Technical Notes for yesterday

EAFA iShares $EFA moved below $59.54 extending an intermediate downtrend.

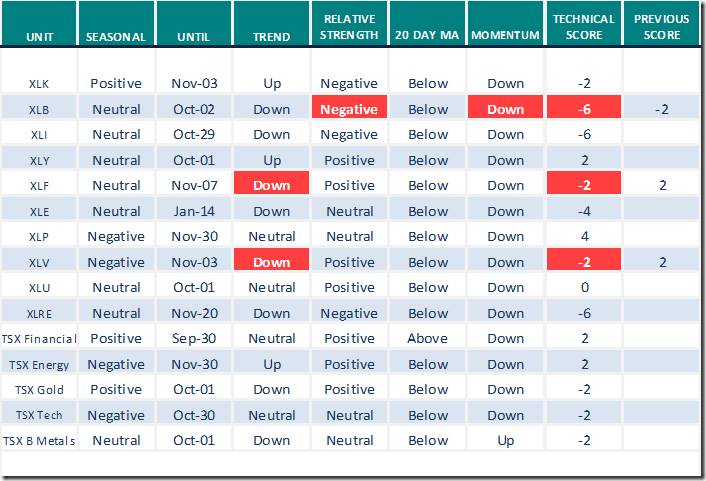

Financials SPDRs $XLF moved below $32.48 setting an intermediate downtrend.

Healthcare SPDRs $XLV moved below $124.39 setting an intermediate downtrend.

Pfizer $PFE a Dow Jones Industrial Average stock moved below $44.69 setting an intermediate downtrend.

Medical Devices iShares $IHI moved below $49.80 setting an intermediate downtrend.

Retail SPDRs $XRT moved below $61.47 setting an intermediate downtrend.

eBay $EBAY a NASDAQ 100 stock moved below $40.32 extending an intermediate downtrend.

Micron $MU a NASDAQ 100 stock moved below $51.30 extending an intermediate downtrend.

Cdn. REIT iShares $XRE.TO moved below $16.56 and $16.18 extending an intermediate downtrend.

Trader’s Corner

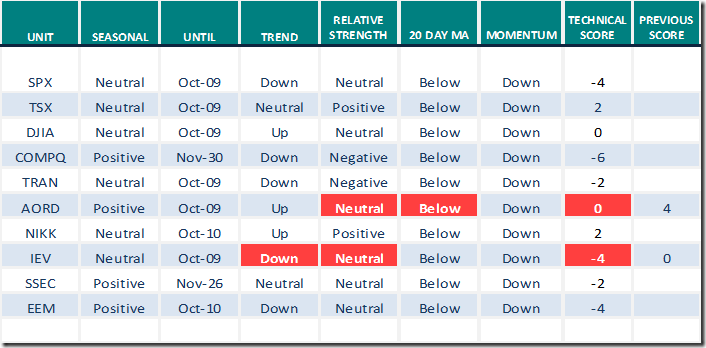

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for September 20th 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for September 20th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for September 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

EquityClock’s Toronto Money Show Presentation

“On the weekend, we had the pleasure of presenting at the Toronto Money Show on the topic of “Using Seasonality to Determine Where We are in the Economic Cycle.” It was great to see so many of you in person after more than two years of presenting virtually at these events. For those that could not make it, we have uploaded our slide deck to the following link:

https://charts.equityclock.com/featured/toronto_money_show_september_2022

Chart of the day

Technical score for Europe iShares $IEV changed from 0 to -4 when intermediate trend changed from Neutral to Down on a move below $40.25 and when strength relative to the S&P 500 changed from Positive to Neutral. Units remain below their 20 day moving average and their momentum indicators (Stochastics, RSI and MACD) continue to trend down.

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 8.80 to 23.20 yesterday. It remains Oversold. Trend is down.

The long term Barometer dropped 2.80 to 26.20 yesterday. It remains Oversold. Trend is down.

TSX Momentum Barometers

The intermediate term Barometer plunged 9.70 to 37.55 yesterday. It changed from Neutral to Oversold on a drop below 40.00.

The long term Barometer dropped 2.11 to 31.22 yesterday. It remains Oversold. Trend is down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed