by Don Vialoux, EquityClock.com

Technical Notes for yesterday

at StockCharts.com@EquityClock

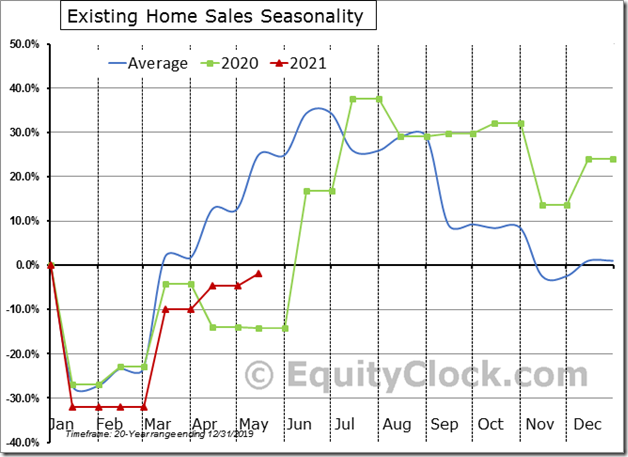

Existing home sales struggle again during what is typically the height of the spring home selling season. This is threatening the strength in the consumer economy. Find out how and why in today’s report. equityclock.com/2021/06/22/… $ITB $XHB $LEN $DHI $PHM #Housing $STUDY

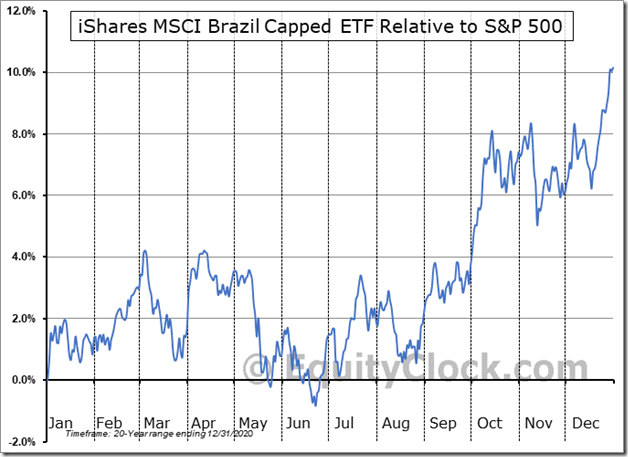

Brazil iShares $EWZ moved above $41.41 extending an intermediate uptrend.

Seasonal influences are positive for Brazil iShares $EWZ from mid-June to at least the beginning of November.

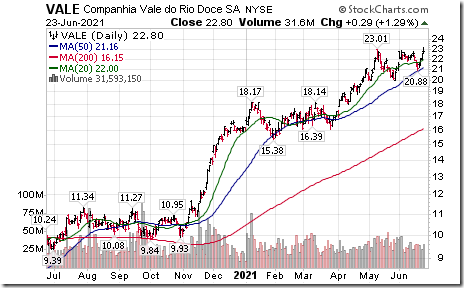

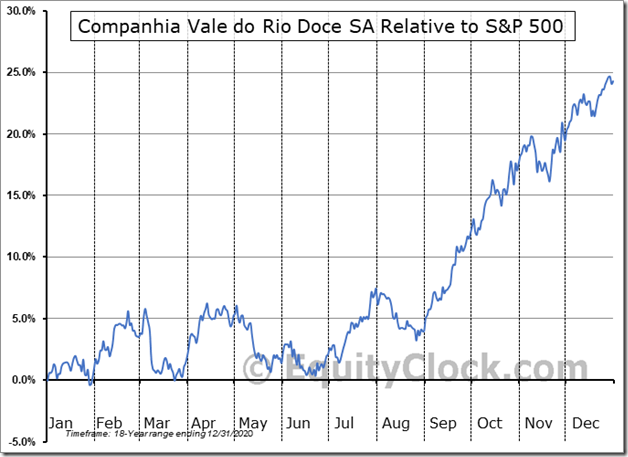

VALE $VALE one of the world’s largest base metals producers moved above $23.01 to an all-time high extending an intermediate uptrend.

Seasonal influences for VALE $VALE are positive on a real and relative basis (relative to the S&P 500 Index) from mid-June to the end of December.

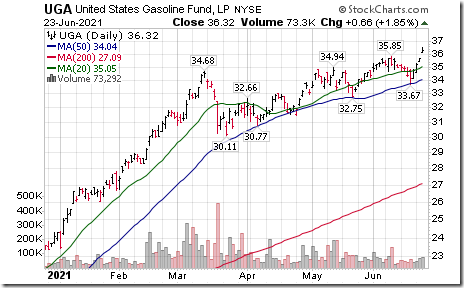

Gasoline ETN $UGA moved above $35.85 extending an intermediate uptrend.

Match $MTCH a NASDAQ 100 stock moved above $160.25 resuming an intermediate uptrend.

Trader’s Corner

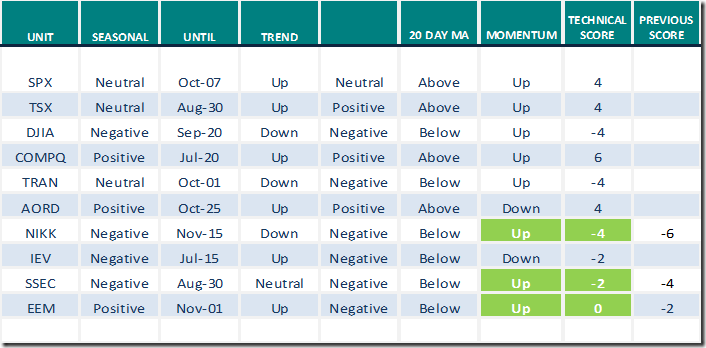

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

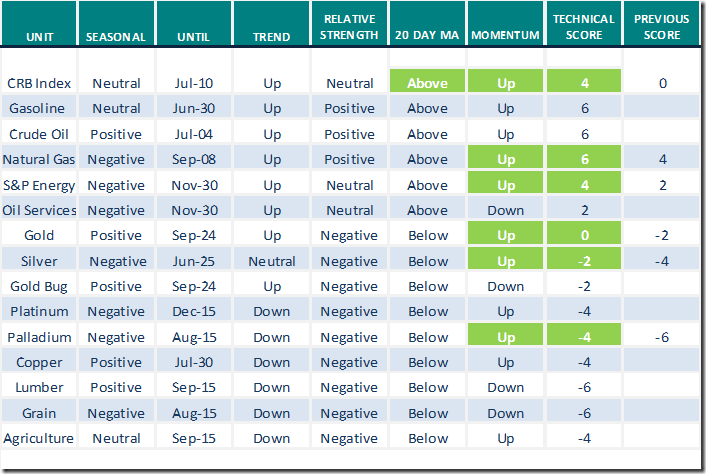

Commodities

Daily Seasonal/Technical Commodities Trends for June 23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

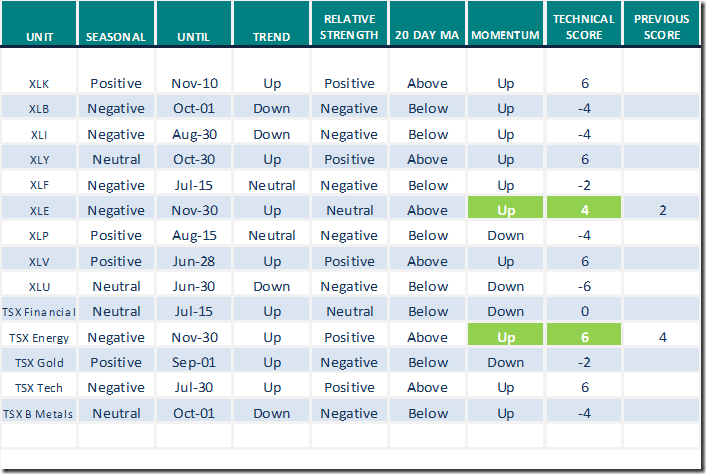

Sectors

Daily Seasonal/Technical Sector Trends for June 23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Interesting Comments from https://uncommonsenseinvestor.com/

Mark Bunting from “uncommon SENSE Investor” offers links to the following articles:

How to be the Smart Money

How to Be the Smart Money – Uncommon Sense Investor

Canadian stocks are trading at the steepest discount to U.S. stocks in about 20 years.

Where were you in 2004? How This Market Mirrors 2004 and Why That’s Good

How This Market Mirrors 2004 and Why That’s Good – Uncommon Sense Investor

Market Buzz

Greg Schnell discusses “The Grand Breakout”. Following is a link:

https://www.youtube.com/watch?v=7y4x8ZnRZ0Q

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 2.00 to 43.49 yesterday. It remains Neutral.

The long term Barometer eased 1.20 to 88.78 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer slipped 1.84 to 60.37 yesterday. It remains Overbought

The long term Barometer was unchanged at 75.12 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.