by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

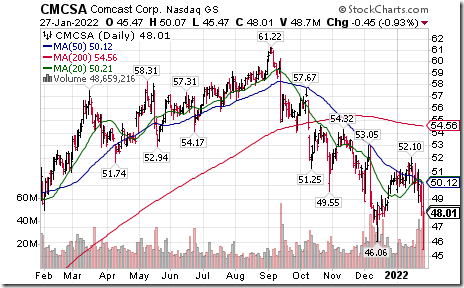

Comcast $CMCSA an S&P 100 stock moved below $46.06 extending an intermediate downtrend. Subsequently, the company reported higher than consensus fourth quarter results and the stock has recovered.

Agnico-Eagle $AEM moved below US$47.07, AEM.CA moved below Cdn$60.27 and Kirkland Lake $KL.CA moved below Cdn$47.64. They are proceeding with a merger.

Trader’s Corner

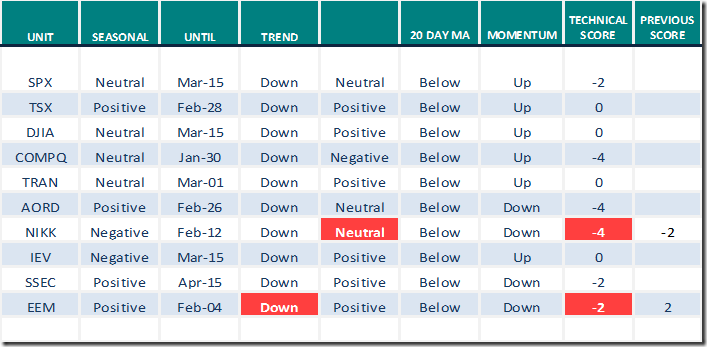

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Jan.27th 2022

Green: Increase from previous day

Red: Decrease from previous day

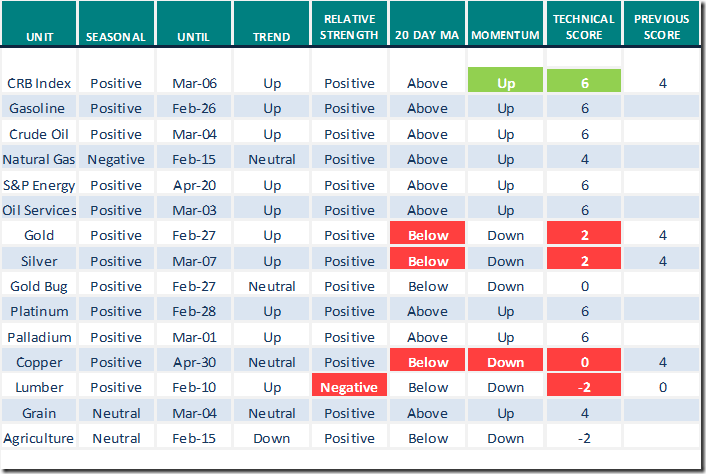

Commodities

Daily Seasonal/Technical Commodities Trends for Jan.27th 2022

Green: Increase from previous day

Red: Decrease from previous day

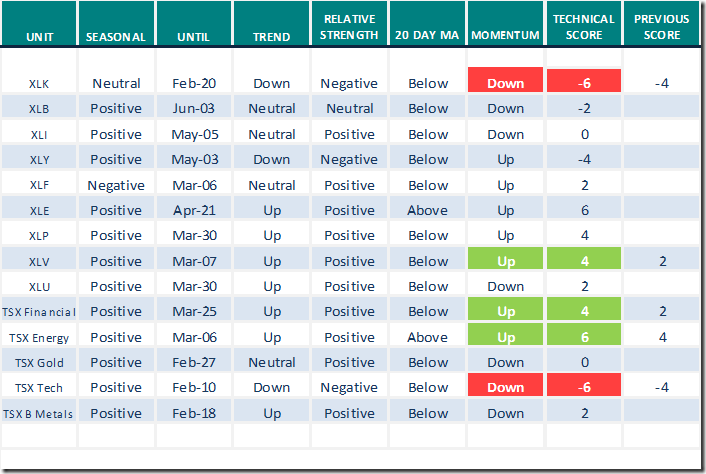

Sectors

Daily Seasonal/Technical Sector Trends for Jan.27th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

World Outlook Financial Conference

"We have reached the end of the road. I have had high-level discussions with SEVERAL major banks and we have indeed reached that critical point in the fate of the world with US banks refusing to accept European Sovereign Debt as collateral for any loan whatsoever, which has massive implications for the credit markets."

~ Martin Armstrong

Martin will be presenting two sessions at the upcoming World Outlook Financial Conference along with a host of other world-class analysts and forecasters. It is shaping up as a critical time for all investors and the insights, advice and recommendations offered at this year’s Conference may be critical to your long-term financial well being.

Watch the broadcast on Feb 4th & 5th, plus get unlimited access to the on-demand video archive. To get your access pass codes CLICK HERE.

Disclosure: Mr. Vialoux is participating on one of the panels presenting during the conference.

S&P 500 Momentum Barometers

The intermediate term Barometer slipped another 2.00 to 28.26 yesterday. It remains Oversold and trending down.

The long term Barometer dropped another 3.81 to 41.88 yesterday. It remains Neutral and trending down.

TSX Momentum Barometers

The intermediate term Barometer added 0.74 to 37.39 yesterday. It remains Neutral.

The long term Barometer slipped 0.66 to 46.40 yesterday. It remains Neutral and trending down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.comare for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.