by Doug Drabik, Fixed Income, Raymond James

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

I didn’t want to turn this message into a dispute about a recession. After all, it’s just a word, and, as we’ve experienced, words and definitions can be changed to meet an agenda. What is more important is that every time you put gas in your car or buy groceries for the table, you are likely feeling the pains of inflation. Inflation and its effects touch nearly all consumers with no prejudice to economic standing or asset selection. It impacts bonds, stocks, cash, homes, cars… all assets. The strategic actions we have been advocating for the last couple of months address the existing inflationary environment and may better position fixed income assets to endure an officially acknowledged recession.

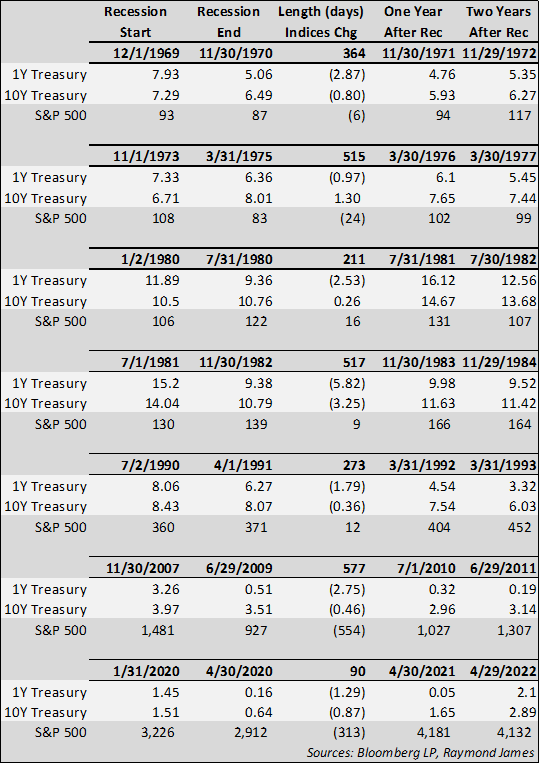

Don’t get lost in the data, after all, past occurrences are not exact predictors of the future. However, the trends or tendencies may provide insights that help to divulge strategic biases. This chart reveals data points from the last seven recessions. Some observations:

- In all 7 occurrences, 1-year Treasury yields were lower at the end versus start of the recession.

- In all 7 occurrences, the 10-year Treasury yield had less nominal and percentage moves versus the 1-year Treasury (the short end of the Treasury yield curve displays more change than the long end of the Treasury curve)

- In 5 of the 7 recessions, the 1-year Treasury yield was still lower one year after the end of the recession.

- In 4 of the 7 recessions, the 10-year Treasury yield was still lower one year after the recession ended.

- In all 7 occurrences, the S&P Index was higher one year after the recession ended.

Excluding the last 3 month recession in 2020, the rest have lasted between 7 months and 1 year & 7 months. Couple this with leanings toward lower rates one and even two years beyond the recession, and it becomes clearer why extending out on the yield curve now while rates are elevated may work to an investor’s advantage. Locking into higher yields may posture the fixed income allocation for higher yields for longer. Laddered structures may add the benefit of mitigating uncertainties in the less apparent and less consistent curve behaviors.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Securities Industry and Financial Markets Association’s Project Invested website and Investor Guides at www.projectinvested.com/category/investor-guides, FINRA’s Investor section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.