by Brian Levitt, Global Market Strategist, Invesco

Key takeaways

U.S. midterms and marketsInvestors tend to believe that election outcomes matter significantly for the economy and markets, but the data suggests otherwise. |

Fed watchInflation has been coming down, but not at a pace that’s sufficient to appease the U.S. Federal Reserve (Fed). |

Is the U.S. heading for recession?High inflation and policy tightening tend to end cycles. It appears a recession is likely in the offing. |

Welcome back to Above the Noise. I hadn’t intended to launch a new monthly commentary during an “everything bear” market, but my timing proved impeccable. A broad selloff across most asset classes is not ideal for the retirement accounts and college savings plans, but I’m told readership tends to be higher during the more uncertain times. I struggle to identify when times weren’t uncertain, but I recognize the confluence of factors weighing on investors’ minds. That’s why we’re here. I cover a lot of ground this month, but in the background of it all is an increasingly loud question: Will the U.S. Federal Reserve (Fed) pivot before markets panic? Let’s again try to rise above the noise and put all of this into perspective.

A ‘keep it simple’ strategy

1) Where are we in the cycle?

The U.S. job market is still too strong. The U.S. economy created 263,000 jobs in September.1 Inflation is still too hot. September’s U.S. core inflation reading was 6.6% over the prior year.2 High inflation and policy tightening tend to end cycles. A recession in the U.S. is likely in the offing.

2) What’s the direction of the U.S. economy?

It’s a contraction. Financial conditions are tightening, and leading indicators suggest that the U.S. economy will be growing below trend and falling.

3) What will be the likely policy response by the Fed?

(Sigh) Still tighter. The market, prior to the September inflation report, had priced a terminal federal funds rate of roughly 4.5%. That is now closer to 5%.3

With the risk of sounding like a broken record, the conclusion is the same from last month. From a tactically minded perspective, I still favour a more modest risk profile and a more defensive posture in the near term. This includes quality bonds and businesses that can potentially generate cash flow and growth in a slowing environment. We won’t be in contraction forever, and I look forward to reporting signs of a recovery when we see them.

The U.S. conversation

It’s midterm election time in the U.S.! Nate Silver has said that “Midterm elections can be dreadfully boring, unfortunately.” Not this time. This year’s midterm election participation is projected to reach record levels, resembling counts reached in presidential elections.

As James Carville said in the early 1990s, “It’s the economy, stupid.” That’s still true today — 80% of Americans listed inflation as the most important issue going into the midterms.4

How do we know which party to blame for inflation? There’s a case to be made either way:

The left’s argument: President Trump injected $4 trillion into the economy and pressured his Fed Chair to keep rates low. Plus, inflation isn’t just a U.S. phenomenon. It’s happening everywhere.

The right’s argument: President Biden spent an additional $2 trillion when the economy was already recovering. Gasoline and food prices have skyrocketed under his watch.

Right or wrong, I expect the buck will likely stop with the current president and his party. Midterm elections have been notoriously bad for the party in power anyway.

Does it matter? Investors tend to believe that election outcomes matter significantly for the economy and markets. The data suggests otherwise.

For what it’s worth, here’s the median quarterly U.S. real gross domestic product (GDP) under different compositions of government back to 1946:5

- Single-party Republican: 3.6%

- Single-party Democrat: 4.4%

- Divided government: 3.7%

Nothing to see here.

It was said

“(the rapid pace of interest rate hikes to control inflation) is not stepping on the brakes, this is slamming the brakes. The economy is starting to go through the windshield, the financial system is starting to go through the windshield.”6 – Mohamed El-Erian, Chief Economic Advisor at Alliance

“Policymakers are facing a trilemma. They need to fight inflation, support growth, and prevent a financial crisis.”7 – Jonathan Ferro, Co-host Bloomberg Surveillance

Therein lies the rub. U.S. inflation has been coming down, but not at a pace that’s sufficient to appease the Fed. Tightening continues. As the saying goes, “something always breaks when yields rise.”

- April 1990: Nikkei Crash / Savings and Loan Crisis

- November 1994: Mexican Peso Crisis

- August 1996: Asian Currency Crisis

- January 2000: NASDAQ Crash

- May 2006: Housing Crisis

- May 2010: European Debt Crisis

- December 2013: Turmoil in Emerging Markets

- 2022: The “Everything Bear” Market

Investors are now left waiting for the proverbial pause in tightening by the Fed. Will it come because inflation has come down or will it come because something breaks? Pivot or panic? Those are two very different outcomes for the financial markets.

Maybe it’s confirmation bias …

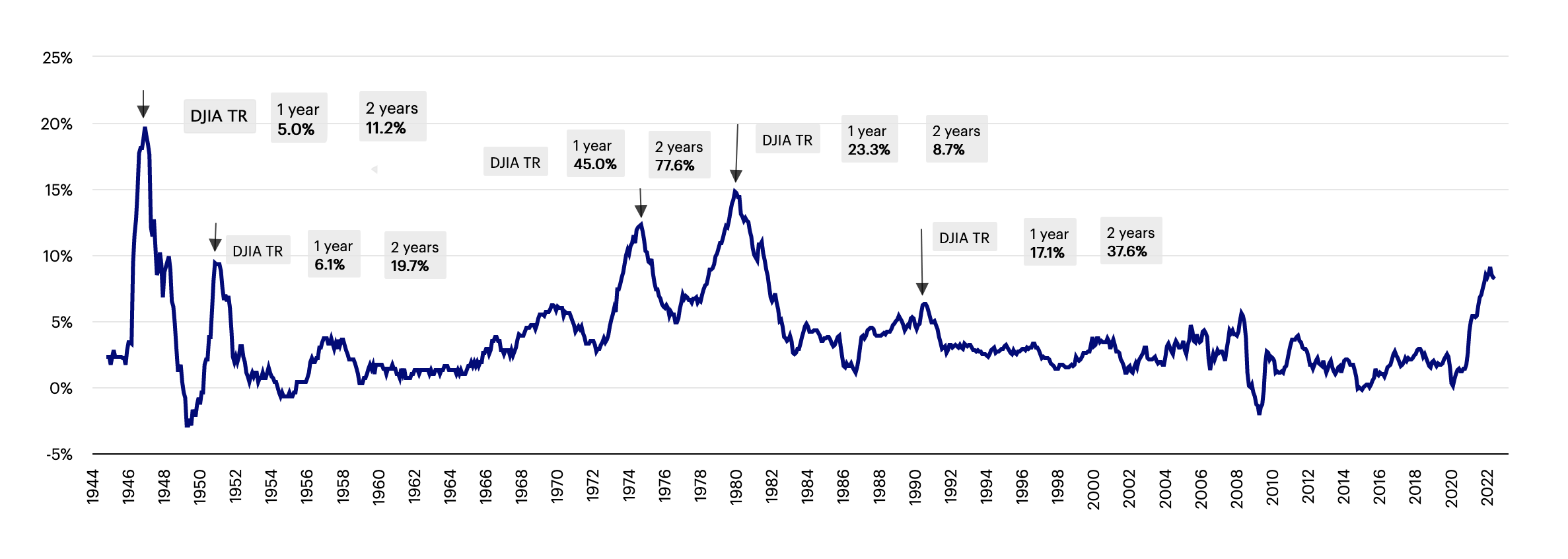

… but every time inflation peaks, it seems to come down rapidly and equities have historically performed well over the subsequent two years.

U.S. equity performance post-peak inflation

U.S. Consumer Price Index and the 1-year and 2-year cumulative returns of the Dow Jones Industrial Average Total Return (DJIA TR) Index post peak inflation above 6%

Source: Bloomberg, U.S. Bureau of Labor Statistics, 9/30/22. Inflation peaks: March 1947, April 1951, December 1974, May 1980, and November 1990. The Dow Jones Industrial Average is a stock market index of 30 prominent companies listed on stock exchanges in the United States. Indices cannot be purchased directly by investors. Past performance is no guarantee of future results.

Source: Bloomberg, U.S. Bureau of Labor Statistics, 9/30/22. Inflation peaks: March 1947, April 1951, December 1974, May 1980, and November 1990. The Dow Jones Industrial Average is a stock market index of 30 prominent companies listed on stock exchanges in the United States. Indices cannot be purchased directly by investors. Past performance is no guarantee of future results.

My travels this month took me to Minneapolis for the annual Financial Planning Association conference. The topic was The Great Economic Debate, and the participants were David Kelly of J.P. Morgan, Jim Paulsen of The Leuthold Group, and me. I’ll be honest, 20-year-old Brian Levitt would not have expected to be on that stage.</p>\r\n<p>Let’s just say that our views were largely congruent. So much for a debate. A highlight of the session for me was when Jim Paulsen rose to present after I had concluded and said, “Ditto.” The crowd got a laugh out of that. I couldn’t help but think of General George Patton and his famous quip, “If everyone is thinking alike then somebody isn’t thinking.” That point wasn’t lost on all three of us.</p>\r\n<p>All of us shared the opinion that:</p>\r\n<ol>\r\n<li>The war against inflation in the U.S. will be coming to an end.</li>\r\n<li>The Fed will ultimately go too far. Today’s inflation isn’t structural. Kelly asked why is the Fed data dependent? Don’t they have models to assess the future? If the three of us see the problems of tightening into a global contraction, why don’t they? Great questions.</li>\r\n<li>A U.S. recession is likely, and the risk of an accident is heightened. The Fed will then pivot.</li>\r\n<li>Valuations, in equities and fixed income, are becoming quite attractive. As my first chart showed, U.S. markets have tended to do well after inflation has peaked, even in the event of recessions.</li>\r\n</ol>\r\n<p>I’m already looking forward to next year’s event. David — if you’re reading this, I want to know more about you sending a hologram of yourself to Las Vegas to present to clients. Neat. Was the hologram able to enjoy Vegas’s great restaurant and club scenes? Asking for a friend.</p>\r\n<h4>Since you asked</h4>\r\n<p>Could U.S. inflation really possibly fall below 4% within the next year? How and by when? With reverence to Chevy Chase’s classic character Irwin M. “Fletch” Fletcher, “Come on guys, it’s so simple. Maybe you need a refresher course. It’s all (mathematics) nowadays.”</p>\r\n<p>Fortunately, this math could be easier than figuring out Underhill’s tab. Let’s assume a 0.3% monthly inflation rate over the next year for the U.S. Why 0.3%? That’s about half the average monthly inflation rate in the first nine months of 2022.<sup><a href=\"#8\">8</a></sup> Also, remember that inflation was flat in July, was up 0.1% in August, and was up 0.4% in September, for an average of 0.26%.<sup><a href=\"#9\">9</a></sup></p>\r\n<p>We run it through the Excel machine:</p>\r\n"}}">

On the road again

My travels this month took me to Minneapolis for the annual Financial Planning Association conference. The topic was The Great Economic Debate, and the participants were David Kelly of J.P. Morgan, Jim Paulsen of The Leuthold Group, and me. I’ll be honest, 20-year-old Brian Levitt would not have expected to be on that stage.

Let’s just say that our views were largely congruent. So much for a debate. A highlight of the session for me was when Jim Paulsen rose to present after I had concluded and said, “Ditto.” The crowd got a laugh out of that. I couldn’t help but think of General George Patton and his famous quip, “If everyone is thinking alike then somebody isn’t thinking.” That point wasn’t lost on all three of us.

All of us shared the opinion that:

- The war against inflation in the U.S. will be coming to an end.

- The Fed will ultimately go too far. Today’s inflation isn’t structural. Kelly asked why is the Fed data dependent? Don’t they have models to assess the future? If the three of us see the problems of tightening into a global contraction, why don’t they? Great questions.

- A U.S. recession is likely, and the risk of an accident is heightened. The Fed will then pivot.

- Valuations, in equities and fixed income, are becoming quite attractive. As my first chart showed, U.S. markets have tended to do well after inflation has peaked, even in the event of recessions.

I’m already looking forward to next year’s event. David — if you’re reading this, I want to know more about you sending a hologram of yourself to Las Vegas to present to clients. Neat. Was the hologram able to enjoy Vegas’s great restaurant and club scenes? Asking for a friend.

Since you asked

Could U.S. inflation really possibly fall below 4% within the next year? How and by when? With reverence to Chevy Chase’s classic character Irwin M. “Fletch” Fletcher, “Come on guys, it’s so simple. Maybe you need a refresher course. It’s all (mathematics) nowadays.”

Fortunately, this math could be easier than figuring out Underhill’s tab. Let’s assume a 0.3% monthly inflation rate over the next year for the U.S. Why 0.3%? That’s about half the average monthly inflation rate in the first nine months of 2022.8 Also, remember that inflation was flat in July, was up 0.1% in August, and was up 0.4% in September, for an average of 0.26%.9

We run it through the Excel machine:

Doing the math: U.S. Inflation assumptions

September 2021 to September 2022 are actual inflation figures. Starting with October 2022, we do the math to show what 0.3% monthly increases in CPI would look like over the next nine months.

DateConsumer Price Index LevelConsumer Price Index Year over Year Percent Change

Sep. 2021274.215.4%Oct. 2021276.596.2%Nov. 2021278.526.8%Dec. 2021280.137.0%Jan. 2022281.937.5%Feb. 2022284.187.9%Mar. 2022287.718.5%Apr. 2022288.668.3%May 2022291.478.6%Jun. 2022295.339.1%Jul. 2022295.278.5%Aug. 2022295.628.3%Sep. 2022296.768.2%Oct. 2022(296.76*1.003) = 297.65((297.65/276.59) – 1) = 7.6%Nov. 2022(297.76*1.003) = 298.54((298.54/278.52) – 1) = 7.2%Dec. 2022(298.54*1.003) = 299.43((299.43/280.13) – 1) = 6.9%Jan. 2023(299.43*1.003) = 300.33((300.33/281.93) – 1) = 6.5%Feb. 2024(300.33*1.003) = 301.23((301.23/284.18) – 1) = 6.0%Mar. 2024(301.23*1.003) = 302.14((302.14/287.71) – 1) = 5.0%Apr. 2024(302.14*1.003) = 303.05((303.05/288.66) – 1) = 4.9%May 2024(303.05*1.003) = 303.96((303.96/291.47) – 1) = 4.3%Jun. 2024(303.96*1.003) = 304.87((304.87/295.33) – 1) = 3.2%

Source: U.S. Bureau of Labor Statistics, 9/30/22. For illustrative purposes only and not intended as investment advice or as a forecast.

Annual inflation down to 3.2% by June? If you assume a 0.3% monthly increase, then yes.</p>\n<p>See kids, math is fun.</p>\n<h4>Song of the month</h4>\n<p>Let’s go with “Wake Me Up When September Ends” by Green Day. The challenging market of September carried into the early days of October. I was afraid we would regret waking up Green Day. Yet, as we go to print, the S&P 500 Index appears to be poised for a positive-return month. It may prove to be little more than a near-term bounce as challenges remain. Nonetheless, I do expect a recovery to play out in 2023. Investors should be awake and alert looking for signs of recovery and arising investment opportunities.</p>\n"}}">

Annual inflation down to 3.2% by June? If you assume a 0.3% monthly increase, then yes.

See kids, math is fun.

Song of the month

Let’s go with “Wake Me Up When September Ends” by Green Day. The challenging market of September carried into the early days of October. I was afraid we would regret waking up Green Day. Yet, as we go to print, the S&P 500 Index appears to be poised for a positive-return month. It may prove to be little more than a near-term bounce as challenges remain. Nonetheless, I do expect a recovery to play out in 2023. Investors should be awake and alert looking for signs of recovery and arising investment opportunities.

Footnotes

1 Source: U.S. Bureau of Labor Statistics, 9/30/22.

2 Source: U.S. Bureau of Labor Statistics, 9/30/22.

3 Source: Bloomberg, 10/13/22. As represented by the Fed Funds Implied Futures.

4 Source: Pew Research Center, 6/30/22. Latest data available.

5 Source: U.S. Bureau of Economic Analysis, 6/30/22.

6 Source: Bloomberg News, “El-Erian Says Economy Is Starting to ‘Go Through the Windshield,’” 10/11/22

7 Source: Bloomberg Surveillance

8 Source: U.S. Bureau of Labor Statistics, 9/30/22. The average monthly gain in the Consumer Price Index for the first nine months of the year is 0.63%.

9 Source: U.S. Bureau of Labor Statistics, 9/30/22.