by Brian S. Wesbury - Chief Economist, Robert Stein, CFA – Deputy Chief Economist, First Trust Portfolios

At its most recent meeting the Federal Reserve made no changes to monetary policy and minimal changes to its statement, simply acknowledging that some economic indicators have "turned up" recently while also noting that inflation remains below 2.0%.

Instead, the "action" from the Fed was in changes to its projections, including changes to the economic forecast as well as the number of policymakers who think the Fed will lift short-term interest rates in either 2022 or 2023. In particular, the Fed raised its forecast for real GDP growth this year to 6.5% versus a prior forecast of 4.2%, largely the result of the recently-enacted $1.9 trillion "stimulus" plan. In turn, higher real GDP translates into lower unemployment rate projections, including 4.5% at the end of 2021 (was 5.0%), 3.9% at the end of 2022 (was 4.2%), and 3.5% at the end of 2023 (was 3.7%). In addition, the Fed raised its forecast for PCE inflation this year to 2.4% versus a prior estimate of 1.8%.

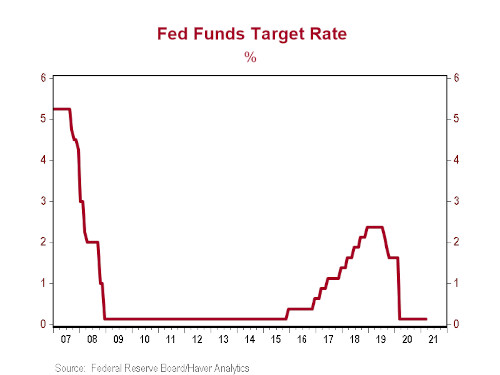

As you'd expect, a forecast that includes faster real growth, lower unemployment, and faster inflation also includes more policymakers who foresee an earlier start to rate hikes. Back in December, only one policymaker thought the Fed would raise rates in 2022; now, four of eighteen officials think they'll raise rates at least once next year. Back in December, only five policymakers thought rates would be higher by the end of 2023; now, seven of eighteen foresee at least on rate hike by the end of that year.

Yes, that means a majority of monetary officials still think the first rate hike will be in 2024 or beyond. And now that the Fed has lifted its economic projections, the data have a higher hurdle to clear before the Fed will consider them worth changing the expected path of short-term interest rates.

However, there is still plenty of time for the Fed to change its mind and bring forward a first rate hike into 2023. The key issue will be inflation. The Fed expects 2.4% PCE inflation this year but then a decline to 2.0% in 2022. If, instead, inflation continues to rise in 2022, a rate hike in 2023 would be possible, maybe even a rate hike by the end of 2022.

Our view is that the Fed's new inflation forecast for 2021 is correct, but it will be surprised in 2022 by inflation's staying power. The M2 measure of the money supply has never grown as fast as it has in the past year and the federal government has helped keep incomes very high relative to production levels. Combined, these will push inflation higher than the Fed expects. The Fed still says no rate hikes until 2024. We think it's more likely sooner than that versus later.

Click here for a PDF version

Copyright © First Trust Portfolios