by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

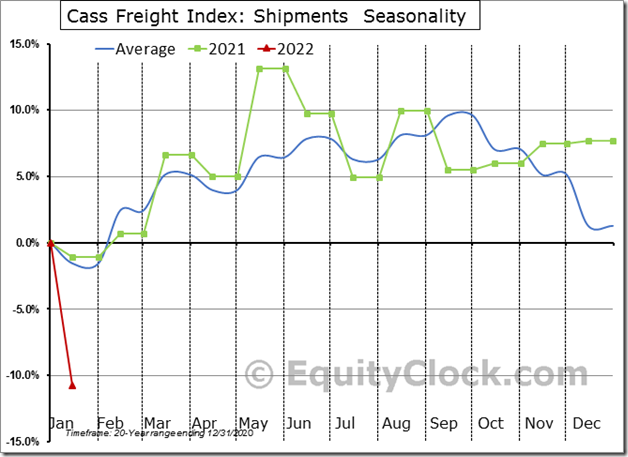

Shipping volumes in January fell by the most for the first month of the year on record! equityclock.com/2022/02/15/… $MACRO $STUDY $IYT $DJT

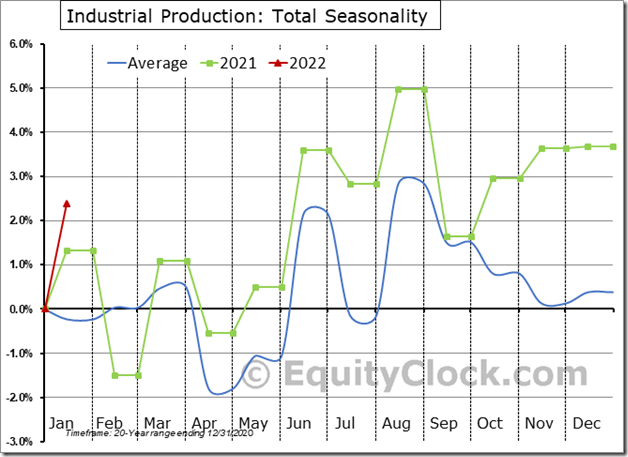

Growth in US Industrial Production remains on an upswing, rising by 2.4% (NSA) in January, which is a positive divergence compared to the 0.2% decline that is the norm. Weather had a noticeable influence on the aggregate result. $STUDY $MACRO #Economy #Manufacturing

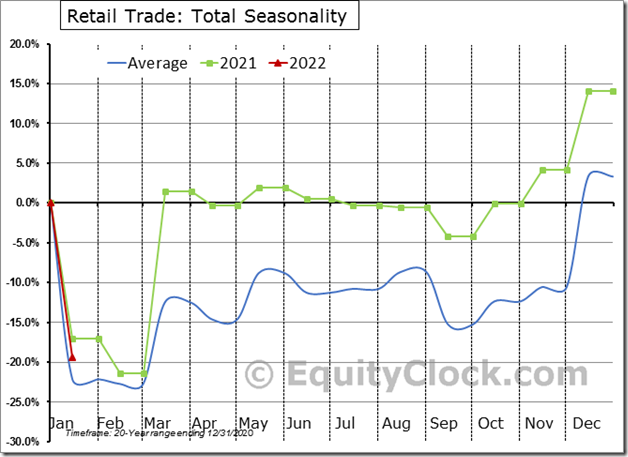

US Retail Sales dropped by 19.4% (NSA) in January, which is stronger than the 22.2% decline that is average for this first month of the year. Year-over-year comparisons are becoming tougher as the months go by. $STUDY $MACRO #Economy #Consumer #Retail $XRT $RTH

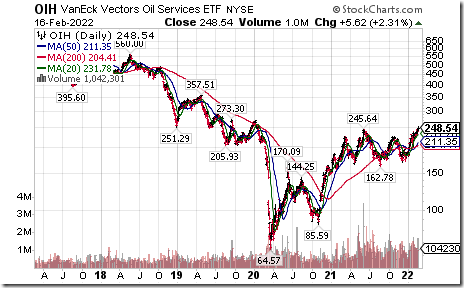

Oil Services ETF $OIH moved above $246.64 completing a long term reverse Head & Shoulders pattern.

Canadian oil service stocks also are stronger. Trican Well Services $TCW.CA moved above $3.68 extending an intermediate uptrend.

Danaher $DHR an S&P 100 stock moved below $264.17 extending an intermediate downtrend.

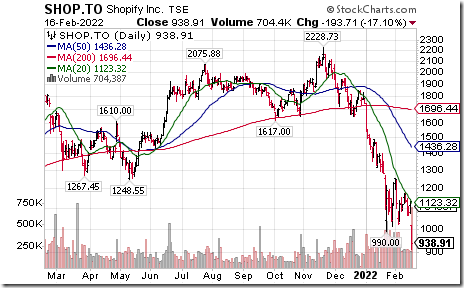

Shopify $SHOP.CA a TSX 60 stock moved below Cdn$990.00 extending an intermediate downtrend. Responded to lower than consensus quarterly earnings.

Precious metal prices are moving higher. Notably today is the Platinum ETN $PPLT on a move above $99.05 extending an intermediate uptrend

TSX Gold Index iShares $XGD.CA moved above $19.31 extending an intermediate uptrend.

Rogers Communications $RCI.B.CA a TSX 60 stock moved above Cdn$67.05 to an all-time high extending a long term uptrend

Trader’s Corner

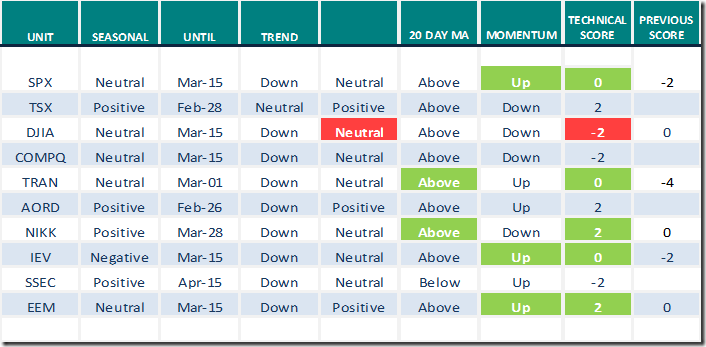

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Feb.16th 2022

Green: Increase from previous day

Red: Decrease from previous day

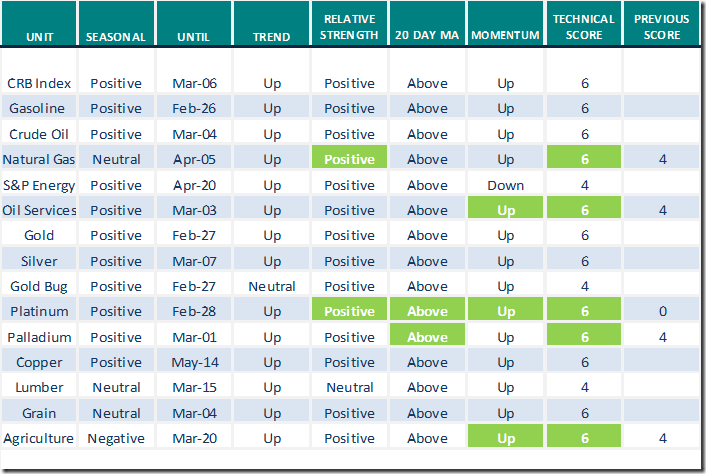

Commodities

Daily Seasonal/Technical Commodities Trends for Feb.16th 2022

Green: Increase from previous day

Red: Decrease from previous day

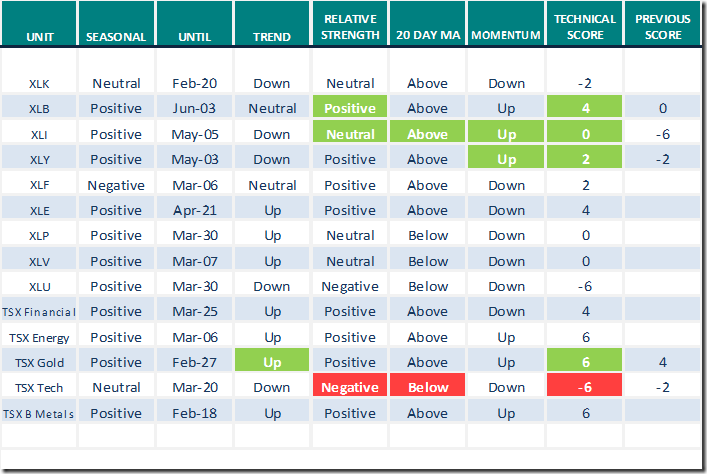

Sectors

Daily Seasonal/Technical Sector Trends for Feb.16th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Links from valued providers

Thank you to Mark Bunting and www.uncommoninvestor.com for the following links:

Top Growth at a Reasonable Price Canadian Stocks from Brian Belski – Uncommon Sense Investor

Evaluating the Prospects for Big Tech’s Gang of Six – Uncommon Sense Investor

De-Globalization, Populism & How to Profit From It – Uncommon Sense Investor

Market Buzz

Greg Schnell asks, “Is a rally starting”?

Is A Rally Starting? | Greg Schnell, CMT | Market Buzz (02.16.22) – YouTube

Larry Williams asks, “Will there be a bear market”?

Will There Be A Bear Market? | Larry Williams (02.15.22) – YouTube

S&P 500 Momentum Barometers

The intermediate term Barometer added 1.12 to 41.88 yesterday. It remains Neutral.

The long term Barometer added 1.30 to 52.10 yesterday. It remains Neutral.

TSX Momentum Barometers

The intermediate term Barometer slipped 0.73 to 64.76 yesterday. It remains Overbought. Trend is up.

The long term Barometer added 1.06 to 60.35 yesterday. It changed from Neutral to Overbought on a move above 60.00. Trend is up.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.