above$108.82 and GOOGL moved above $108.18.

Southern Companies $SO an S&P 100 company moved above $72.38 extending an intermediate uptrend.

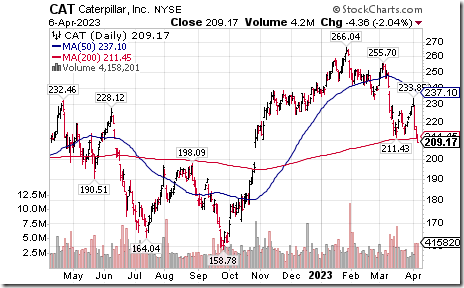

Caterpillar $CAT a Dow Jones Industrial Average stock moved below $211.43 extending an intermediate downtrend.

Okta $OKTA a NASDAQ 100 stock moved below $77.51 completing a double top pattern.

BCE $BCE.TO a TSX 60 stock moved above Cdn$63.10 completing a reverse Head & Shoulders pattern.

Nutrient $NTR.TO a TSX 60 stock moved below Cdn$96.10, Cdn$94.87 and Cdn$92.30 extending an intermediate downtrend.

Links offered by valued providers

Mark Hulbert: Your market-timing move to sell stocks in May and ‘go away’ until October actually starts now

mod=mw_pushly&send_date=20230406

Greg Schnell asks “Where is the money going”?

https://www.youtube.com/watch?v=XRVsSjpL07U

Chart Setups Ready For Liftoff | TG Watkins | Your Daily Five (04.06.23)

https://www.youtube.com/watch?v=xFjRTvPboL4

These Trades Are Money Makers | Tom Bowley | Trading Places (04.06.23)

https://www.youtube.com/watch?v=UboR0HwUfiQ

Sprott Precious Metals Report: Gold Bulls Run Faster as Fed Tackles Banking Crisis

Sprott Precious Metals Report: Gold Bulls Run Faster as Fed Tackles Banking Crisis

Michael Campbell’s Money Talks for April 8th

Michael Campbell’s MoneyTalks – Complete Show (mikesmoneytalks.ca)

Key Levels for the FAANG Stocks: David Keller April 07, 2023

Key Levels for the FAANG Stocks | The Mindful Investor | StockCharts.com

Recession Fears Drive Sector Rotation | Mary Ellen McGonagle | The MEM Edge (04.07.23)

Recession Fears Drive Sector Rotation | Mary Ellen McGonagle | The MEM Edge (04.07.23) – YouTube

Comments by Ross Clark, Victor Adair and Mark Leibovit

This Week in Money – HoweStreet

April 6, 2023 | Should You Worry About US Dollar in Post Bubble Contraction? Mark Hoye

Should You Worry About US Dollar in Post Bubble Contraction? – HoweStreet

Link from Mark Bunting and www.uncommonsenseinvestor.com

"We Have the Highest Cash Balance We’ve Ever Had." – Uncommon Sense Investor

Technical Scoop by David Chapman and www.EnrichedInvesting.com

"We Have the Highest Cash Balance We’ve Ever Had." – Uncommon Sense Investor

S&P Momentum Barometers

The intermediate term Barometer eased 0.20 on Thursday and dropped 6.20 last week to 44.00. It remains Neutral.

The long term Barometer eased 1.00 on Thursday and dropped 3.20 last week to 56.80. It returned to Neutral from Overbought after moving below 60.00.

TSX Momentum Barometers

The intermediate term Barometer added 1.07 on Thursday and gained 0.63 last week to 49.79. It remains Neutral.

The long term Barometer added 0.70 on Friday, but dropped 1.01 last week. It remains Overbought.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed