by Ryan James Boyle, Senior Economist, Northern Trust

Evidence of a cooling labor market is emerging.

Fears of a recession are pervasive. While we can offer rebuttals, the concerns are understandable: volatile financial markets have given most investors a terrible year, inflation has eaten away purchasing power and sentiment surveys have plummeted to new depths.

The persistent strength of the job market has been a pleasant surprise throughout the year. Indeed, the just-released September employment situation summary from the Bureau of Labor Statistics (BLS) continued the streak, with another 263,000 jobs added and the unemployment rate returning to 3.5%. But the beginnings of a job market cooldown are beginning to emerge.

The private sector produces a series of interesting measures of the labor market. Payroll processor ADP publishes monthly employment levels based on aggregations of their large client base. This year, ADP revised its methodology to be an independent estimate of the jobs market, rather than a forecast of the monthly BLS payroll reading. According to this series, gains peaked at over 600,000 jobs in both July and August of last year; since then, they have fallen steadily (to 208,000 in September 2022). Slowing, but still positive.

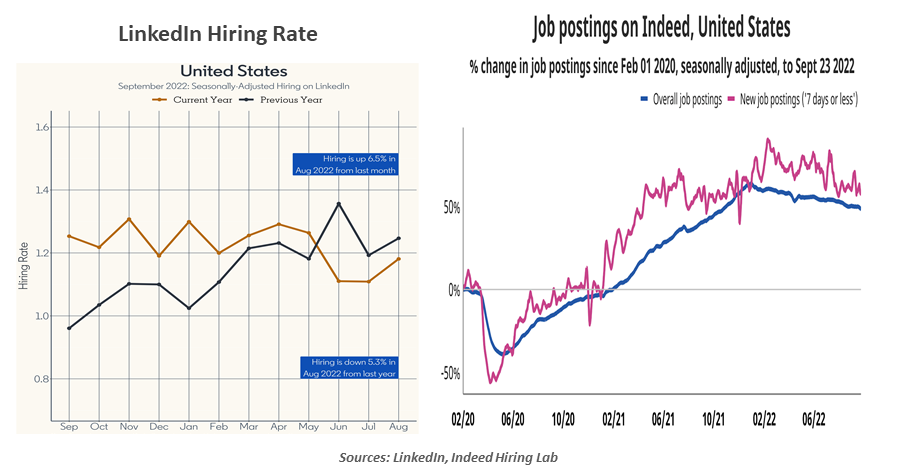

Several other sources show a corroborating trend. Social network LinkedIn publishes monthly trends of job change activity. Its most recent report, through August, confirmed that employment markets remain active. Its hiring rate (hires as a share of total network members) peaked in October 2021, then fell through summer 2022, but remains comfortably higher than the rate observed just two years ago. LinkedIn’s audience skews toward professional occupations, suggesting corporate turnover peaked a year ago.

Job portal Indeed.com is a broader venue to find a wider assortment of job listings. Indeed’s Hiring Lab continues to report its job posting activity since the pandemic crash, and it is holding above its prior norms. Their peak in job postings was at the end of the year 2021, trending slightly downward since. However, new postings have held at an elevated rate.

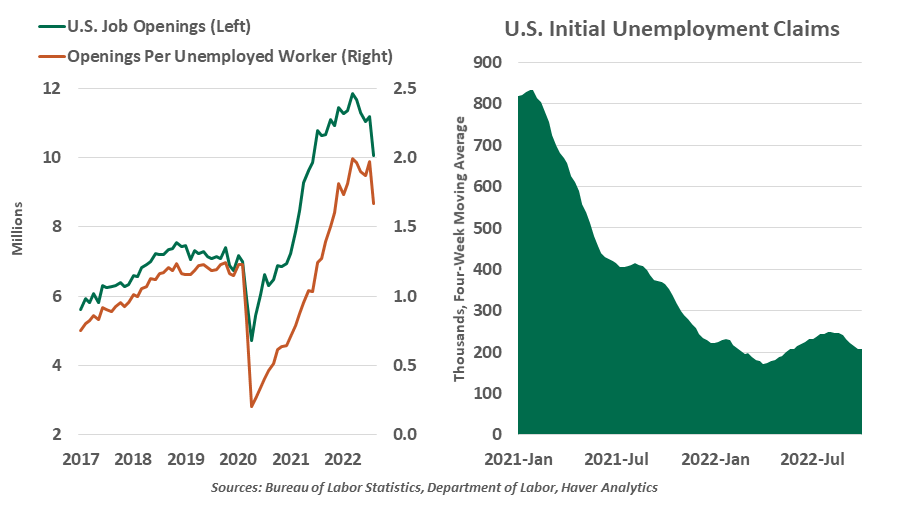

The clearest evidence of cooling in the U.S. labor market was in this week’s BLS Job Openings and Labor Turnover Survey (JOLTS) for August. Total job openings fell sharply to 10 million, from a record high of 11.9 million in March 2022. Though in decline, the level of openings remains in breakthrough territory; prior to the reopening surge in hiring, the peak was only 7.6 million openings. The decline in openings was broad-based across nearly all sectors and income levels.

Hot labor markets are cooling slowly.

On other fronts, the JOLTS report was still reassuring. Hiring activity held a steady pace, and workers are still quitting at elevated rates, a sign of confidence. Layoffs and involuntary terminations have not yet picked up, corroborated by the persistently low weekly readings of initial unemployment claims.

A soft landing will entail reducing openings without exploding layoffs. In press conferences, Fed Chair Jerome Powell has frequently referred to the number of job openings relative to the number of people estimated to be unemployed. As of August, that ratio is now 1.67 jobs per available worker. Before the pandemic, a 1:1 ratio was a sign of a hot labor market.

Analysts are struggling to reconcile the elevated levels of job openings with slowing economic activity. One theory holds that companies are expecting a brief period of slow growth; in that event, they wish to be well-staffed to capitalize on renewed expansion. Others suggest that readings on openings are artificially high; advertising a listing is easy, but should candidates present themselves for every posting, firms would almost surely not hire them all. Anecdotes of hiring freezes and layoffs suggest that openings will continue a downward trend.

One remaining curiosity within the U.S. labor market is the 5.8 million Americans who are not currently in the labor force, but who express the desire to hold a job. This is not far off of historical averages, but stands at a deep deficit to the number of openings in the economy.

Even allowing for some mismatch of skills between those seeking work and positions open, there should be more matching going on. Is the remaining friction due to pay levels? Personal circumstances? Geographical misalignment? The decisions taken by this community in the coming months could go a long way toward rebalancing labor supply and demand.

From all of this, we conclude that the labor market appears to have turned a corner. But the road to better balance is still a long one, which could mean tighter-for-longer monetary policy.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/terms-and-conditions.

Ryan James Boyle

Ryan James Boyle

Vice President, Senior Economist

Ryan James Boyle is a Vice President and Senior Economist within the Global Risk Management division of Northern Trust. In this role, Ryan is responsible for briefing clients and partners on the economy and business conditions, supporting internal stress testing and capital allocation processes, and publishing economic commentaries.