echnical Notes for Yesterday

Shanghai Composite Index moved above 3,145.75 to 3,149.75 completing an intermediate reversal pattern. It also moved above its 20 and 50 day moving averages. Strength relative to the S&P 500 Index has just turned positive.

Emerging Markets and related ETFs continue to show improving technicals on a real and relative basis. BMO Emerging Markets ETF $ZEM moved above $18.81 extending an intermediate uptrend. Strength in its Chinese components was a major contributor. Seasonal influences have just turned positive

Base metal equities and related ETFs are responding to weakness in the U.S. Dollar Index. Base Metals iShares $PICK moved above $42.06 extending an intermediate uptrend. VALE $VALE one of the largest base metals producers in the world moved above $15.98 extending an intermediate uptrend. Seasonal influences are positive until mid-February.

Fox Corporation $FOXA a NASDAQ 100 stock moved above $31.62 completing a double bottom pattern.

Zoom $ZM a NASDAQ 100 stock moved below $70.43 extending an intermediate downtrend.

Trader’s Corner

Lots of seasonality updates! December tends to be a month when seasonal

influences change the most.

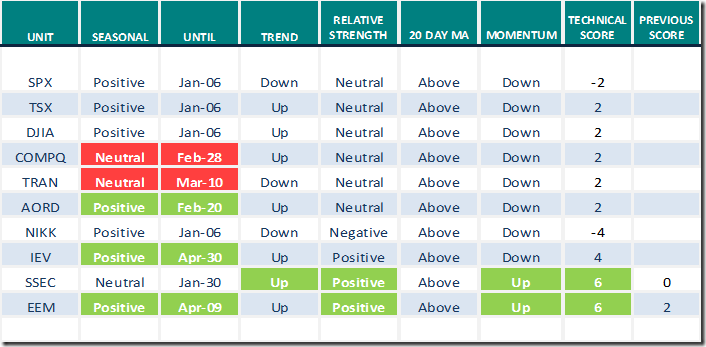

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for November 29th 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for November 29th 2022

Green: Increase from previous day

Red: Decrease from previous day

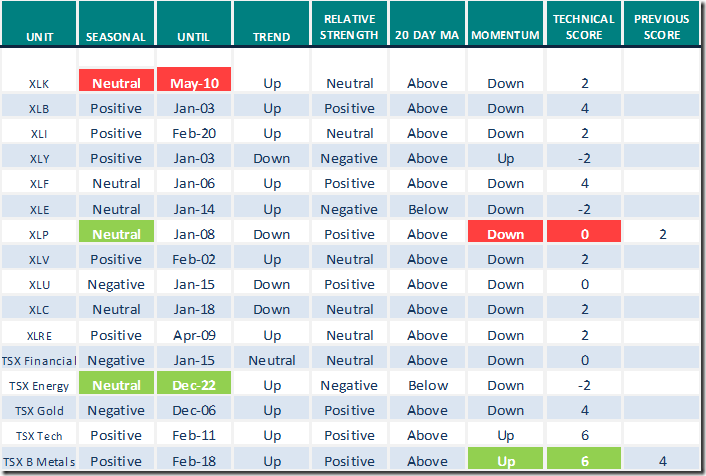

Sectors

Daily Seasonal/Technical Sector Trends for November 29th 2021

Green: Increase from previous day

Red: Decrease from previous day

‘Tis the season to “Pay it forward”

Thank you to all subscribers for your interest and support of Tech Talk services. As you are aware, the services are completely free of charge. No cost to you at all. We are thankful for the opportunities to offer this and are aware that many of you may wish to give back in some way . Once a year, Tech Talk gives you an opportunity to do just that — to “Pay it forward” for these services by making a charitable donation to Tech Talk’s favourite charity: Wellspring.

Wellspring is a unique charity. It offers free non-medical services to cancer patients and their caregivers. Services include counselling and support through a variety of programs including diet, exercise, finance and updates on available cancer treatments. Several locations are available across Canada, including the Birmingham Gilgan House located in Oakville. Operations are funded without federal or provincial government support. Previously, services were offered only at physical locations across Canada. Since the start of COVID 19 most services also have been offered “on line”.

The annual fund raising program at this time of year is called “Light up Wellspring”. The idea is to make official charitable donations in the form of virtual Christmas decorations: Sponsor a bulb ($20), strand of lights ($50), red cardinal ornament ($100), guiding star ($250), wreath ($500) or Tree of Hope ($1,000) to bring light and hope to those living with cancer this holiday season.

The “Light up Wellspring” event is held tomorrow, December 1st. More information on Wellspring and its services is available at https://wellspring.ca/the-wellspring-approach/

This is a direct link to the Light-up Donations page:

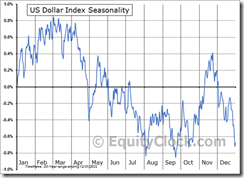

Seasonality Chart of the Day

One of the reasons why U.S. equity prices historically have moved higher in December is currency flows: Seasonal influences for the U.S. Dollar Index are negative in the month of December. That’s when free cash flow from non-U.S .operations realized by major U.S. based companies is repatriated into U.S. Dollars for year-end reporting, dividend and tax purposes.

Share prices most impacted by weakness in the U.S. Dollar Index in December are U.S. equities involved with extensive international operations. Prominent are share prices in the commodity, consumer discretionary and consumer staple sectors.

S&P 500 Momentum Barometers

The intermediate term Barometer was unchanged at 86.00 yesterday. It remains Overbought.

The long term Barometer was unchanged at 58.20 yesterday. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer added 4.24 to 78.81 yesterday. It remains Overbought.

The long term Barometer added 3.81 to 51.27 yesterday. It remains Neutral.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed