by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

Buying exhaustion becoming apparent in some of this quarter’s favored bets. equityclock.com/2022/03/08/… $XME $XOP $GDX $GLD $XLP $XLU $XLV

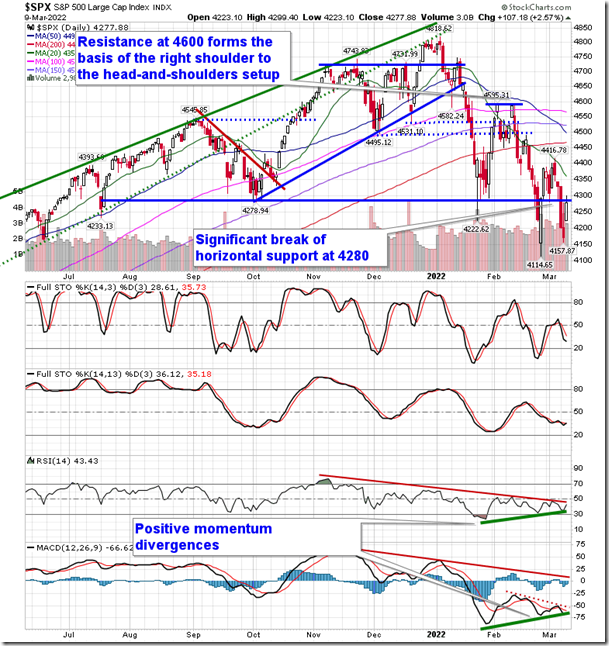

Despite another test of resistance on Wednesday, the action on the session was highly encouraging, enough for us to put some of our cash hoard back to work. equityclock.com/2022/03/09/… $SPX $SPY $ES_F

Long term U.S. Treasury ETF $TLT moved below $134.33 extending an intermediate downtrend.

Shanghai Composite $SSEC and related ETFs $CQQQ $FXI have broken long term support levels setting long term downtrends.

Coca Cola $KO a Dow Jones Industrial Average stock moved below $59.28 and $58.57 setting an intermediate downtrend.

NetEase $NTES a NASDAQ 100 stock moved below $77.60 extending an intermediate downtrend.

TCOM $TCOM a NASDAQ 100 stock moved below $21.40 extending an intermediate downtrend

Twenty First Century $FOXA an S&P 100 stock moved below $39.65 completing a double top pattern.

Hudbay Minerals $HBM.CA a major base metals producer moved above Cdn$10.67 extending an intermediate uptrend. Seasonal influences are favourable to early May. If a subscriber to EquityClock, see seasonality chart at https://charts.equityclock.com/hudbay-minerals-inc-tsehbm-seasonal-chart

Trader’s Corner

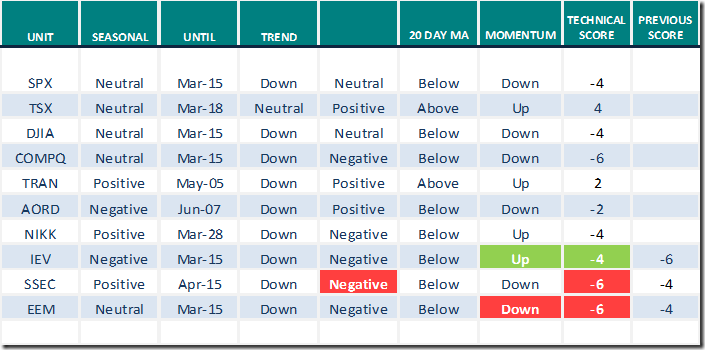

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 10th 2022

Green: Increase from previous day

Red: Decrease from previous day

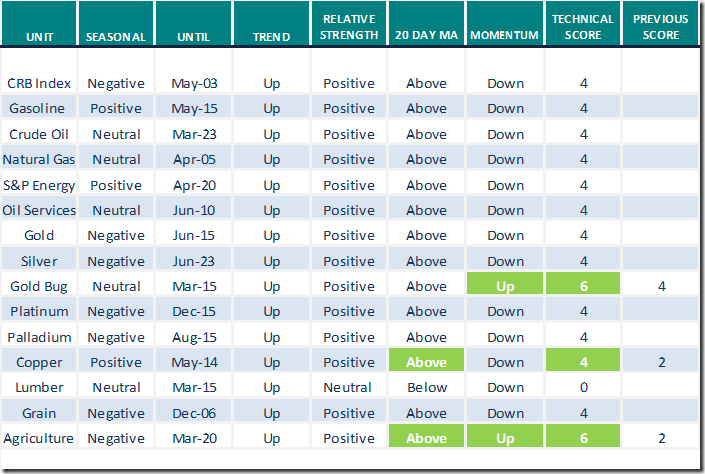

Commodities

Daily Seasonal/Technical Commodities Trends for March 10th 2022

Green: Increase from previous day

Red: Decrease from previous day

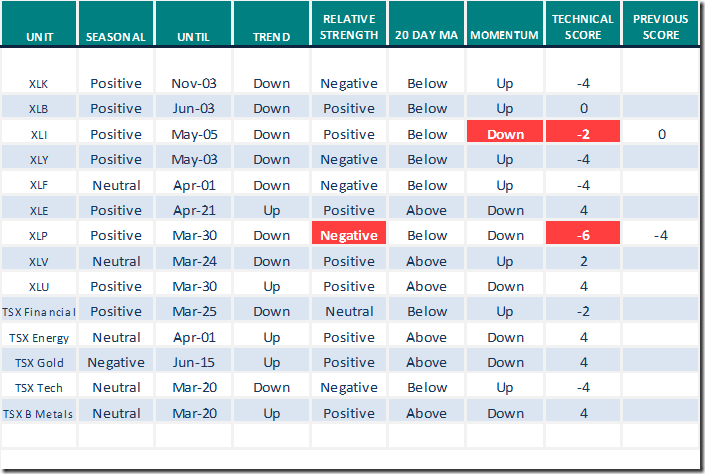

Sectors

Daily Seasonal/Technical Sector Trends for March 10th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

S&P 500 Momentum Barometers

The intermediate barometer added 0.80 to 29.46 yesterday. It remains Oversold.

Long term barometer slipped 0.20 to 39.68 yesterday. It remains Oversold.

TSX Momentum Barometers

The intermediate barometer slipped 0.60 to 61.84 yesterday. It remains Overbought.

The long term barometer added 0.71 to 63.16 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.