The Bottom Line

Broadly based U.S. equity indices moved higher last week despite release of mixed first quarter reports on Friday. Notably stronger were the money center banks and their related ETFs. After opening weaker on news, they closed significantly higher.

Most international equity indices outperformed broadly based U.S. equity indices last week including the Canadian, Australian, European and Emerging Markets indices.

Technical indicators show that most equity indices are intermediate and long term Overbought, but have yet to show signs of rolling over.

Consensus for Earnings and Revenues for S&P 500 Companies

Analysts slightly increased fourth quarter earnings and revenue estimates since our last report on January 9th. According to www.factset.com fourth quarter earnings are expected to decrease 3.9% (versus previous decrease of 4.1%) and revenues are expected to increase 3.9% (versus previous increase of 3.8%). For all of 2022 earnings are expected to increase 4.8% (versus previous increase of 4.7%) and revenues are expected to increase 10.3% (versus previous 10.4%).

Preliminary earnings estimates for 2023 continued moving lower. According to www.factset.com first quarter 2023 earnings are expected to decrease 0.6% (versus previous decrease at 0.1%) but revenues are expected to increase 3.1% (versus previous increase of 3.8%). Second quarter 2023 earnings are expected to decrease 0.7% (versus previous decrease at 0.5%) and revenues are expected to increase 0.7% (versus previous increase at 0.9%). For all of 2023, earnings are expected to increase 4.6% (versus previous increase of 4.8%) and revenues are expected to increase 3.2%.

Economic News This Week

Martin Luther King Jr. Holiday in the U.S. on Monday. U.S. equity markets are closed.

Canadian December Consumer Price Index released at 8:30 AM EST on Tuesday is expected to decline 0.5% versus a gain of 0.1% in November. On a year-over-year basis, December CPI is expected to increase 6.3% versus a gain of 6.8% in November.

December Retail Sales released at 8:30 AM EST on Wednesday are expected to drop 0.8% versus a decline of 0.6% in November. Excluding auto sales, December Retail Sales are expected to decline 0.4% versus a decline of 0.2% in November.

December Producer Price Index released at 8:30 AM EDT on Wednesday is expected to decrease 0.1% versus a gain of 0.3% in November. On a year-over-year basis, December Producer Price Index is expected to increase 6.8% versus a gain of 7.4% in November. Excluding food and energy, December Producer Price Index is expected to increase 0.1% versus a gain of 0.4% in November. On a year-over-year basis, core December Producer Price Index is expected to increase 5.9% versus a gain of 6.2% in November.

December Capacity Utilization released at 9:15 AM EST on Wednesday is expected to slip to 79.6 from 79.7 in November. December Industrial Production is expected to slip 0.1% versus a decline of 0.2% in November.

Beige Book is released at 2:00 PM EST on Wednesday

December Housing Starts released at 8:30 AM EST on Thursday are expected to drop to 1.385 million units from 1.427 million units in November.

January Philly Fed Index released at 8:30 AM EST on Thursday is expected to drop to -11.0 versus a drop to 13.8 in December.

December Canadian Retail Sales released at 8:30 AM EST on Friday are expected to drop 0.5% versus a gain of 1.4% in November. Excluding auto sales December Canadian Retail Sales are expected to versus a gain of 1.7% in November.

December Existing Home Sales released at 10:00 AM EST on Friday are expected to slip to 3.95 million units from 4.09 million units in November.

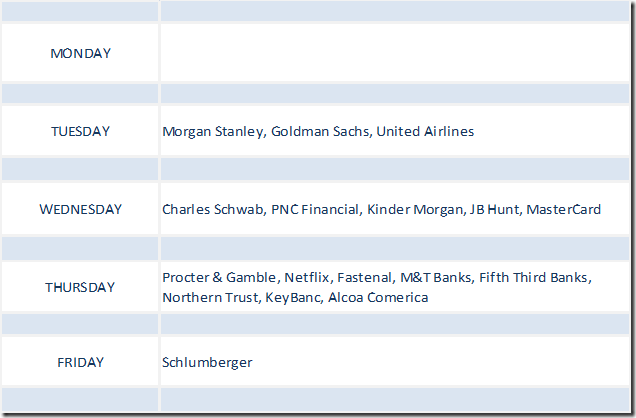

Selected Earnings News This Week

Focus this week is on reports by Financial Services companies. Twenty six S&P 500 companies (including two Dow Jones Industrial companies) are scheduled to release results.

Trader’s Corner

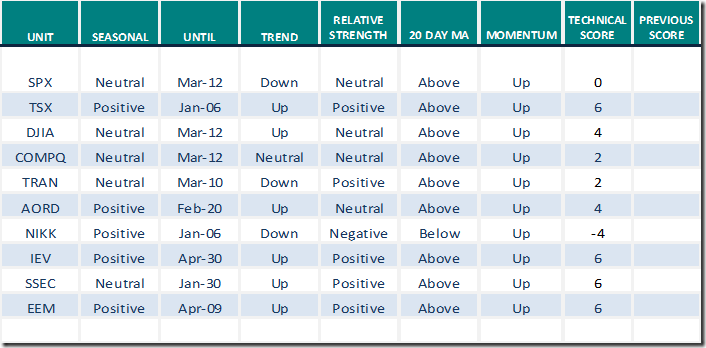

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for January 13th 2023

Green: Increase from previous day

Red: Decrease from previous day

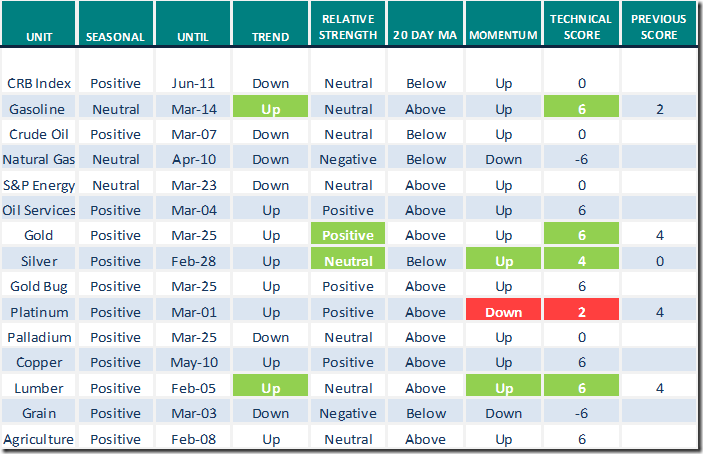

Commodities

Daily Seasonal/Technical Commodities Trends for January 13th 2023

Green: Increase from previous day

Red: Decrease from previous day

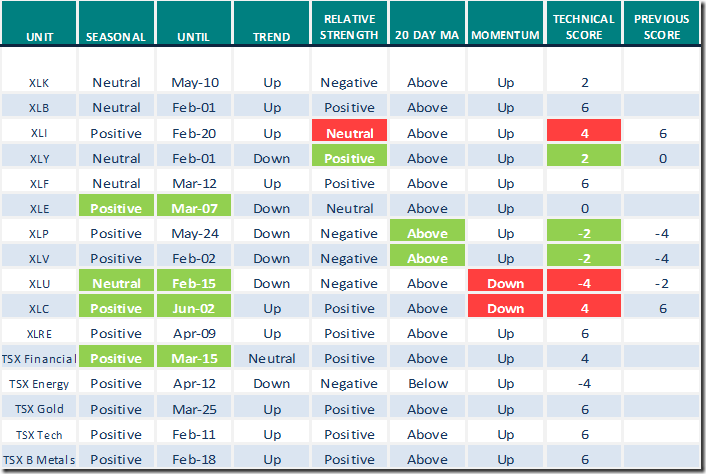

Sectors

Daily Seasonal/Technical Sector Trends for January 13th 2023

Green: Increase from previous day

Red: Decrease from previous day

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for Friday

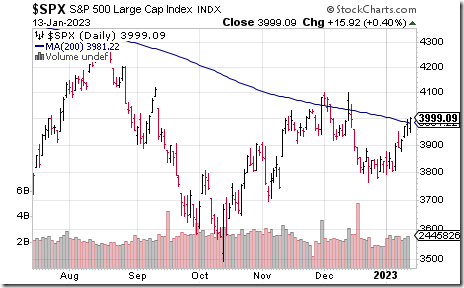

The S&P 500 Index closed above its 200 day moving average.

Lockheed Martin $LMT an S&P 100 stock moved below intermediate support at $455.21. The stock was downgraded by Goldman Sachs.

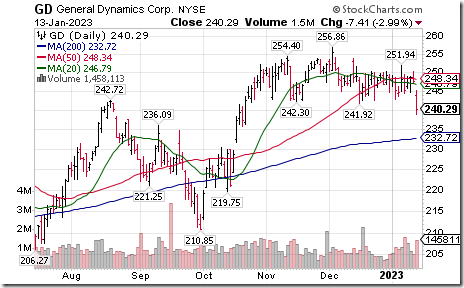

General Dynamics $GD an S&P 100 stock moved below $241.92 completing a Head & Shoulders pattern.

Netflix $NFLX a NASDAQ 100 stock moved above $332.72 extending an intermediate uptrend.

Saputo $SAP.TO a TSX 60 stock moved above $35.86 extending an intermediate uptrend.

Links offered by valued providers

Mark Leibovit’s weekly column

Bitcoin, Gold, US Dollar, Stock Markets – HoweStreet

Michael Campbell’s Money Talks for January 14th

Michael Campbell’s MoneyTalks – Complete Show (mikesmoneytalks.ca)

2023 Outlook by Martin Pring and Bruce Fraser

2023 Equity Market Outlook | Martin Pring & Bruce Fraser (01.12.23) – YouTube

Charting First Quarter Market Outlook: Comments by Mish Schneider, Greg Schnell and Tom Bowley

Charting Forward: Q1 Market Outlook (01.13.23) – YouTube

“Five charts to focus on” by Larry Tentareli

5 Charts To Focus On | Larry Tentarelli | Your Daily Five (01.13.23) – YouTube

David Keller discusses “Four scenarios for the S&P 500”.

The Four Scenarios for the S&P 500 | The Mindful Investor | StockCharts.com

Arthur Hill discusses “Relative seasonality and Monthly Equity Curve”

Relative Seasonality and a Monthly Equity Curve | Art’s Charts | StockCharts.com

Greg Schnell discusses “Stock market rallies:Is the light switch turning on”?

Stock Market Rallies: Is This Light Switch Turning On? | The Canadian Technician | StockCharts.com

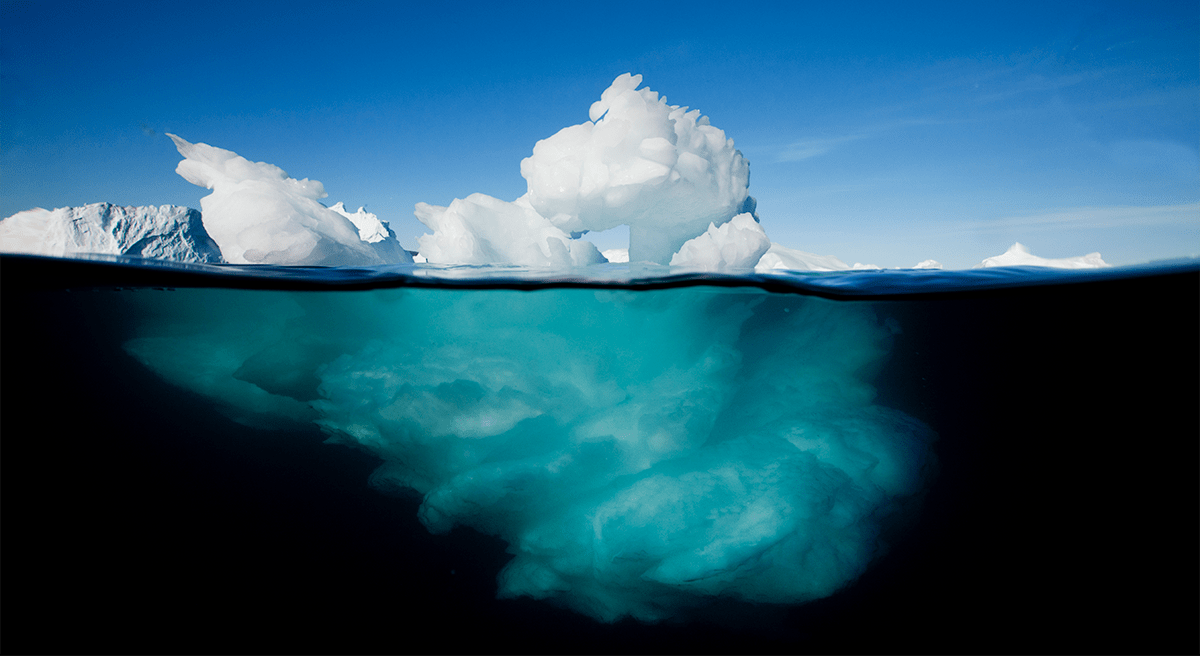

Tyler Wood discusses “Changing Tides for Risk Assets”.

Changing Tides for Risk Assets | Tyler Wood, CMT | GoNoGo Charts (01.12.23) – YouTube

Victor Adair’s Trading Notes

https://victoradair.ca/trading-desk-notes-for-january-14-2023/

Links from Mark Bunting and www.uncommonsenseinvesting.com

Four Top Internet Stock Ideas – Uncommon Sense Investor

Best Stock Ideas for 2023 From Our All-Star Roster – Uncommon Sense Investor

Central Bank Losses Make Them Buy Record Amounts of Gold | dlacalle.com

Investors look for 2023 outlooks from companies as earnings season looms (yahoo.com)

Weekly Technical Scoop from David Chapman and www.EnrichedInvesting.com

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 0.26 on Friday, but gained 9.20 last week to 77.00. It remains Overbought. Short term trend is up.

The long term Barometer slipped 0.40 on Friday, but gained 8.60 last week to 66.20. It changed from Neutral to Overbought on a move above 60.00. Short term trend is up.

TSX Momentum Barometers

The intermediate term Barometer added 2.54 on Friday and gained 10.59 last week to 75.00. It remains Overbought. Short term trend is up.

The long term Barometer advanced 2.54 on Friday and gained 11.87 last week to 66.53. It changed from Neutral to Overbought on a move above 60.00. Short term trend is up.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed