by Kent Hargis, AllianceBernstein

After last year’s sharp equity market rally, the recent selloff serves as a reminder that the exit from the pandemic will be bumpy—and some markets still look pricey. Defensive stocks with attractive valuations can help provide balance through an uncertain recovery.

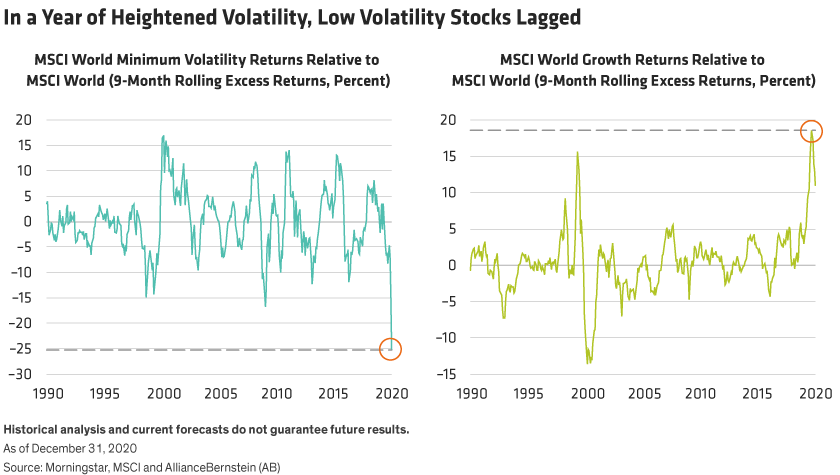

Market patterns last year were as extreme as the COVID-19 environment that created them—first a historic crash, then a dramatic rebound, driven by a small group of giant growth stocks. Late in the year, vaccine hopes boosted value stocks in sectors more sensitive to economic growth. Traditional defensive stocks were caught in the middle and lagged the market by the most in 30 years (Display).

For many investors, this was surprising. After all, defensive stocks are prized for stable businesses and cashflows that help reduce risk, and market volatility was acute in 2020. The MSCI World and the S&P 500 rose or fell by more than 1% on 85 trading days and 109 days respectively—more than triple the number in 2019. The MSCI ACWI advanced by 16%, an unusually strong outcome given the shock to economies as well as consumer and business behavior. Yet volatility jumped to 28% in 2020 from 10% in 2019.

Hypergrowth vs. High Quality

Despite the volatility, investors preferred expensive stocks and companies with strong sales growth to an unusual degree. Hyper-growth companies surged with little regard to low profitability. Meanwhile, shares of defensive companies underperformed significantly, even though they generally have delivered relatively resilient earnings, despite the extreme uncertainty (Display).

So, are lower-volatility stocks smart investments in 2021? We think so. Even as the world moves toward an exit from the pandemic and a stronger economic recovery, the path to normalcy is fraught with challenges. Markets seem to be assuming that COVID-19 vaccinations will be complete by the second quarter, and have already priced in much of the recovery, in our view. Yet the rollout will vary by country, and the impact of vaccines is unlikely to be uniform.

Countries will reopen economies based on different policies and different experiences with the virus, and economic growth won’t be restored in one fell swoop. Similarly, earnings will depend on how quickly consumer and business activity is restored, and how individual companies have adjusted their businesses to the new normal. And after rebounding from recessionary levels, earnings growth will still be challenged, as it was before the pandemic.

Seek Stability for an Uncertain Recovery

In this environment, we believe investors should balance near-term optimism with medium-term caution. Focusing on high-quality companies with relatively stable shares, trading at attractive prices, is a prudent strategy in our view.

Quality companies with strong balance sheets and businesses with high cash flows should be well positioned for an array of known and unknown risks. Shares that have demonstrated stable trading patterns should hold up better in bouts of volatility that may strike along the road to recovery.

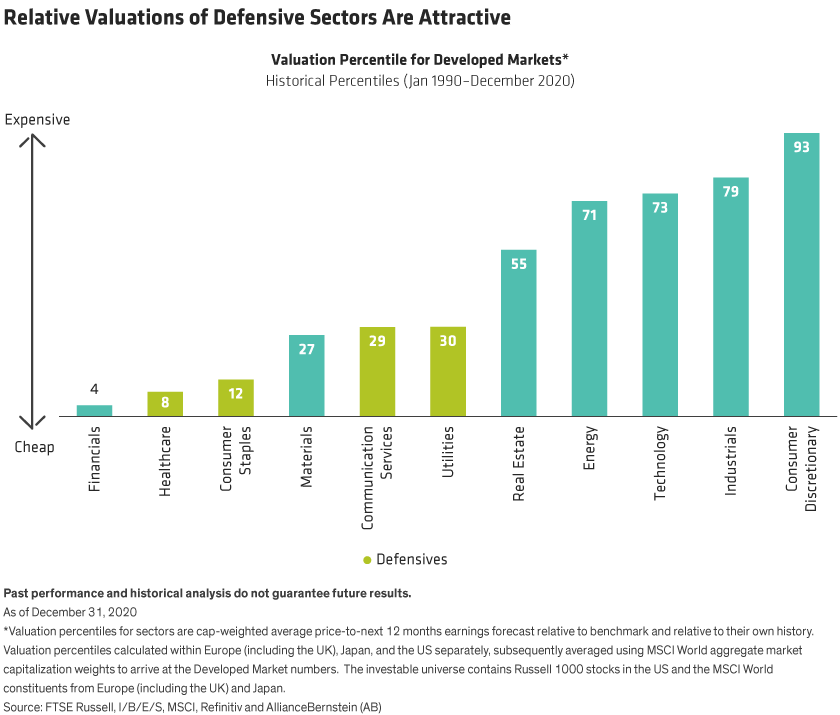

And in a market where the most popular growth stocks look especially expensive, focusing on price is paramount. Relative valuations of defensive sectors, such as healthcare, consumer staples and communications, are much lower versus their 30-year history than sectors such as technology and industries (Display). Within expensive sectors, investors can also find select high quality companies that trade at attractive valuations.

What about Rising Interest Rates?

Critics argue that the potential for inflation—which could fuel an increase in interest rates—adds risks for defensive stocks, which have underperformed in similar cycles in the past. It’s true that certain groups of defensive equities, such as low-beta stocks, have underperformed when interest rates rose. However, we believe these risks can be monitored and managed in a low-volatility portfolio by reducing exposure to sectors and companies that are more vulnerable to inflation and interest-rate risk. What’s more, it’s too soon to say when and by how much interest rates will rise from here, so we don’t think an investment strategy should be too heavily built on rate expectations.

For risk-aware investors, piling into stocks that outperformed strongly through the COVID-19-induced dislocations is a perilous strategy, in our view. Similarly, chasing the latest popular investing themes, such as hypergrowth stocks or post-pandemic “recovery plays,” isn’t a recipe for long-term success.

Instead, focus on companies with strong business fundamentals among highly discounted traditional defensive stocks and companies mispriced for a post-vaccine world. Some of these companies can be found in areas benefiting from structural shifts that were accelerated by the pandemic, such as payment digitization, consumer e-commerce and a shift toward green energy. Stocks like these can form the foundation for a portfolio with robust shock absorbers and real business drivers to support solid performance as the world economy starts to shed the burden of the pandemic and slowly return to normal.

Kent Hargis is Co-Chief Investment Officer—Strategic Core Equities at AllianceBernstein (AB)

Sammy Suzuki is Co-Chief Investment Officer—Strategic Core Equities at AB

Chris Marx is Senior Investment Strategist—Equities at AB

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

This post was first published at the official blog of AllianceBernstein..