by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

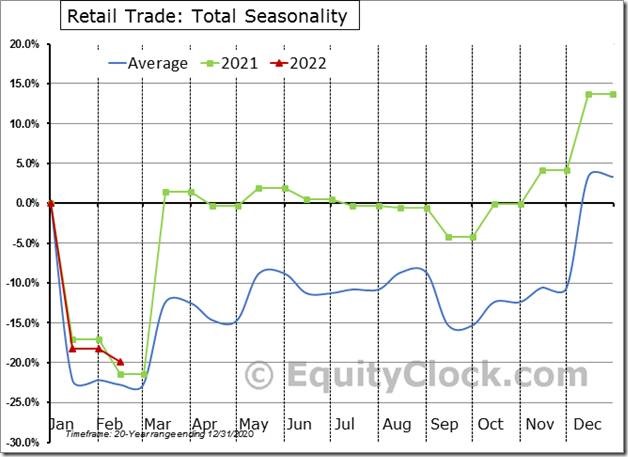

February was a weak month for the consumer with Retail Sales in the US slipping by 2.1% (NSA), which is weaker than the 1.0% decline that is average for the month. Activity is still maintaining an above average pace on the year, however. $MACRO $STUDY #Economy #Retail #Consumer$XRT $RTH

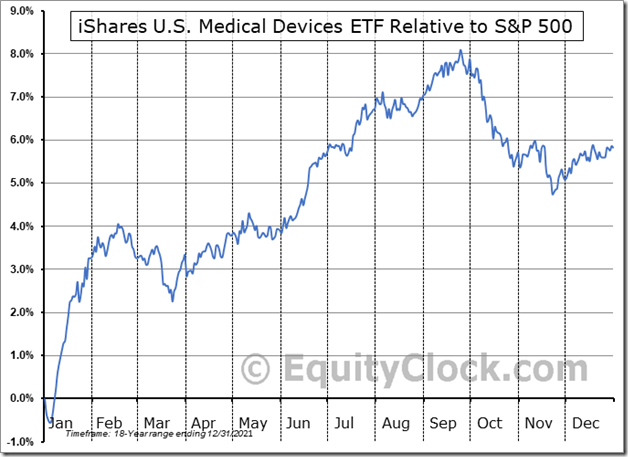

While mean reversion is providing a temporary reprieve in some of this quarter’s extreme moves, this industry play may see longer-term benefits as its period of seasonal strength gets underway. equityclock.com/2022/03/16/… $IHI $XLV

Canada iShares $EWC moved above $39.62 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable until at least April 18th and frequently to the end of May. If a subscriber to EquityClock, see seasonality chart at

https://charts.equityclock.com/ishares-msci-canada-etf-nyseewc-seasonal-chart

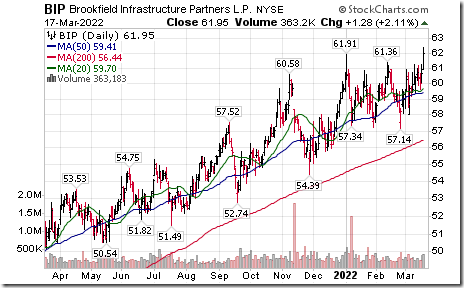

Brookfield Infrastructure $BIP a TSX 60 stock moved above US$128.39 extending an intermediate uptrend. Seasonal influences currently are favourable. If a subscriber to EquityClock, see seasonality chart at

https://charts.equityclock.com/brookfield-infrastructure-partners-l-p-nysebip-seasonal-chart

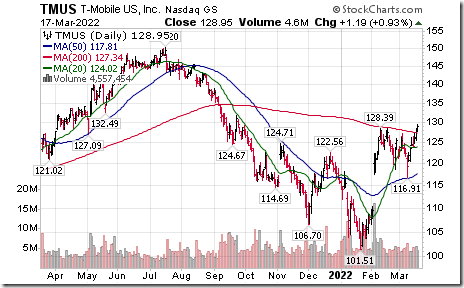

T-Mobile $TMUS a NASDAQ 100 stock moved above $128.39 extending an intermediate uptrend. Seasonal influences are favourable to May 30th. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/tmobile-us-inc-nasdtmus-seasonal-chart

Twitter $TWTR a NASDAQ 100 stock moved above $36.13 completing a double bottom pattern.

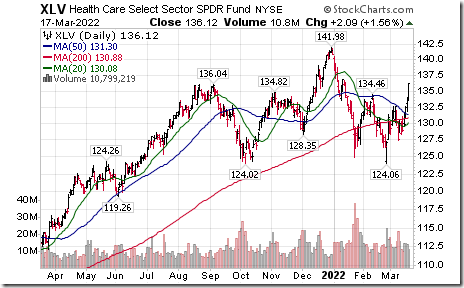

Healthcare SPDRs $XLV moved above intermediate resistance at $134.46.

Pharmaceutical ETF $PPH moved above $78.16 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable until at least mid-May. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/vaneck-vectors-pharmaceutical-etf-nasdpph-seasonal-chart

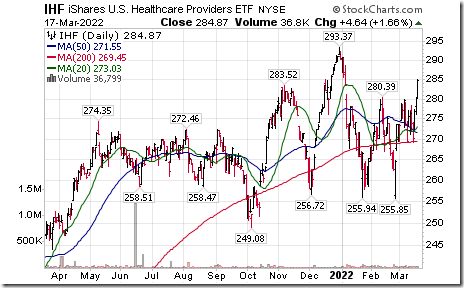

U.S. Healthcare Providers $IHF moved above intermediate resistance at $280.39

Johnson & Johnson $JNJ a Dow Jones Industrial Average stock moved above $176.63 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to May 24th. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/johnson-johnson-nysejnj-seasonal-chart

Eli Lilly $LLY an S&P 100 stock moved above $282.72 to an all-time high extending an intermediate uptrend.

Regeneron $RGEN a NASDAQ 100 stock moved above $686.62 to an all-time high extending an intermediate uptrend.

Water Resources ETF $PHO moved above $52.32 completing a reverse Head & Shoulders pattern.

Honeywell $HON a Dow Jones Industrial Average stock moved above $191.85 completing a double bottom pattern

Precious metals producer equities and related ETFs are responding strongly to the increase in precious metal prices today. First Majestic $FR.CA moved above Cdn$18.19 extending an intermediate uptrend.

Trader’s Corner

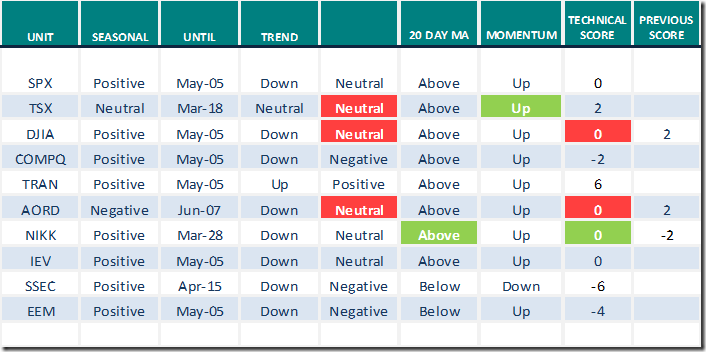

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 17th 2022

Green: Increase from previous day

Red: Decrease from previous day

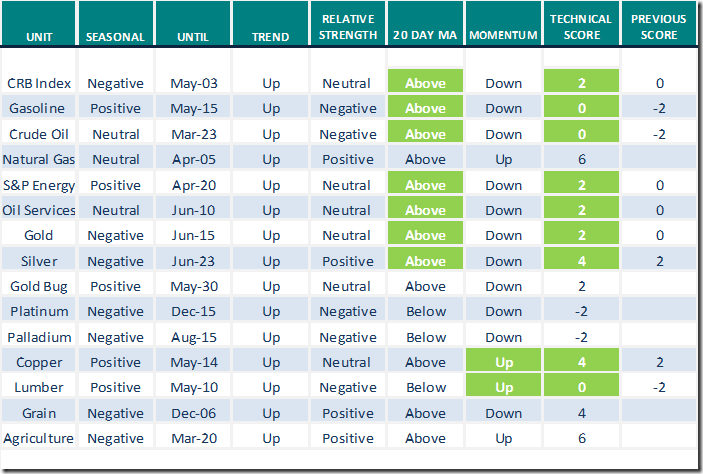

Commodities

Daily Seasonal/Technical Commodities Trends for March 17th 2022

Green: Increase from previous day

Red: Decrease from previous day

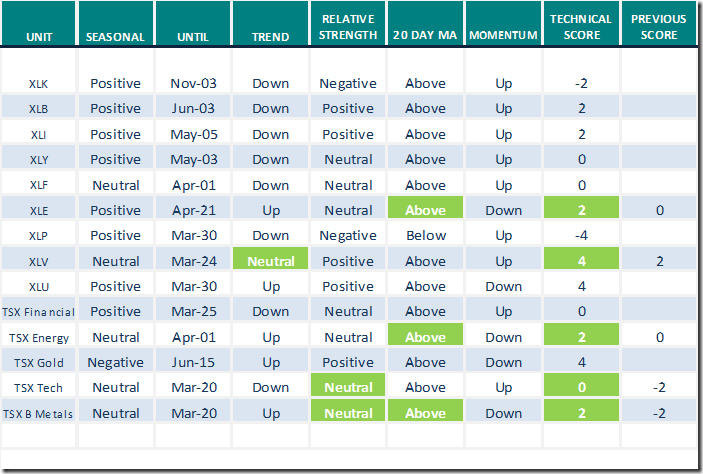

Sectors

Daily Seasonal/Technical Sector Trends for March 17th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from valued providers

Thank you to Mark Bunting and www.uncommoninvestor.com for the following links:

Why You’re Not Missing Out on Oil & Gas & Gold Stocks – Uncommon Sense Investor

Three Reasons 40-Year Bull Market Can Keep Running – Uncommon Sense Investor

S&P 500 Momentum Barometers

The intermediate term Barometer advanced another 7.82 to 50.90 yesterday. It remains Neutral and trending up.

The long term Barometer added another 3.01 to 48.30 yesterday. It remains Neutral and trending up.

TSX Momentum Barometers

The intermediate term Barometer advanced 9.13 to 71.74 yesterday. It remains Overbought. Trend remains up.

The long term Barometer added 3.48 to 66.09 yesterday. It remains Overbought. Trend is up.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

This post was originally publised at Vialoux's Tech Talk.