by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

Buying exhaustion becoming apparent in some of this quarter’s favored bets. equityclock.com/2022/03/08/… $XME $XOP $GDX $GLD $XLP $XLU $XLV

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 9th 2022

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Daily Seasonal/Technical Commodities Trends for March 9th 2022

Green: Increase from previous day

Red: Decrease from previous day

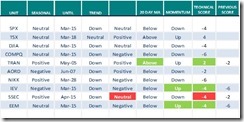

Sectors

Daily Seasonal/Technical Sector Trends for March 9th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links offered by valued providers

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for the following link:

Volatility Happening All at Once After Starting Slowly – Uncommon Sense Investor

"Sell Any Rally" Says Strategist Catching Up to Market Reality – Uncommon Sense Investor

Greg Schnell’s Market Buzz discusses “A tough market to trade” Following is a link:

https://www.youtube.com/watch?v=tQqlDrnRGw0

S&P 500 Momentum Barometers

The intermediate term Barometer added 3.41 to 28.66 yesterday. It remains Oversold.

The long term Barometer gained 3.81 to 39.88 yesterday. It remains Oversold.

TSX Momentum Barometers

The intermediate term Barometer added 7.86 to 62.45 yesterday. It changed from Neutral to Overbought on a move above 60.00.

The long term Barometer advanced 4.80 to 62.45 yesterday. It changed from Neutral to Overbought on a move above 60.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.