by John Lynch, Chief Investment Strategist, Comerica Wealth Management

Executive Summary

After the failure of two banks, support escalated in a variety of forms from the U.S. Treasury, FDIC, and the Federal Reserve, along with a consortium of leading institutions providing First Republic with $30 billion in deposits. Unfortunately, these steps proved insufficient to quell investor anxiety.

In addition, the Federal Reserve and five other leading central banks announced a plan to boost dollar liquidity through swap arrangements daily rather than the current weekly program.

The risks to liquidity and sentiment were not solely domestic issues, however, as the Swiss National Bank provided Credit Suisse with a $50 billion injection of support. That news was also not enough to limit the damage, however, and UBS stepped in last night to purchase Credit Suisse for $3 billion.

Key Takeaways

- While these steps should help quell concerns over liquidity, the Federal Reserve meets this week and we expect a 25-basis point increase in the federal funds rate, to a range of 4.75% to 5.0%, on Wednesday. That is right, on one hand the Fed is injecting liquidity into the markets, and on the other, it is tightening liquidity to defeat inflation. Alas, these are challenging times.

- It should be noted that while volatility in equities has gained most headlines, the recent swings in market interest rates has been striking. Yields plunged and the MOVE Index of bond volatility climbed back to its 2008 highs, while the CBOE Equity Volatility Index (VIX) remains well below its peak over the past few years.

- The S&P Dow Jones Indices and MSCI Inc. made a few adjustments on Friday 3/17 to their Global Industry Classification Standard (GICS) sector composition. While most of the changes can be considered “tweaks” by investors, we view the most important adjustment as the GICS sector reclassification of firms from the Information Technology into the Financials Services sector.

Bank Volatility

After the failure of two banks in the past week, support escalated in a variety of forms from the U.S. Treasury, FDIC, and the Federal Reserve, along with a consortium of leading institutions providing First Republic with $30 billion in deposits. Unfortunately, these steps proved insufficient to quell investor anxiety.

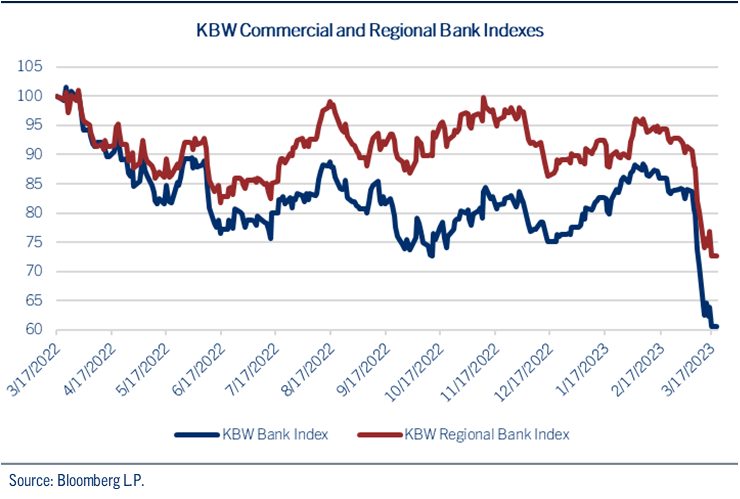

To be sure, the FDIC takeovers of Silicon Valley Bank and Signature Bank represented the second and third largest bank failures in history. Measures to improve confidence and bank liquidity include the Bank Term Funding Program, the Fed’s discount window, and increased coordination with the Federal Home Loan Bank (FHLB). Yet, the most eye-catching was the decision for 11 of the largest banks in the U.S. to inject $30 billion in deposits to First Republic, to improve sentiment among depositors and investors. Initially viewed positively by the financial markets, they failed to stem the losses in commercial and regional banks, which plunged again last week. See chart: KBW Commercial and Regional Bank Indexes.

The risks to liquidity and sentiment were not solely domestic issues, however, as the Swiss National Bank provided Credit Suisse with a $50 billion injection of support. That news was also not enough to limit the damage, however, and UBS stepped in last night to purchase Credit Suisse for $3 billion.

That was not the only power move before markets opened for trading on Monday. The Federal Reserve and five other leading central banks announced a plan to boost dollar liquidity through swap arrangements daily rather than the current weekly program.

While this recent step should help quell concerns over liquidity, the Federal Reserve meets this week and we expect a 25-basis point increase in the federal funds rate, to a range of 4.75% to 5.0%, on Wednesday. That is right, on one hand the Fed is injecting liquidity into the markets, and on the other, it is tightening liquidity to defeat inflation. Alas, these are challenging times.

Market Volatility

Despite all the efforts to prevent fears of contagion, volatility prevailed in the markets for fixed income and equities last week.

It should be noted that while volatility in equities has gained most headlines, the recent swings in market interest rates has been striking. In less than eight trading days, the yield on the 2-year Treasury plunged from 5.0% to less than 4.0%, the benchmark 10-year Treasury note declined by more than 50 basis points, and the Fed Funds futures market went from projecting a year-end target of 5.50% to below 4.0% currently. Indeed, these swings in market interest rates resulted in the MOVE Index of bond volatility climbing back to its 2008 highs, while the CBOE Equity Volatility Index (VIX) remains well below its peak over the past few years. See chart: Bond (MOVE) and Equity Market (VIX) Volatility.

Of course, the degree of fragility in consumer confidence and investor sentiment will play an important role going forward. Traders have thus far shown little discernment, as the bonds and equities of most financial institutions have been under extreme pressure. To the extent to which cooler heads will prevail in the coming days and weeks, we suspect investors will gain an improved understanding and appreciation for those banks with the solid foundations of diversified deposit, lending, and securities portfolio strategies.

This collective exercise will continue to pressure the weakest players in the industry, especially those with narrow business strategies who are most at risk for a run on their deposit bases. We also look for further regulations for the banking industry, particularly regional banks, with potential increases in capital and liquidity requirements. The mild recession that we projected in our 2023 Market Outlook, which has thus far been elusive given strong employment and consumption trends, may finally come to fruition in the months ahead. Therefore, further market volatility is likely in the coming days and weeks as market interest rates fluctuate, the weakest banks struggle, and equity indexes possibly revisit their October lows.

Sector Changes

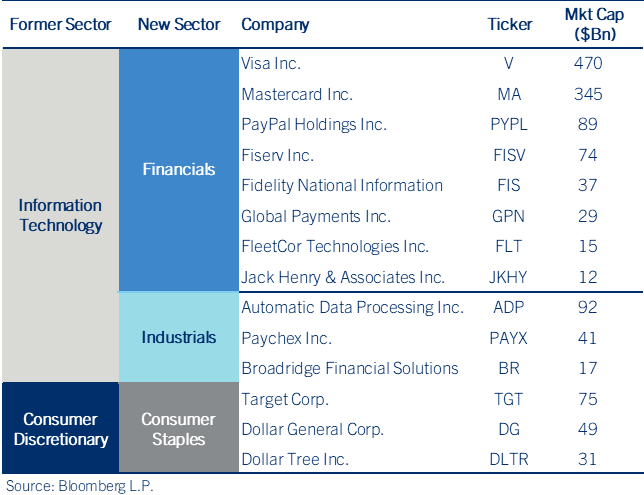

The S&P Dow Jones Indices and MSCI Inc. made a few adjustments on Friday 3/17 to their Global Industry Classification Standard (GICS) sector composition. While most of the changes can be considered “tweaks” by investors, we view the most important adjustment as the GICS sector reclassification of firms from the Information Technology into the Financials Services sector. The Data Processing & Outsourced Services industry group within Technology is being dissolved and its constituents are being reallocated to the Financials and Industrials sectors. See chart: Sector Change and Stock Reallocation.

Companies that focus on services including data and human-capital management, including ADP and Paychex, will move from Technology to the Industrials sector. Retailers including Target Corp, Dollar General, and Dollar Tree Inc., will join Walmart and Costco in the Consumer Staples sector in a newly created Consumable Merchandise Retail sub-industry.

To be sure, almost $1 trillion in market capitalization is being added to the Financial Services sector. Moreover, the reduction in the Information Technology sector will make it even more concentrated, with Apple and Microsoft projected to account for more than one half of the sector’s market capitalization going forward.

While all these changes are significant, we believe the most important development is the shift of “growthier” names into the Financial Services sector. Particularly given the recent challenges in the banking industry, we view the changes as a chance to remove the “deep value” perception that at times has weighed down performance and profitability of the Financial Services sector. As a result, we look for a healthier P/E multiple for the group going forward, justified by improved earnings momentum.

Copyright © Comerica