by Don Vialoux, EquityClock.com

Technical Notes for yesterday at

US Dollar has turned higher, presenting a headwind to this favoured seasonal trade for the third quarter. equityclock.com/2021/08/09/… $USDX $UUP $USDU $GLD $GDX

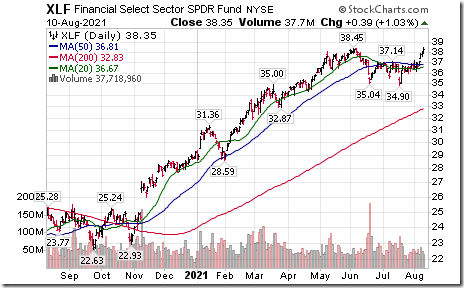

Financial SPDRs $XLF moved above $38.45 to an all-time high extending an intermediate uptrend.

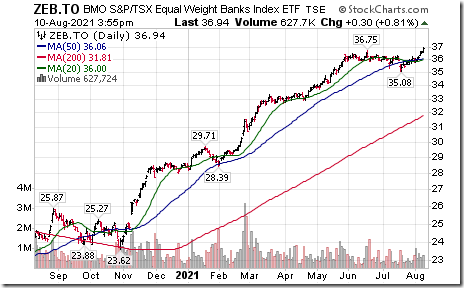

BMO Canadian Bank Equal Weight ETF $ZEB.TO moved above $36.75 to an all-time high extending an intermediate uptrend.

Docusign $DOCU a NASDAQ 100 stock moved above $310.51 to an all-time high extending an intermediate uptrend.

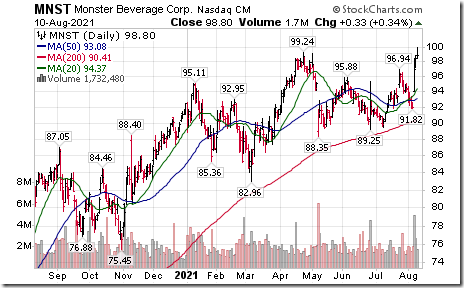

Monster Beverages $MNST a NASDAQ 100 stock moved above $99.24 to an all-time high extending an intermediate uptrend.

Kinross Gold $KGC a TSX 60 stock moved below US$5.98 extending an intermediate downtrend

Canadian Pacific $CP.CA a TSX 60 stock moved below $89.16 setting an intermediate downtrend. Responding to its offer to acquire Kansas City Southern at US$300 per share.

Wheaton Precious Metals $WPM a TSX 60 stock moved below US$42.45 setting an intermediate downtrend.

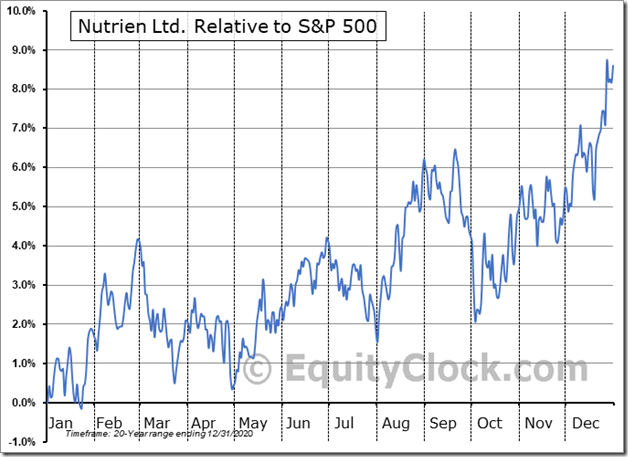

Nutrien $NTR.CA a TSX 60 stock moved above $79.05 to a 6 year high extending an intermediate uptrend. The company reported higher than consensus second quarter results and offered positive guidance.

SNC Lavalin $SNC.CA a TSX 60 stock moved above $33.92 and $34.20 to reach a two year high extending an intermediate uptrend.

Trader’s Corner

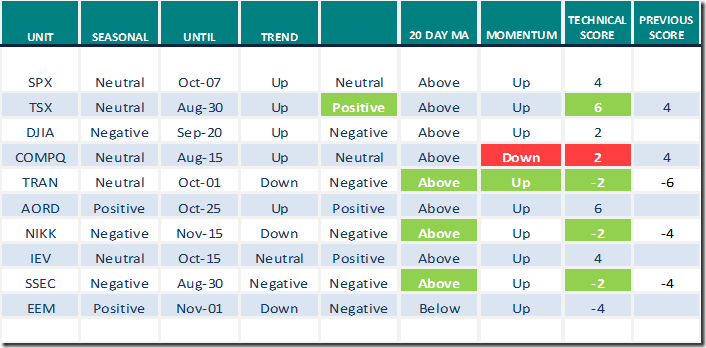

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 10th 2021

Green: Increase from previous day

Red: Decrease from previous day

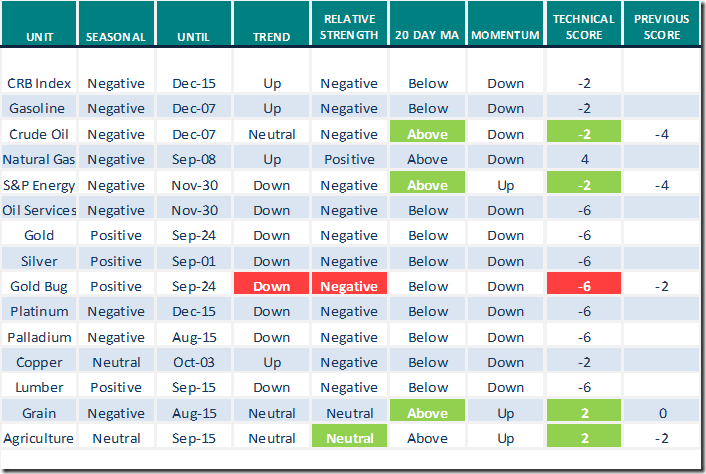

Commodities

Daily Seasonal/Technical Commodities Trends for August 10th 2021

Green: Increase from previous day

Red: Decrease from previous day

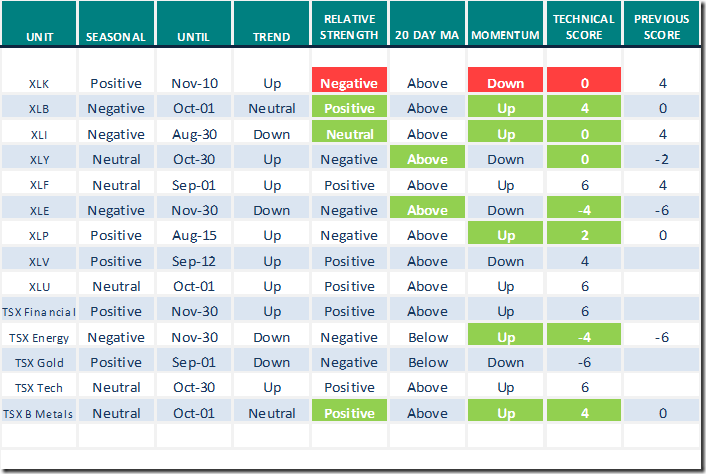

Sectors

Daily Seasonal/Technical Sector Trends for August 10th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Seasonality Chart of the Day

Nice pop in Nutrien yesterday after announcing better than consensus second quarter results! More importantly, the company offered positive guidance. ‘Tis the season for the stock to move higher on a real and relative basis (relative to the S&P 500 Index) until at least the end of September and frequently to the end of the year!

S&P 500 Momentum Barometers

The intermediate term Barometer added 2.00 to 63.53 yesterday. It remains Overbought.

The long term Barometer added 0.80 to 94.97 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 2.17 to 53.62 yesterday. It remains Neutral.

The long term Barometer slipped 1.80 to 70.05 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.