Technical Notes yesterday

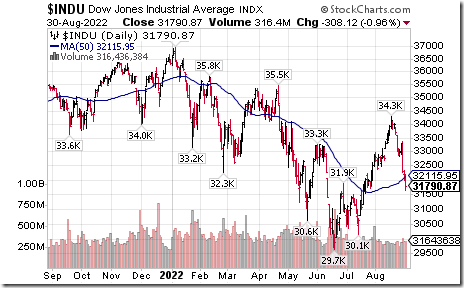

Broadly based U.S. equity indices and related ETFs broke below their 50 day moving averages.

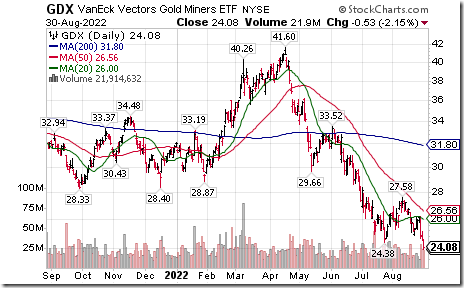

Gold equity ETG $GDX moved below $24.38 extending an intermediate downtrend. The Gold Bug Index $HUI also broke support extending an intermediate downtrend.

Franco-Nevada $FNV a TSX 60 stock moved below US$122.38 extending an intermediate downtrend.

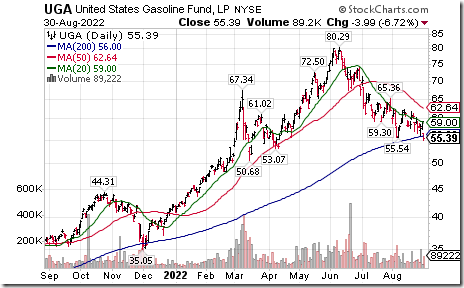

Gasoline ETN $UGA moved below $55.54 extending an intermediate downtrend.

Biotech ETN $FBT moved below intermediate support at $136.50.

MMM $MMM a Dow Jones Industrial Average stock moved below $124.32 extending an intermediate downtrend.

Trader’s Corner

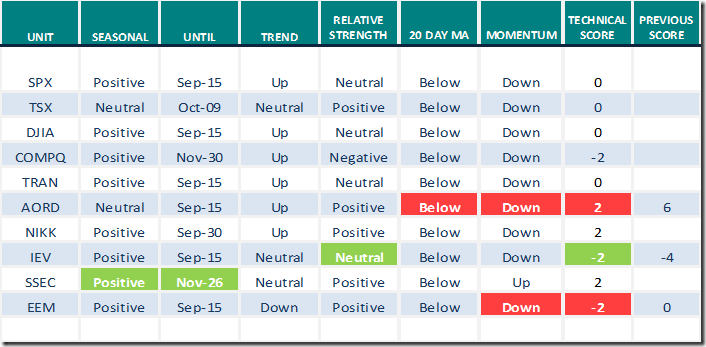

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 30th 2022

Green: Increase from previous day

Red: Decrease from previous day

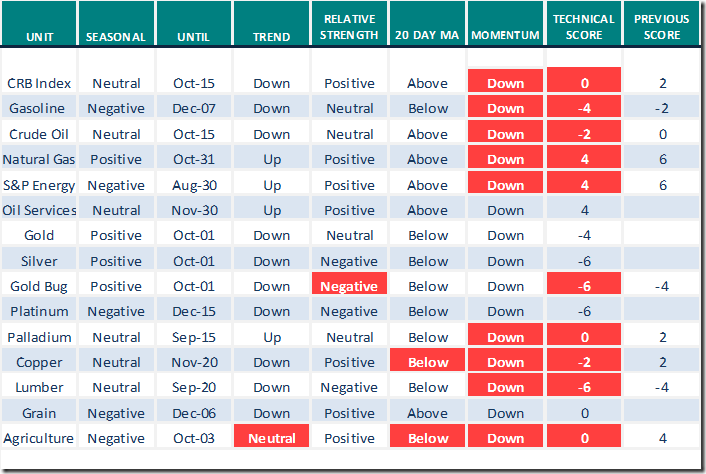

Commodities

Daily Seasonal/Technical Commodities Trends for August 30th 2022

Green: Increase from previous day

Red: Decrease from previous day

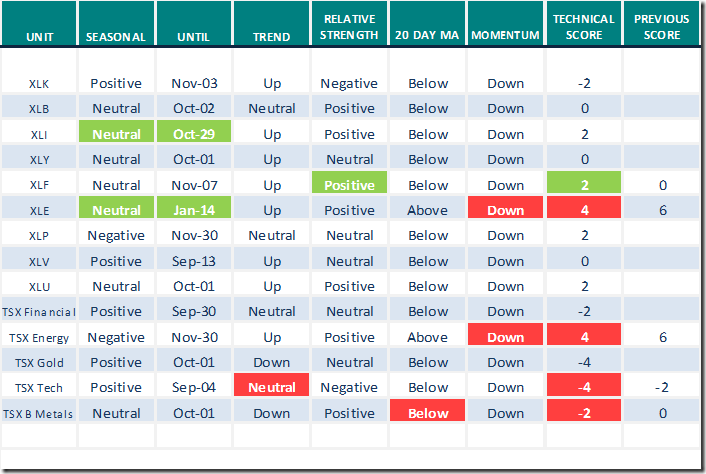

Sectors

Daily Seasonal/Technical Sector Trends for August 30th 2021

Green: Increase from previous day

Red: Decrease from previous day

Links offered by valued providers

Mark Hulbert says “The stock market typically bottoms before the end of a Fed rate hike cycle”.

Tom Bowley asks “Can the S&P 500 Index hold its 50 day MA”?

Can the S&P 500 Hold Its 50-Day MA? | Tom Bowley | Trading Places (08.30.22) – YouTube

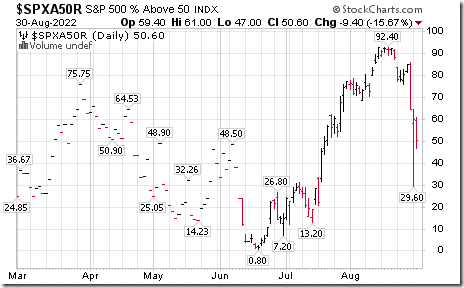

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 9.40 to 50.60 yesterday. It changed from Overbought to Neutral. Trend remains down.

The long term Barometer dropped 2.80 to 30.40 yesterday. It remains Oversold. Trend remains down.

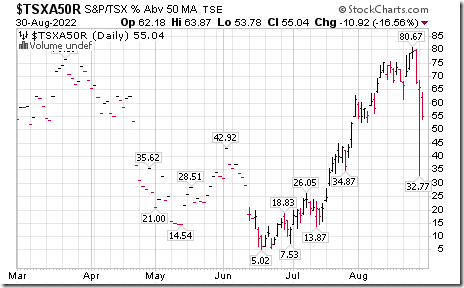

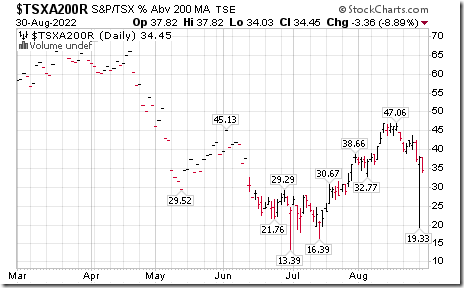

TSX Momentum Barometers

The intermediate term Barometer plunged 10.92 to 55.04 yesterday. It changed from Overbought to Neutral on a drop below 60.00. Trend remains down.

The long term Barometer dropped 3.36 to 34.45 yesterday. It remains Oversold. Trend remains down.

Disclaimer: Seasonality ratings and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed