by Niels Clemen Jensen, Absolute Return Partners

It all comes down to interest rates. As an investor, all you're doing is putting up a lump-sump payment for a future cash flow.

Ray Dalio

Important developments at Absolute Return Partners

Before getting into this month’s topic – higher interest rates – I need to share a story with you. The reason will become obvious in a moment.

Back in the summer of 1986, I was offered a job at Shearson Lehman in London. Quite excited about the opportunity, I was keen to accept the offer but acknowledged that my newly married wife had, only months earlier, landed a new job at Nykredit in Copenhagen which she very much enjoyed. Knowing that she was probably going to be less enthusiastic about this opportunity than me, as I cycled home from the office that evening, I carefully prepared what to say. The talks went on and on – into the early hours of the next day. Finally, she caved in. “Yes, I will come along, but you must promise that this is only a 2-3 year adventure, following which we’ll go back to Denmark – promise?”. “Promise!”, I said. Deal done.

35 years later, we are still here but not for much longer. Boris Johnson’s inept handling of the trade terms between the UK and the EU, where financial services were blatantly ignored, has made it impossible for Absolute Return Partners to do parts of its business without having a foot inside the EU. Consequently, I will be moving back to Denmark later this year (once the necessary licence have been secured) to manage Absolute Return Partners (DK), a wholly owned subsidiary of the UK mothership.

The move won’t affect the Absolute Return Letter, neither will it affect the services we provide through ARP+. In fact, I will most likely have a little bit more time on my hands to dig deeper on various investment opportunities, as I will relinquish my management responsibilities in London, so ARP+ subscribers should benefit.

Talking about ARP+, we have recently published an update on fusion energy, which is available to all subscribers here. If you haven’t read it yet, I urge you to do so. We all dream of the occasional 10-bagger in our investment portfolio, but this one could exceed even my wildest imaginations. Investment opportunities rarely come bigger than this. However, as I am not allowed to discuss specific investment opportunities in the Absolute Return Letter, I shall stop here.

One final word before I start this month’s letter. I will shortly be passing on the responsibility of managing the firm to Peter Kim, who will become our new Managing Partner, subject to FCA approval. Peter joined ARP in February 2012 and has been rising through the ranks ever since. At present, he is our Chief Operating Officer. Please join me in congratulating Peter.

Recent moves in interest rates

Bond yields have risen meaningfully since bottoming out last summer. In the US, 10-year T-bonds troughed at 0.53% last July before yields started to rise again. They peaked at 1.73% in mid-March before dropping back to 1.62% where they stand at present (Exhibit 1). However, going forward, I will treat the modest, recent decline in bond yields as noise and focus on the implications of rising bond yields since last summer.

Source: marketwatch.com (US bonds)

In the UK, 10-year gilts troughed at a measly 0.1% in late July last year only to rise to 0.84% by mid-March. Since March, yields on 10-year gilts haven’t changed much and now stand at 0.85% (Exhibit 2).

Source: marketwatch.com (UK bonds)

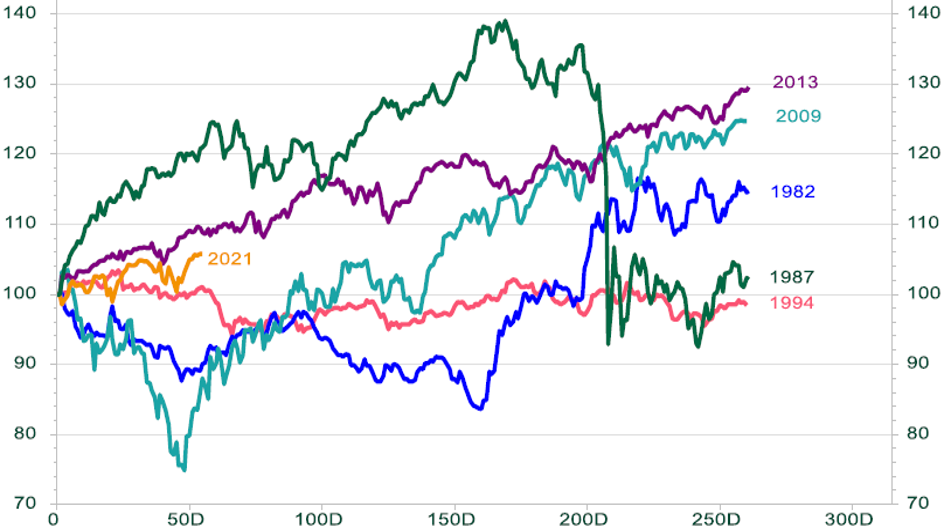

In an international context, the UK selloff in 2021 has been quite dramatic. Investors in gilts have lost 6% so far this year – more than elsewhere (Exhibit 3). I also note that the 2021 UK selloff (through mid-March) has been one of the steepest selloffs in gilts since the early 1980s. As you can see in Exhibit 4 below, 1994 stands out as the worst year for UK bond investors since 1981, but it is being challenged by 2021. (The reason some years have been highlighted (coloured) in Exhibit 4 will become apparent in a moment.)

Source: Bloomberg

Source: Cardano

In other words, US 10-year T-bond yields stand more than one percentage point higher today than they did last summer, while UK 10-year gilts offer three-quarters of a percentage point more in yield than they did last summer. The obvious questions is why? Why are bond yields on the rise at a time the global economy is struggling after a year-long pandemic that has undermined the global economy and cost the lives of more than 3 million people?

Why interest rates are rising

The main reason bond yields are ticking up is, in my opinion, massive fiscal spending combined with a relatively small output gap in the US which, in many investors’ opinion, is likely to lead to higher inflation. The first signs of rising inflation are already there. Not that many years ago, US wages grew at c. 2% annually but are now rising at nearly twice that rate (Exhibit 5).

Source: QMA Wadhwani

If you combine that fact with excessive US money supply growth (Exhibit 6) and massive excess savings (Exhibit 7) you can understand why investors feel unsettled. Without doubt, the almost absurd rise in excess savings everywhere is a result of the lockdown(s). Consumers have simply not been able to spend what they would have spent under normal circumstances, hence the big war chest building up.

Source: BofA Global Research

Note: Excess savings are savings in excess of what is required to settle costs of living.

Source: Bloomberg

The combination of those three factors – rising wage growth, rapid money supply growth and huge excess savings – can only lead to higher inflation (say the bond bears), hence the rise in bond yields. Officials at the Federal Reserve Bank don’t disagree with that but, importantly, they argue that the rise in inflation will be transitory and that inflation will begin to fade again in 2022, hence why they don’t need to act (they say). Only time can tell who is right and who is wrong.

Who do I think is right? As I was about to finish this letter, Exhibit 8 was dumped in my inbox. As you can see, price pressures on goods are most definitely becoming more acute. I don’t think I have ever seen US manufacturing PMI on input prices this high before. That said, manufacturing doesn’t account for more than 11-12% of US GDP, so even a steep price rise on goods won’t necessarily have a massive impact on overall inflation.

Source: The Daily Shot

I have little anecdotal evidence from the US, but anecdotal evidence from the UK suggests to me that service inflation is also about to rise. Restaurants, pubs, cafes and hair dressers, all of which have been closed for months, have now re-opened in the UK and are charging more than the going rate pre-COVID (to make up some of the losses of the last 12 months, I suppose). For example, a good friend of mine told me the other day that his local pub, which has just re-opened, now charges almost twice what it used to charge pre-COVID.

I am not at all suggesting that the Fed is wrong in its assessment, i.e. for inflation to mellow again in 2022. In my opinion, that is what is most likely to happen, but it does mean that we could be in for a bit of a spike in the months to come. Furthermore, as I will discuss later, there are still several plausible outcomes.

How equities usually perform when interest rates are rising

Many investors expect equities to come under pressure every time interest rates rise, i.e. the correlation between equities and bond yields should, according to this logic, always be negative, but that isn’t true (Exhibit 9). As you can see, for much of the 20th century, the correlation between the two was indeed negative but, more recently, it has been consistently positive. Adding to that, despite the correlation being mostly negative in the 20th century, there were extended periods of positive correlation.

Source: Reserve Bank of Australia

There can be no doubt that the high level of uncertainty in the years since the double equity whammy (the dotcom crash followed by the Global Financial Crisis) is a key reason the correlation has turned positive more recently, but that is not really my point here. My point is that you shouldn’t make any hasty assumptions. The correlation can be both positive and negative.

Let’s go back to Exhibit 4. Why did Cardano highlight certain years on the chart (1982, 1987, 1994, 2009 and 2013)? The one thing all those years have in common is that UK equities delivered flat(ish) or positive returns despite rising bond yields (Exhibit 10). If you combine the acquired wisdom from Exhibits 4 and 10, it becomes obvious that one shouldn’t always expect equities to fall when bond yields are rising. More recently, equities have performed better in rising yield environments than you would expect, based on the experience from the 20th century.

Source: Cardano

What next?

The $64 million question now is what next? Given the high allocation to equities in many portfolios, it is time to form an opinion on this question. Will interest rates continue to rise or not, and how are equities likely to perform if they do go higher? In the following, I am leaning heavily towards my good friend Sushil Wadhwani, who has shared his wisdom with me (look here if you want to learn more about Sushil and his business).

Assuming inflation will rise, three outcomes stand out as the most likely. Either (a) the rise in inflation will be transitory and we don’t have much to worry about (scenario 1 in Exhibit 11 below), (b) we will enter a new inflation regime very much like the 1970s (scenario 2), or (c) it will be a typical boom/bust scenario, where the economy is pushed into another recession by a hesitant Fed (scenario 3).

Source: QMA Wadhwani

Scenario 1 is obviously the most favourable outcome for equities. As per this scenario, massive fiscal spending by the government (nowhere more so than in the US), combined with a gigantic consumer war chest will lead to rapid GDP growth but also to higher inflation. “Do not worry” say US central bankers. The rise will be transitory, and inflation will soon begin to fade again – sometime in 2022, according to Fed chairman Jerome Powell.

Scenario 2 is effectively a return to the 1970s and is a complete game changer but is also, in my opinion, the least likely of the three. Underlying forces continue to be quite deflationary, and I wouldn’t assign more than a 10% probability to scenario 2 unfolding. Scenario 3 is a classic recessionary outcome. The central bank sits on its hands for too long and only belatedly realises that the rise in inflation is not transitory, hence it reacts quite firmly (to avoid scenario 2) and pushes the economy into another recession.

Assigning only a 10% probability to scenario 2 means that I think we will most likely end up in either scenario 1 or scenario 3, but which one is more likely? For now, my money is on scenario 1, but the probability of scenario 3 unfolding is too high to be ignored – at least 30% in my book.

Why scenario 1 is more likely than scenario 3

Goldman Sachs have done some brilliant research on the inflationary impact of pandemics vis-à-vis wars and found that the two affect inflation very differently. Whereas wars typically lead to higher inflation, both during the war and in the immediate aftermath (Exhibit 12a), pandemics have no noticeable impact on inflation (Exhibit 12b).

If anything, pandemics are deflationary, and I urge you not to fall into the trap I nearly fell into at first. “How can you reach such a conclusion when we have had virtually no other pandemics in modern history?”, I asked myself, but that is nonsense. We have access to inflation data going back at least 200 years, and there have been plenty of pandemics over the last couple of centuries.

There are two key reasons why wars and pandemics affect inflation differently. Firstly, wars drive aggregate demand higher, whereas pandemics drive aggregate demand lower. During pandemics, unlike in wars, an increase in spending is almost always used to fill the gap left by absent private sector demand.

Source: Goldman Sachs Global Investment Research

Source: Goldman Sachs Global Investment Research

Secondly, wars destroy physical capital, driving investments and interest rates higher. By contrast, pandemics do not result in any loss of physical capital. Pandemics may even result in an increase in the capital-labour ratio and, according to Goldman Sachs (and to economic theory), a higher capital-labour ratio should lower equilibrium interest rates while raising real wages.

The Green Revolution

Before wrapping it all up, allow me to make a comment on inflation in the context of the Green Revolution. For years, most of Europe have been committed to going carbon neutral – and, more recently, also climate neutral – and Joe Biden is now taking the US down the same path. Although I would never argue that it is the wrong path (for the sake of our children and grandchildren, it certainly isn’t), going green is inflationary, and there are (at least) two reasons for that.

Firstly, converting to various green technologies is, in itself, inflationary, as most of these, new technologies are more expensive than fossil fuels. ARP+ subscribers will soon receive a paper on this topic, as I am preparing one on hydrogen, and why liquid hydrogen will probably replace oil, petrol, diesel and kerosene (aviation fuel) in the years to come. Expect that paper to be published on ARP+ within the next couple of weeks.

Secondly, emitting excessive amounts of CO2, which is what you do when you burn lots of fossil fuels, is becoming an expensive ‘crime’ in Europe. Until early 2018, EU carbon prices traded below €10 per tonne but are now fast approaching €50 (Exhibit 13). You can read more about EU carbon prices here.

Heavy users of fossil fuels, e.g. many (but not all) electric utilities and many industrial companies, must buy these permits in the open market in addition to what they were allocated, whereas those who have already converted to a green technology can take advantage and sell their allocation in the open market, as they won’t need them. To the consumer, though, the net effect is higher prices. If a powerplant, running on natural gas, is subjected to a cost like this, what will it do? Pass it to the consumer!

Source: The Daily Shot

Final few words

I think I will stop here. As I have pointed out, there are both inflationary and disinflationary forces in play here, and it is hard to predict which ones will come out on top. When preparing for this letter, the information which had the biggest impact on me was the data expressed in Exhibit 8. When the PMI data takes off like it is doing now in the US, it is rarely a false signal, so my money is definitely on higher inflation in the short-term.

Longer term, I am not so sure. As long-term readers of the Absolute Return Letter will be aware, I subscribe to the view that underlying structural forces will prevent inflation from becoming a serious problem for many years to come. For that reason, I tend to agree with Jerome Powell that any rise in inflation in 2021 will prove short-lived.

Having said that, the risk of scenario 3 unfolding is too high to be ignored, and it is obvious that equity investors share that concern. That said, if my analysis is correct, any significant selloff in equities during 2021, should be looked upon as a buying opportunity, as spending plans all over the OECD, but particularly in the US, will almost certainly ensure robust economic growth over the next 12-18 months – if the Fed doesn’t decide to kill the party, that is.

Niels C. Jensen

4 May 2021

Investment Megatrends

Our investment philosophy, and everything we do at ARP, is driven by the long-term Investment Megatrends which are identified and routinely debated by our investment team.

About the Author

Niels Clemen Jensen founded Absolute Return Partners in 2002 and is Chief Investment Officer. He has over 30 years of investment banking and investment management experience and is author of The Absolute Return Letter.

In 2018, Harriman House published The End of Indexing, Niels' first book.