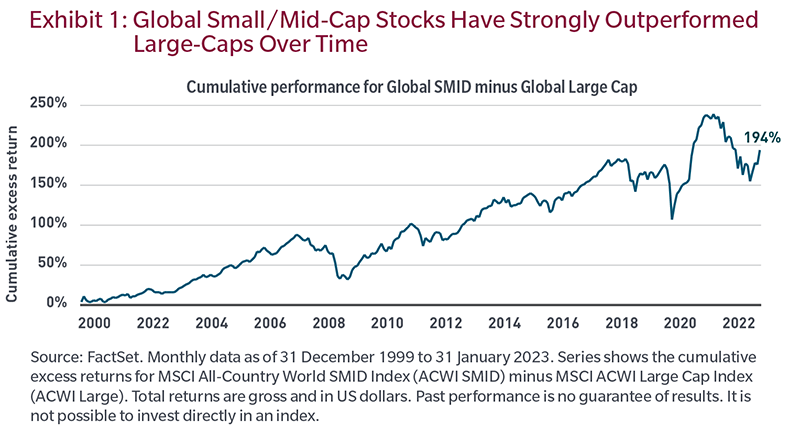

Nicolas J. Paul, CFA, Equity Portfolio Manager & Institutional Portfolio Manager at MFS Investment, highlights the compelling case for investing in global small- and mid-cap stocks. According to Paul, this asset class has shown strong long-term performance compared to large-cap stocks, and current market conditions suggest it could potentially assume a leadership role in the next market rotation.

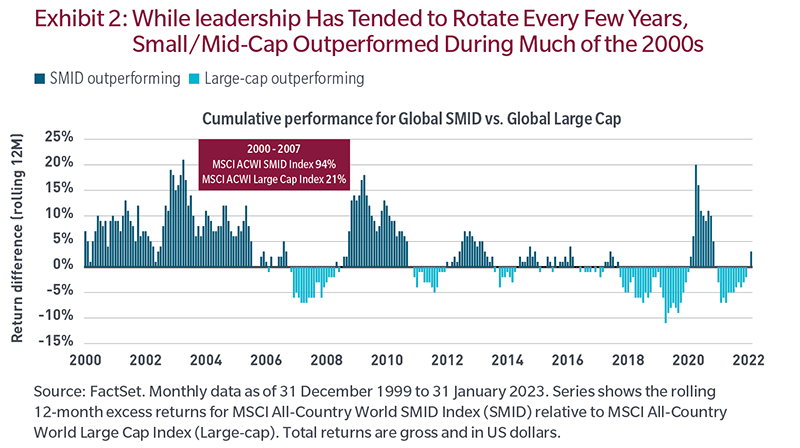

The current opportunity set for small- and mid-caps seems particularly attractive. Paul points to the period between the end of the dot-com era (early 2000s) and the global financial crisis (GFC) (2008) as an example. During this time, global small- and mid-cap stocks significantly outperformed their large-cap counterparts.

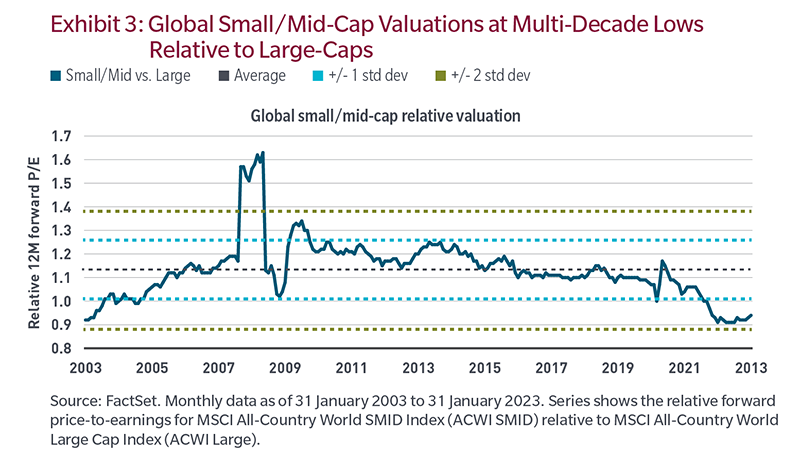

While no two periods are perfectly alike, Paul draws parallels between that time and the present environment, including valuations offering a buying opportunity not seen in decades, and inflation and interest rates more aligned with the pre-GFC period.

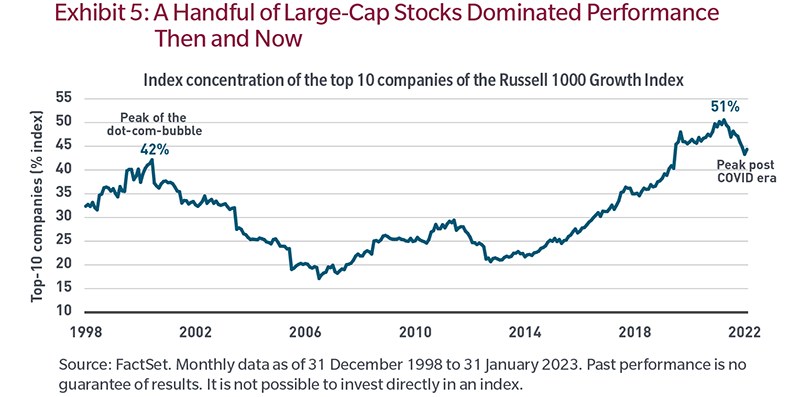

Paul also notes similarities between the high-flying technology stocks of the dot-com era and today's meme stocks.

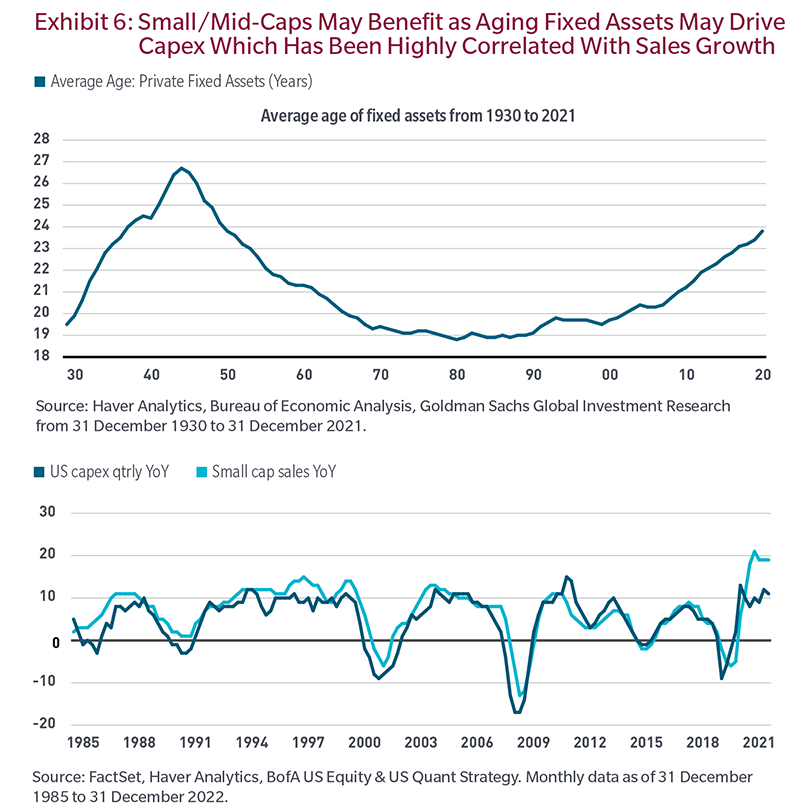

He suggests that future spending trends may benefit a broader range of sectors and industries, including small- and mid-cap stocks, rather than just the mega-cap technology companies that have dominated the past decade. Paul also highlights the local nature of small- and mid-cap companies, which could work in their favor as governments and companies worldwide look to improve supply chain resilience through onshoring.

The dominance of large-cap stocks has resulted in decreased exposure to small- and mid-cap stocks in the traditional standard global benchmark allocation.

Paul argues that this shift in allocation presents a strong case for considering a dedicated allocation to the global small- and mid-cap asset class for suitable investors. Active management is particularly well-suited for this asset class due to the ample alpha opportunities it offers.

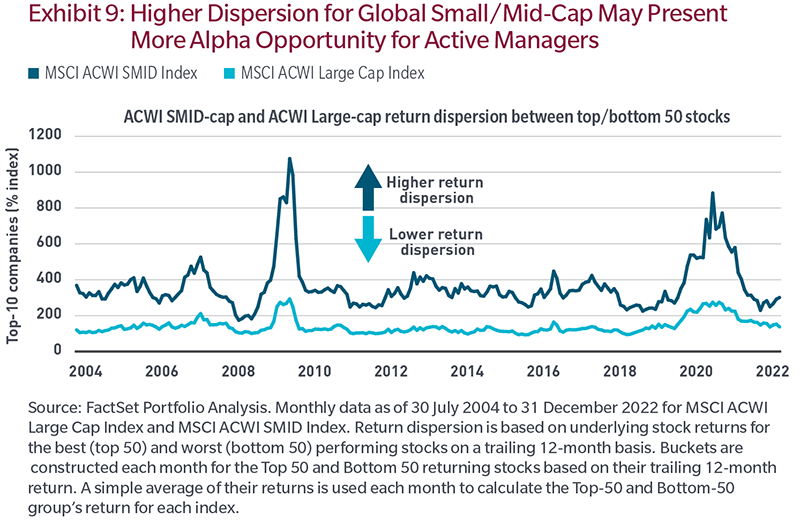

Small- and mid-cap stocks receive less research coverage and exhibit greater return dispersion than their large-cap counterparts. Active managers with extensive research resources and experience can potentially capitalize on these characteristics to identify attractive stock opportunities.

*****

Footnotes:

1 Adapted from source: Paul, Nicholas J. "Exploring Opportunities for Global Small- and Mid-Cap Stocks in the Next Cycle." MFS, 20 Mar. 2023, www.mfs.com/en-us/investment-professional/insights/equity/exploring-opportunities-for-global-small-and-mid-cap-stocks-in-the-next-cycle.html.

2 Photo by Peter Nguyen on Unsplash

*****

For more MFS Investment Management Insights, visit mfs.com

Additional information about Nicholas J. Paul and MFS Investment Management Research:

About

MFS Investment's global research platform and long-term time horizon position the firm to potentially identify unique opportunities in the global small- and mid-cap universe. With nine investment research offices worldwide and a seasoned portfolio management team, MFS Investment can leverage its expertise to deliver a well-diversified global small- and mid-cap portfolio.

In summary, MFS Investment offers:

- The opportunity to invest in a relatively inefficient and less-followed global asset class

- The ability to leverage MFS Investment's global research platform and long-term time horizon for potential opportunities in the global small- and mid-cap universe

- A long history of managing small- and mid-cap strategies on behalf of clients globally, with US$51 billion under management in these portfolios as of 12/31/22

- A seasoned portfolio management team with an average tenure of 17 years at MFS Investment and a strong background in managing small- and mid-cap strategies

The information provided should not be construed as investment advice or a recommendation to buy or sell any security. The views expressed are those of the author and are subject to change at any time.

Important Risk Considerations: Stock markets and investments in individual stocks are volatile and can decline significantly due to various factors. International investments involve greater risk and volatility than U.S. investments. Mid-cap and small-cap investments can be more volatile than investments in larger companies. No forecasts can be guaranteed.