by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

U.S. Retail SPDRs $XRT moved below $75.62 extending an intermediate downtrend.

Home Depot $HD a Dow Jones Industrial Average stock moved below $343.61 extending an intermediate downtrend (Despite announcing higher than consensus fourth quarter results and a 15% increase in its dividend).

Lowe’s $LOW an S&P 100 stock moved below $220.20 extending an intermediate downtrend.

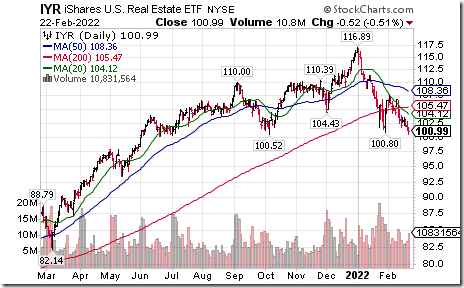

U.S. Real Estate iShares $IYR moved below $100.80 extending an intermediate downtrend.

Germany iShares $EWG moved below $30.77 extending an intermediate downtrend.

Russia ETF $RSX moved below $21.05 extending an intermediate downtrend.

Europe related ETFs are responding to the Ukraine/ Russia conflict. Eurozone iShares $EZU moved below $45.51 extending an intermediate downtrend.

Grain prices are responding to the Ukraine/Russia conflict. $CORN $SOYB $WEAT and $DBA are higher. Nice move by WEAT above $7.89 resuming an intermediate uptrend!

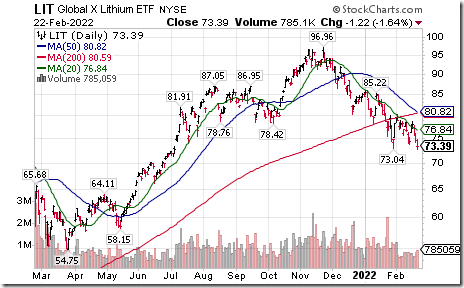

Lithium ETN $LIT moved below $73.04 extending an intermediate downtrend.

IBM $IBM an S&P 100 stock moved below $122.71 setting an intermediate downtrend.

DocuSign $DOCU a NASDAQ 100 stock moved below $108.06 extending an intermediate downtrend.

NetEase $NTES a NASDAQ 100 stock moved below $89.80 extending an intermediate uptrend.

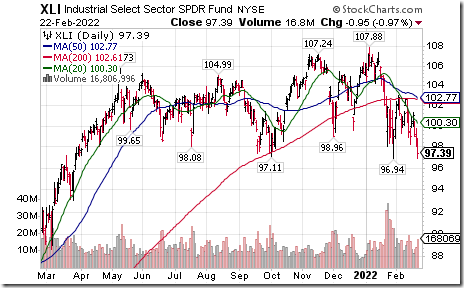

Industrial SPDRs $XLI moved below $96.94 extending an intermediate downtrend.

General Motors $GM an S&P 100 stock moved below $47.07 extending an intermediate downtrend.

Simon Properties $SPG an S&P 100 stock moved below $137.75 extending an intermediate downtrend.

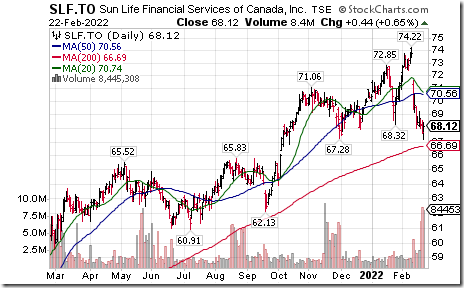

SunLife $SLF.CA a TSX 60 stock moved below Cdn$67.28 setting an intermediate downtrend.

CCL Industries $CCL.B.CA a TSX 60 stock moved below Cdn$62.25 extending an intermediate downtrend.

Trader’s Corner

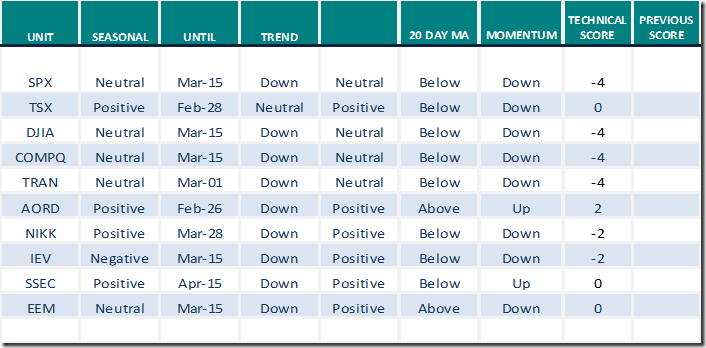

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Feb.22nd 2022

Green: Increase from previous day

Red: Decrease from previous day

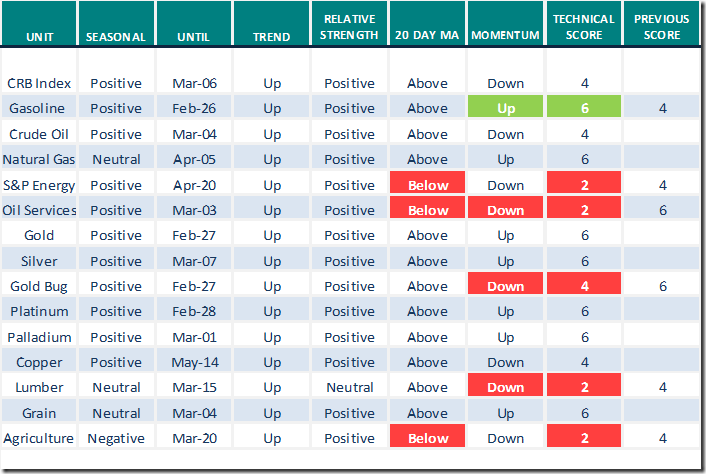

Commodities

Daily Seasonal/Technical Commodities Trends for Feb.22nd 2022

Green: Increase from previous day

Red: Decrease from previous day

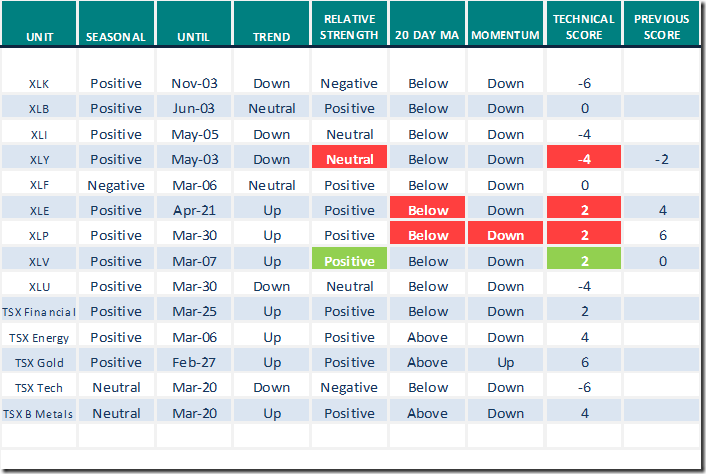

Sectors

Daily Seasonal/Technical Sector Trends for Feb.22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Link from valued provider

Greg Schnell says “This indicator is near five year lows”. Following is a link:

This Indicator Is Near 5 Year Lows! | The Canadian Technician | StockCharts.com

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 3.21 to 31.06 yesterday. It remains Oversold. Trend is down.

The long term Barometer dropped 3.01 to 42.69 yesterday. It remains Neutral. Trend is down.

TSX Momentum Barometers

The intermediate term Barometer fell 3.52 to 51.54 yesterday. It remains Neutral. Trend is down.

The long term Barometer dropped 3.08 to 53.30 yesterday. It remains Neutral trend is down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.