by Chris Hogbin, Head—Equities, AllianceBernstein

It’s been a challenging start to the year for equity investors, with markets dragged down by a sell-off starting in expensive technology stocks, particularly in the US. While the correction is unsettling, we think it may open the door for a healthier recovery in which companies with high-quality, sustainable businesses can stand out.

After setting new records at the end of 2021, the S&P 500 declined by 8.7% through January 26. The tech-heavy Nasdaq tumbled by 13.4%. European and Japanese stocks dropped more modestly, while emerging-market equities were relatively resilient, falling 1.6% in US-dollar terms. Value stocks have performed better than growth stocks in the US and globally. The MSCI World Value Index was down 2.4% through January 26 in local-currency terms, versus a 12.9% decline for the MSCI World Growth Index.

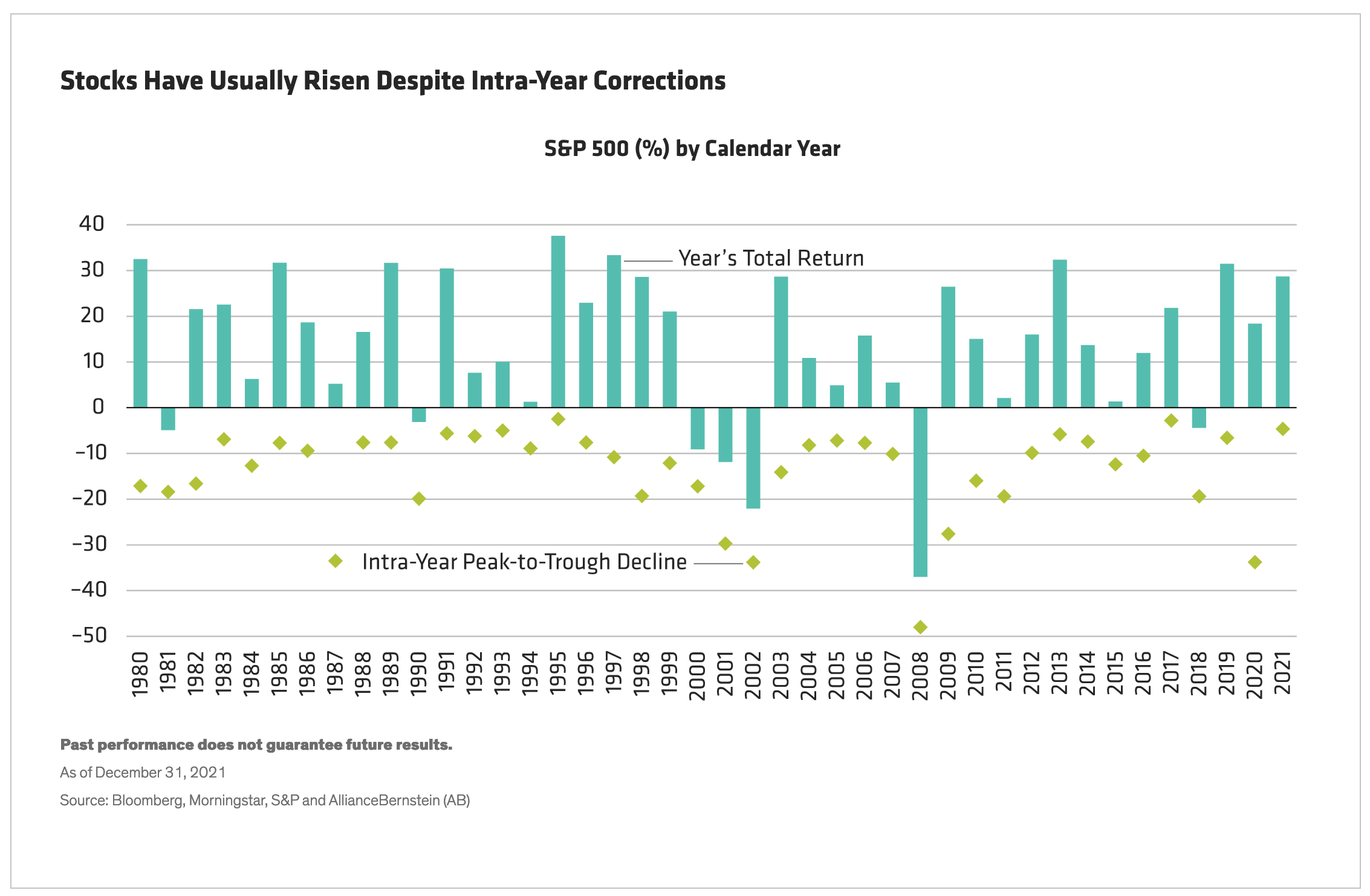

Sharp and sudden market declines are always disturbing and may make investors question equity allocations. But corrections are quite common, and in most calendar years, the S&P 500 posted positive returns even when the market suffered a sharp intra-year decline (Display). When volatility strikes, it’s important to understand what’s driving the uncertainty, and how we can position to best capture the recovery potential when the dust settles.

What Is Stoking Uncertainty?

As the year began, investors faced a challenging outlook. Macroeconomic growth prospects looked solid, although a slower pace of growth than in 2021 was widely expected. Similarly, earnings growth was generally expected to continue at a more modest clip than last year, when economies and companies were recovering from the sharp pandemic-induced recession of 2020.

Monetary policy changes were in the cards. The US Federal Reserve had already signaled its intention to raise interest rates and to taper its quantitative easing program. In this environment, it isn’t surprising that growth stocks in general—and particularly hypergrowth stocks with very high valuations—would come under pressure. Rising rates tend to disproportionately compress valuations of growth stocks, whose cash flows are much further in the future than value stocks.

While we anticipated a year of uncertainty, the speed, intensity and breadth of the sell-off has been jarring. So, given that many of the variables for the outlook were known, why have stocks sold off so sharply?

Monetary Policy and Growth Fears

In our view, the uncertainty isn’t really about the number of rate hikes in store. Rather, given the complex macroeconomic landscape of high inflation and uncertain growth prospects, not least because of ongoing COVID-19 disruptions, investors are concerned that the Fed and other central banks may not succeed at the delicate policy balancing act. In other words, central bank missteps aimed at combating inflation could undermine GDP growth and tip economies into recession. Getting the policy formula right will determine whether we’re headed for a slowdown or healthy growth in 2023.

Company earnings hang in the balance. While the current volatility may be driven by macro and policy fears, long-term stock returns are driven primarily by earnings and cash flows. The volatile US trading session on Wednesday, January 26 illustrated this tension. Early in the day, stocks jumped, fueled by Microsoft’s results and forecasts, which beat consensus estimates. But stocks closed lower after the Fed’s statement suggested a hawkish turn in policy, with the potential for tighter policy moves if the inflation picture worsens.

This tug-of-war is creating a challenging environment for equity investors. But over the long term, we believe that stocks still offer compelling return potential. And over the short term, trying to time market inflection points is a risky strategy that rarely succeeds.

Quality Focus Is Vital

In current market conditions, we believe that focusing on high-quality stocks with strong fundamentals and reasonable valuations is essential. Stocks like these can help reduce risk when markets are falling, and are more likely to do well when a recovery materializes, in our view.

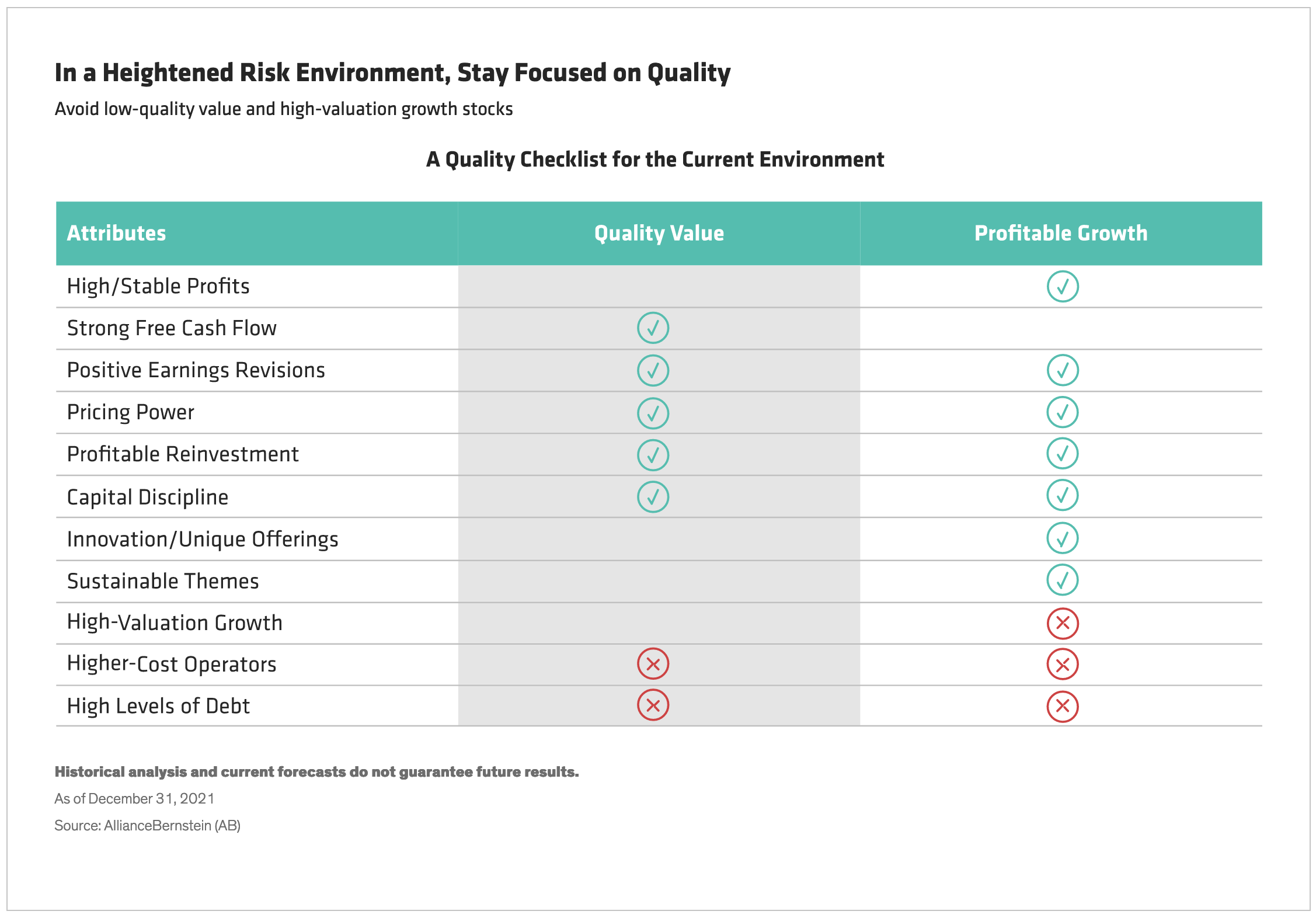

We think investors should avoid extremes in equity markets. Investors who loaded up on expensive hypergrowth stocks have already been burned by the current market repricing. But going to the opposite extreme of accepting lower-quality businesses in return for cheap valuations would also be a mistake, in our view. While “junk rallies” have sometimes happened in the past, they typically follow financial crises or deep recessions as the threat of widespread bankruptcy recedes—very different circumstances to today.

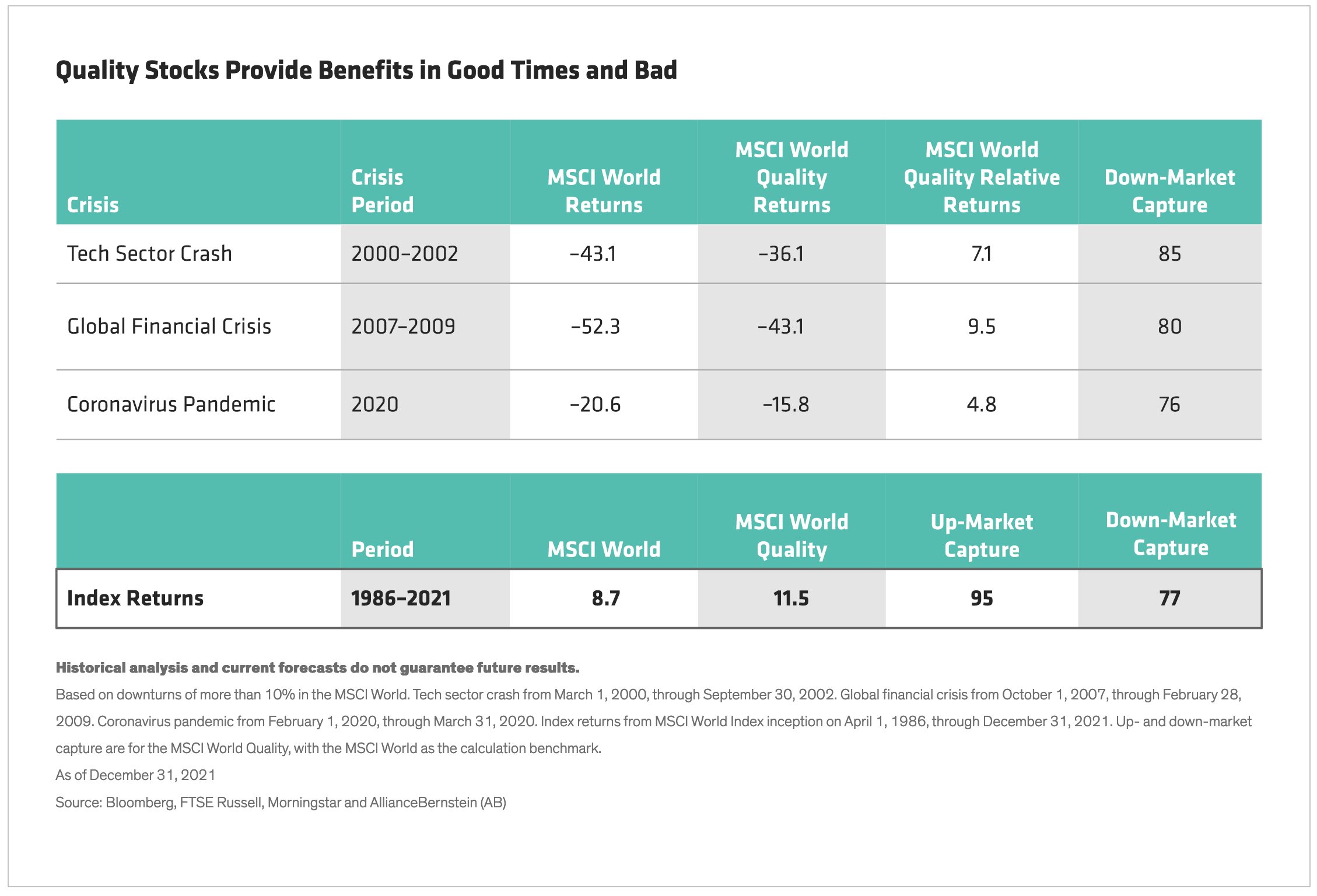

Quality stocks tend to perform relatively well during market crises and over longer time periods (Display). We believe that a quality discipline should be applied to all types of stocks—value and growth. In both camps, we look for solid companies in the middle with resilient balance sheets and quality businesses.

While some features differ when searching for value or profitable growth, others are common to both (Display). For example, pricing power is a key attribute in an inflationary environment and profitable reinvestment is always a good sign that a company is strategically preparing for the future. Today, it’s also important to understand how distortions that have inflated or compressed earnings over the past two years will play out as business conditions normalize.

Market uncertainty is unlikely to abate soon. Inflationary pressures and continued COVID-19 disruption will impact earnings. Monetary policy moves will affect macroeconomic outcomes and market sentiment. And geopolitical issues such as the threat of a Russian invasion of Ukraine will add additional sources of anxiety.

The current volatility creates opportunities for active managers to identify stocks that have sold off more than deserved. By maintaining a strategic focus on higher-quality businesses with relatively attractive valuations, we believe that portfolios can capture stronger recovery potential that is likely to materialize when the turbulence eases and company fundamentals come into focus again.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

*****

About the Author

Chris Hogbin

Chris Hogbin is Head of Equities for AB. In this broad leadership role, he is responsible for overseeing AB's portfolio management and research activities relating to all equity investment portfolios. Hogbin is also a member of the firm's Operating Committee. He joined AB's institutional research business in 2005 as a senior analyst covering the European food retail sector. In 2010, Hogbin was named to Institutional Investor's All-Europe Research Team and was ranked as the #1 analyst in his sector in both 2011 and 2012. He became European director of research for Sell Side in 2012 and was given additional responsibility for Asian research in 2016. In 2018, Hogbin was appointed COO of Equities for AB. Prior to joining the firm, he worked as a strategy consultant for the Boston Consulting Group in London, San Francisco and Shanghai, where he was responsible for the execution of critical business-improvement initiatives for clients in the financial-services and consumer sectors. Hogbin holds an MA in economics from the University of Cambridge and an MBA with distinction from Harvard Business School. Location: New York