Pre-opening Comments for Friday March 24th

U.S. equity index futures were lower this morning. S&P 500 futures were down 34 points at 8:35 AM EDT

Index futures dropped sharply in overnight trade on concerns that Deutsche Bank was experiencing financial distress. Deutsche Bank dropped $1.20 to $8.14 in overnight trade.

Index futures were virtually unchanged following release of the February Durable Goods Order report at 8:30 AM EDT. Consensus was an increase of 0.2% versus a decline of 4.5% in January. Actual was a drop of 1.0%. Excluding transportation orders, consensus was an increase of 0.2% versus a decline of 0.8% in January. Actual was unchanged.

Stochastics dropped $4.81 to $36.51 after reporting a larger than consensus fiscal third quarter loss. The company also lowered guidance for its fiscal fourth quarter

Genuine Parts gained $4.69 to $158.98 after Truist upgraded the stock from Hold to Buy.

EquityClock’s Daily Comment

Headline reads “Coincident indicators continue to hint that an economic recession is underway”.

http://www.equityclock.com/2023/03/23/stock-market-outlook-for-march-24-2023/

Technical Notes

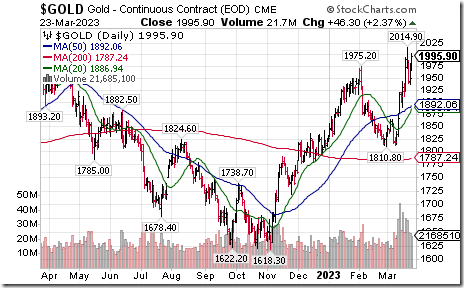

Goldman Sachs raised its 12 month price target for gold to $2,050/oz from $1,950, describing it as the best hedge against financial risks, and reiterated its bullish view on commodities in general.

Russell 2000 iShares $IWM moved below support at $169.71 extending an intermediate downtrend.

Regeneron $REGN a NASDAQ 100 stock moved above $800.48 to an all-time high extending an intermediate uptrend.

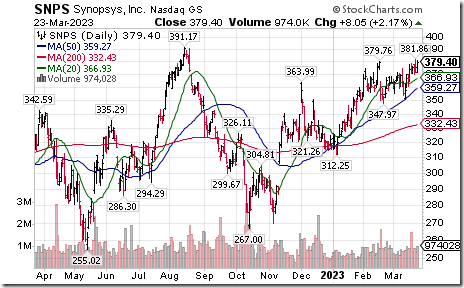

Synopsys $SNPS a NASDAQ 100 stock moved above $379.76 extending an intermediate uptrend.

Exelon $EXC an S&P 100 stock moved below $39.35 setting an intermediate downtrend.

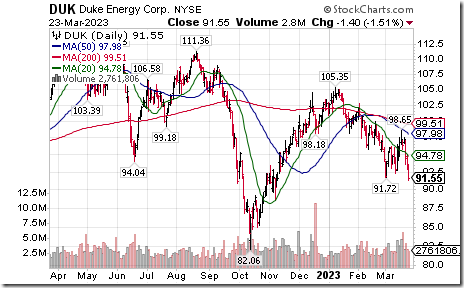

Duke Energy $DUK an S&P 100 stock moved below $91.72 extending an intermediate downtrend.

Lowes Companies $LOW an S&P 100 stock moved below $191.27 setting an intermediate downtrend.

Johnson & Johnson $JNJ a Dow Jones Industrial Average stock moved below $150.71 extending an intermediate downtrend.

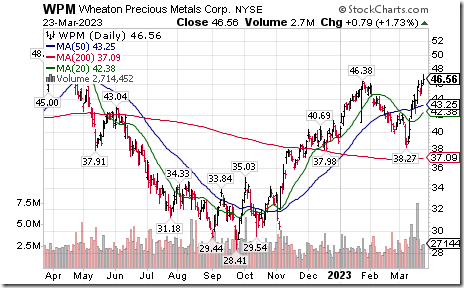

Wheaton Precious Metals $WPM a TSX 60 stock moved above US$46.43 extending an intermediate uptrend.

Canadian National Railway $CNR.TO a TSX 60 stock moved below Cdn$154.25 extending an intermediate downtrend.

Trader’s Corner

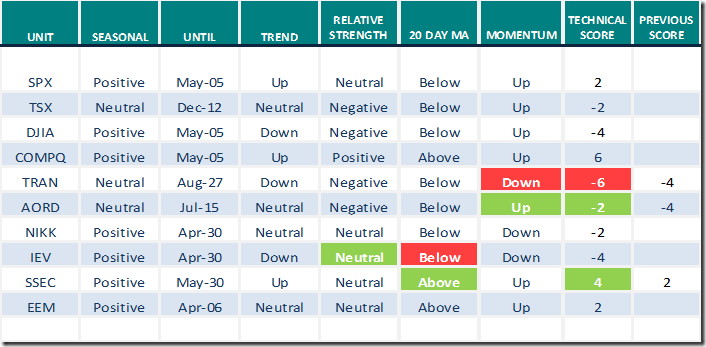

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 23rd 2023

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for March 23rd 2023

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for March 23rd 2023

Green: Increase from previous day

Red: Decrease from previous day

Source for positive Seasonal ratings: www.equityclock.com

Links offered by valued providers

Stocks Fail After Fed Meeting | Tom Bowley | Trading Places (03.23.23)

Stocks Fail After Fed Meeting | Tom Bowley | Trading Places (03.23.23) – YouTube

Editor’s Note: Favourable comments on the Semi-conductor sector

A Growth Sector Turns Up | Greg Schnell, CMT | Market Buzz (03.22.23)

A Growth Sector Turns Up | Greg Schnell, CMT | Market Buzz (03.22.23) – YouTube

Editor’s Note: Favourable comments on the Consumer Discretionary sector.

3 Buyable ETF’s & 2 Stocks In A Volatile Market | Mary Ellen McGonagle | (03.23.23)

Editor’s Note: Favourable comments on the NASDAQ Composite Index and Gold

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 1.00 to 18.80. It remains Oversold.

The long term Barometer dropped 1.80 to 41.40. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer dropped 2.43 to 28.63. It remains Oversold.

The long term Barometer slipped 0.21 to 51.28. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed