by Don Vialoux, EquityClock.com

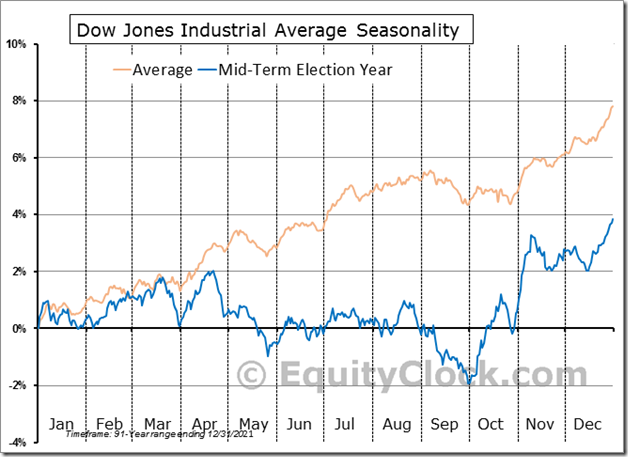

Seasonality Chart of the Day

The Dow Jones Industrial Average has a history of moving lower between mid-April and early October during U.S. mid-term Presidential election cycle years.

Observations

Consensus earnings estimates for S&P 500 companies on a year-over-year basis in the first quarter of 2022 dipped slightly last week.. According to www.FactSet.com first quarter earnings on a year-over-year basis are expected to increase 4.5% (versus 4.7% last week) and revenues are expected to increase 10.7%.

Consensus estimates for S&P 500 companies beyond the first quarter on a year-over-year basis increased slightly again. According to www.FactSet.com second quarter earnings are expected to increase 6.2% (versus 5.8% last week) and revenues are expected to increase 9.8% (versus 9.6% last week). Earnings in the third quarter are expected to increase 10.3% and revenues are expected to increase 8.8% (versus an increase of 8.7% last week) Earnings in the fourth quarter are expected to increase 10.3% (versus 9.6% last week) and revenues are expected to increase 7.4%. Earnings on a year-over-year basis for all of 2022 are expected to increase 9.8% (versus 9.5% last week) and revenues are expected to increase 9.5% (versus 9.3% last week).

Economic News This Week

March Consumer Price Index to be released at 8:30 AM EDT on Tuesday is expected to increase 1.1% versus a gain of 0.8% in February. On a year-over-year basis March Consumer Price Index is expected to increase 8.3% versus a gain of 7.9% in February. Excluding food and energy, March Consumer Price Index is expected to increase 0.5% versus a gain of 0.5% in February.

March Producer Price Index to be released at 8:30 AM EDT on Wednesday is expected to increase 0.9% versus of a gain of 0.8% in February. Excluding food and energy, March Producer Price Index is expected to increase 0.4% versus a gain of 0.2% in February.

Bank of Canada statement to be released at 10:00 AM EDT on Wednesday is expected to increase the overnight lending rate to major Canadian banks from 0.50% to 1.00%.

March Retail Sales to be released at 8:30 AM EDT on Thursday are expected to increase 0.6% versus a gain of 0.2% in February. Excluding auto sales, March Retail Sales are expected to increase 0.7% versus a gain of 0.2% in February.

February Business Inventories to be released at 10:00 AM EDT on Thursday are expected to increase 1.0% versus a gain of 1.1% in January.

April Michigan Consumer Sentiment to be released at 10:00 AM EDT on Thursday is expected to slip to 59.0 from 59.4 in March.

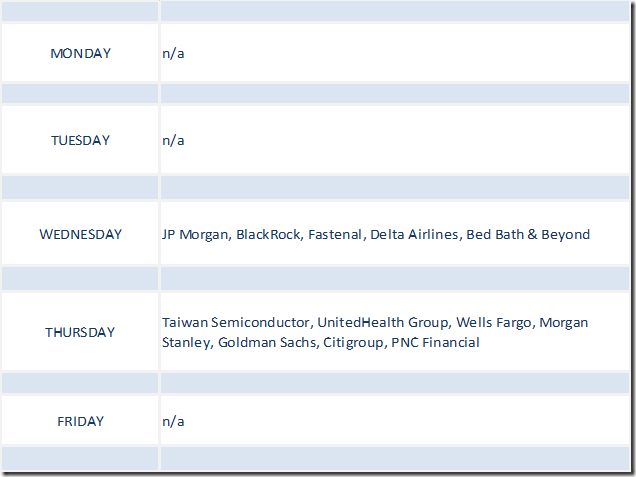

Selected Earnings News This Week

Focus this week is on first quarter reports released by major U.S. money center banks starting with JP Morgan before the market opens on Wednesday.

Trader’s Corner

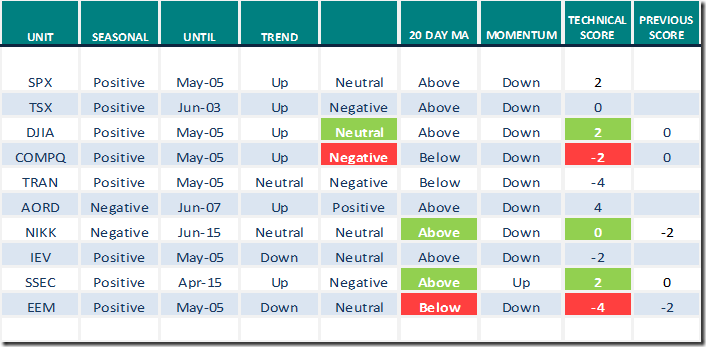

Equity Indices and Related ETFs

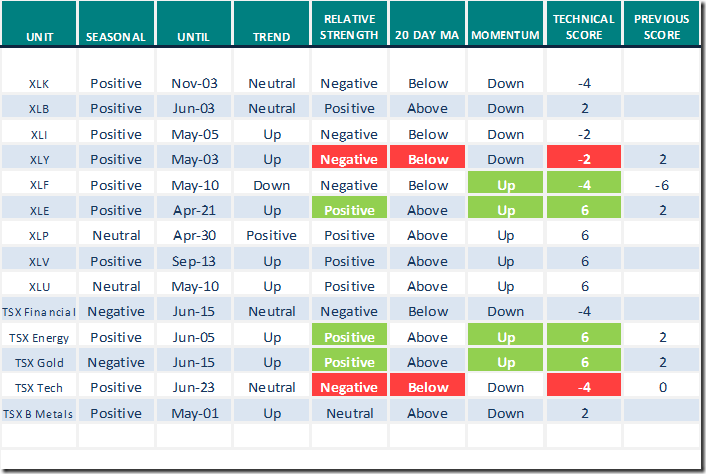

Daily Seasonal/Technical Equity Trends for April 8th 2022

Green: Increase from previous day

Red: Decrease from previous day

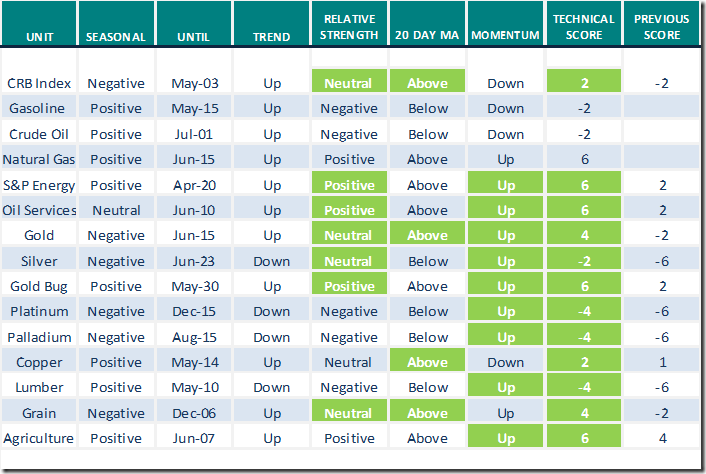

Commodities

Daily Seasonal/Technical Commodities Trends for April 8th 2022

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for April 7th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links offered by valued providers

Mark Leibovit’s Weekly Comment

https://www.howestreet.com/2022/04/uranium-crude-oil-gold-cryptos-mark-leibovit/

Greg Schnell asks “Are you feeling vulnerable”? Headline reads “The chart work I do leads me to believe this is a potential ‘turn the plane around’ moment of decision. As the market works to discover if it can go back to the prior highs, so many pieces are uncomfortably weak…

Are You Feeling Vulnerable? | The Canadian Technician | StockCharts.com

Tom Bowley says “Please do not ignore these three warning signs”.

Please Do NOT Ignore These 3 Warning Signs | ChartWatchers | StockCharts.com

Links from Mark Bunting and www.uncommonsenseinvestor.com

Three Reasons This "Pain Trade" Has Room to Run – Uncommon Sense Investor

Profits Slowing Big Time Compared to Last Year’s Stimulus Party – Uncommon Sense Investor

Q1 Earnings Season Preview – Uncommon Sense Investor

5 First-Rate Retail Stocks the Pros Love | Kiplinger

7 Travel Stocks to Buy as COVID Cases Retreat | Kiplinger

Michael Campbell’s Money Talks for April 9th

April 9th Episode (mikesmoneytalks.ca)

Weekly Technical Scoop from David Chapman and www.enrichedinvesting.com

To be added.

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes released on Friday at

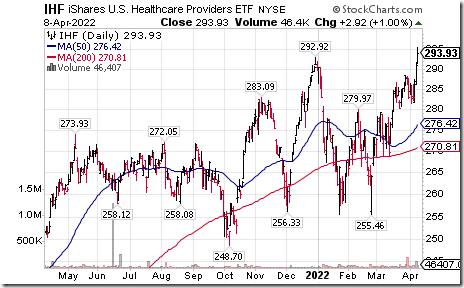

Health Care and Staples chart substantial gains to end at fresh all-time highs, emphasizing the defensive tilt of the market. equityclock.com/2022/04/07/… $XLV $IHF $IHI $IYH $XLP $PBJ $STUDY

Healthcare Providers iShares $IHF moved above $292.92 to an all-time high extending an intermediate uptrend.

Pfizer $PFE a Dow Jones Industrial Average stock moved above $55.30 resuming an intermediate uptrend.

Target $TGT an S&P 100 stock moved above $229.19 completing a base building pattern.

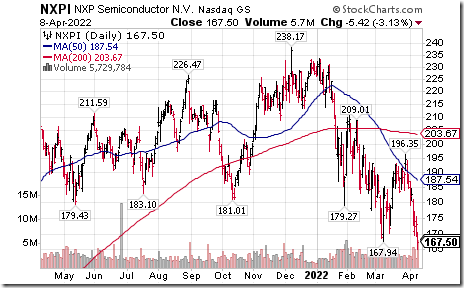

Chinese based technology stocks remain under technical pressure. NXP Semiconductor $NXPI moved below $167.94 extending an intermediate downtrend.

Ross Stores $ROST a NASDAQ 100 stock moved above $97.27 completing a reverse Head & Shoulders pattern.

Canadian gold stocks continue to respond to rising gold prices. Agnico-Eagle $AEM.CA a TSX 60 stock moved above Cdn$81.57 extending an intermediate uptrend.

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 1.20 on Friday and dropped 7.02 last week to 56.31. It changed from Overbought to Neutral on a drop below 60.00. Trend is down.

The long term Barometer eased 0.20 on Friday and 2.91 last week to 49.50. It remains Neutral. Trend is down.

TSX Momentum Barometers

The intermediate term Barometer added 0.88 on Friday, but dropped 4.75 last week to 60.61. It remains Overbought. Trend is down.

The long term Barometer added 0.88 on Friday, but slipped 0.82 last week to 61.95. It remains Overbought. Trend is down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.