Responses to the FOMC meeting release at 2:00 PM EDT

As expected, the FOMC raised the Fed Fund rate by 0.75% to a 3.00%-3.25% range. Unexpectedly, the FOMC raised guidance on the future Fed Fund from 3.40% to 4.4% by the end of 2022 and further increases in 2023.

Responses were volatile: Initially, the S&P 500 Index moved sharply lower, then sharply higher and finally sharply lower.

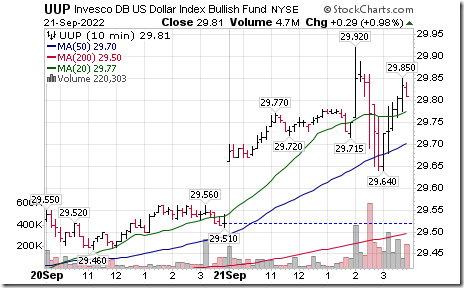

The U.S. Dollar ETN also initially moved higher, then lower and finally higher

Long term bond prices and related ETFs moved sharply higher.

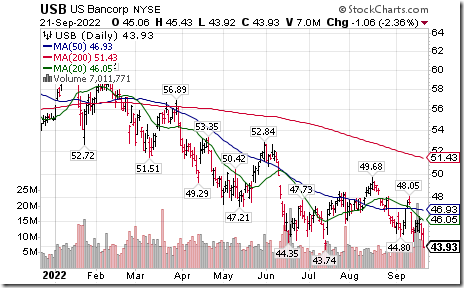

U.S. Money Center equities and related ETFs initially moved lower, moved sharply higher and closed sharply lower.

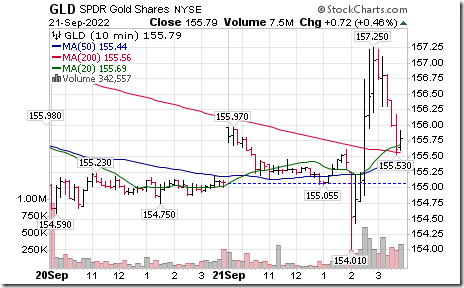

Gold and silver bullion and related equities moved higher but sold off in late trading.

Technical Notes for yesterday

Germany iShares EWG moved below $21.08 extending an intermediate downtrend.

Frontier iShares $FM moved below $26.09 extending an intermediate downtrend.

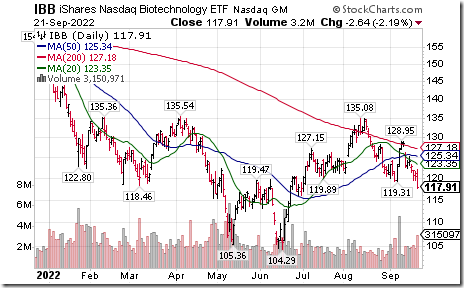

NASDAQ Biotech $IBB moved below $119.31 setting an intermediate downtrend.

S&P 100 stocks breaking intermediate support in late trade: McDonald’s $MCD moved below $251.20 completing a Head & Shoulders pattern. Simon Properties $SPG moved below $97.08 setting an intermediate downtrend. US Bancorp $USB moved below $44.35 extending an intermediate downtrend. Abbott Labs $ABT moved below $100.73 extending an intermediate downtrend.

NASDAQ 100 stocks breaking intermediate support in late trade: Electronic Arts $EA moved below $119.36 extending an intermediate downtrend. Align Technology $ALGN moved below $225.86 extending an intermediate downtrend. Fiserve $FISV stock moved below $100.64 extending an intermediate downtrend.

Trader’s Corner

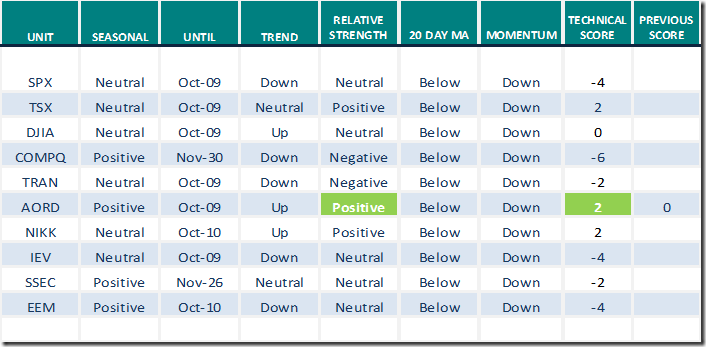

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for September 21st 2022

Green: Increase from previous day

Red: Decrease from previous day

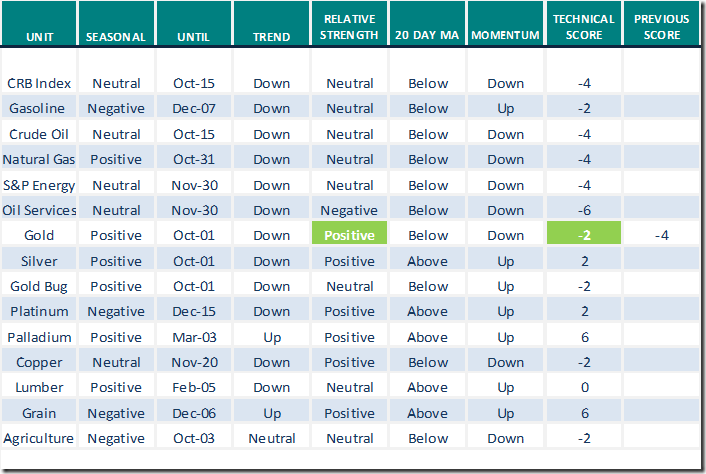

Commodities

Daily Seasonal/Technical Commodities Trends for September 21st 2022

Green: Green: Increase from previous day

Green: Green: Increase from previous day

Red: Decrease from previous day

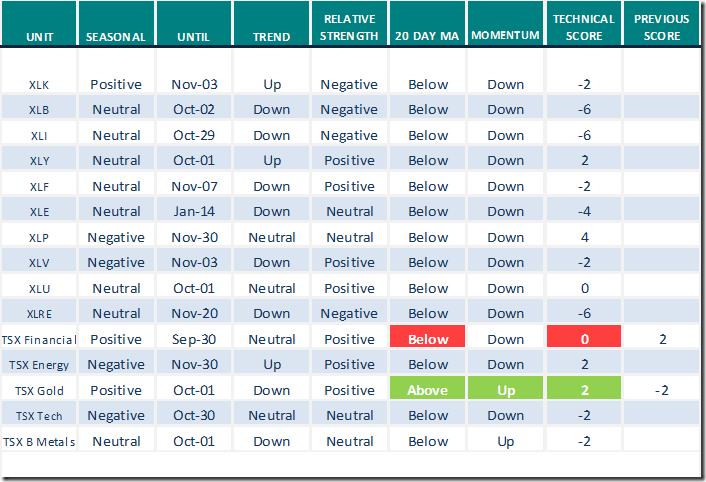

Sectors

Daily Seasonal/Technical Sector Trends for September 21st 2021

Green: Increase from previous day

Red: Decrease from previous day

CATA Meeting Tonight

Speaker at the meeting this evening at 8:00 PM EDT is Jeff Parent, past president of the Canadian Society of Technical Analysis. Interested in membership in CATA and the presentation? See:

https://canadianata.ca/content.aspx?page_id=0&club_id=71614

Remember Bre-X?

Interesting story from Mark Bunting and www.uncommonsenseinvestor.com

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 7.00 to 16.20 yesterday. It remains Oversold. Trend remains down.

The long term Barometer dropped 2.00 to 24.20 yesterday. It remains Oversold. Trend remains down.

TSX Momentum Barometers

The intermediate term Barometer dropped 1.69 to 35.87 yesterday. It remains Oversold. Trend remains down.

The long term Barometer dropped 1.69 to 29.54 yesterday. It remains Oversold. Trend remains down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed