by Edward Bryan, CFA | Senior Research Analyst—Sustainable Thematic Equities, AllianceBernstein

What You Need to Know

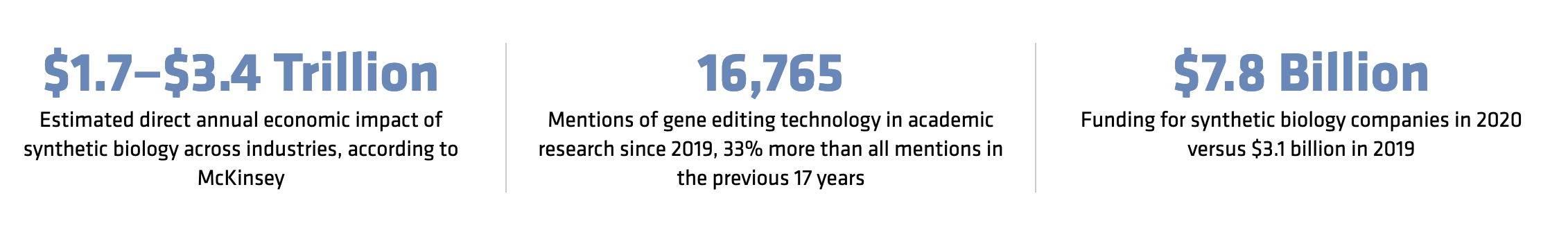

The revolutionary technology of synthetic biology is poised to make a profound impact on the way a vast array of products are manufactured, from lab-grown meat to cosmetics to biodegradable packaging. Yet investors are paying relatively little attention to the huge business potential. In this paper, we explain the science and show how its growing impact on more industries will create exciting opportunities for equity investors.

View PDF

If the technology for making diabetes medicine hadn’t changed since the 1930s, today we’d need an area larger than the surface of the earth for raising pigs, harvesting insulin from their pancreases to help hundreds of millions of diabetics around the world.

That isn’t necessary because of a breakthrough in the 1970s: the invention of synthetic biology. Scientists at start-up Genentech found that inserting the human insulin gene into a yeast cell encouraged the production of that critical protein for treating diabetes. This pioneering application of synthetic biology spawned the biotechnology industry, which now harnesses the power of DNA to produce a growing number of life-changing medicines.

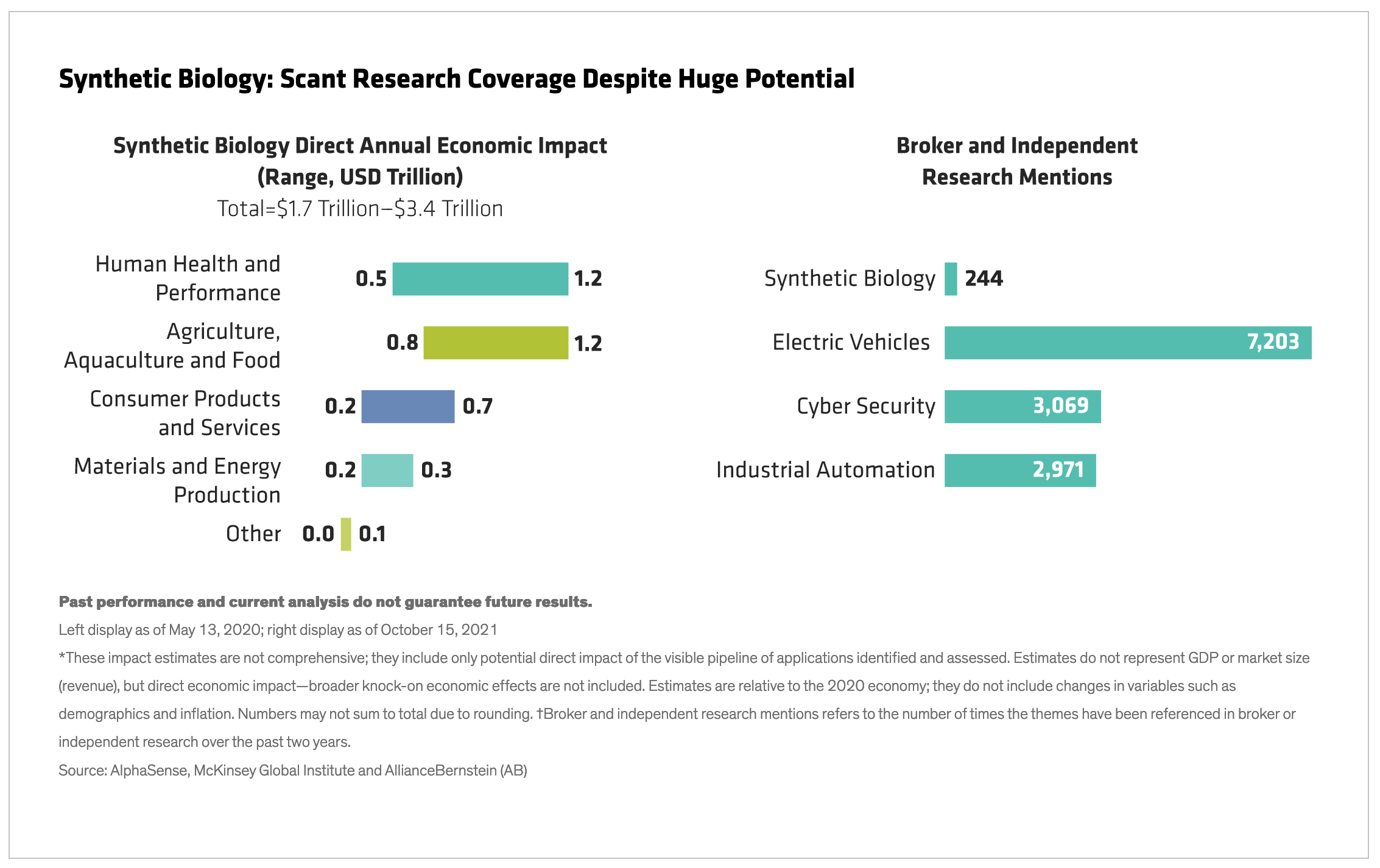

Today, we’re just scratching the surface of this revolutionary technology. What started in the healthcare industry is expanding into many sectors. Over time, synthetic biology is likely to make a profound impact on our world by changing the way a vast array of products are manufactured, from lab-grown meat to cosmetics to biodegradable packaging. McKinsey estimated in a May 2020 report that as much as 60% of the global economy’s physical inputs could be made using synthetic biology, resulting in direct economic benefits of at least US$1.7 trillion between 2030 and 2040 (Display, left).

How does synthetic biology work and why does it matter for equity investors? In this paper, we’ll lay out the basics of the science. We’ll show how exponential cost curves and a convergence of powerful technologies are accelerating progress in synthetic biology and rapidly expanding into new applications. In our view, the growing impact on industries will create many attractive investment opportunities, while the global push for sustainability will add catalysts for adoption. Like the internet revolution, companies that enable or effectively harness synthetic biology will thrive, challenging existing profit pools for incumbents. Simply put: investors can’t ignore the broad, disruptive potential of synthetic biology.

Our research suggests that synthetic biology is still receiving relatively little attention from investment analysts despite its huge potential (Display, right). Many investment firms will struggle to access that potential, because asset managers’ typically siloed sector research isn’t well suited for the cross-sector changes synthetic biology will unleash. Portfolio managers will need to collaborate across industries while applying fundamental research to new products, companies and markets to capture this transformative investment opportunity.

Past performance, historical and current analyses, and expectations do not guarantee future results.

About the Author

Edward Bryan is a Senior Research Analyst, responsible for covering the global healthcare sector for the Sustainable Thematic Equities Portfolios. He began his career at AB in 2007 as an associate in the Institutional Investments division. In 2010, Bryan became a trading desk analyst in the US Equities Trading department. He joined the research team in 2011. Bryan holds a BA in economics from Franklin & Marshall College, and is a CFA charterholder. Location: Nashville