The world is turning a corner toward economic recovery. Capital Group investment professionals offer their views on the 2021 outlook.

by Jared Franz, Jody Jonsson, Mike Gitlin, Capital International Asset Management

With the wreckage of 2020 in the rearview mirror, investor optimism for the new year is high. After all, how could it possibly be any worse than a year marked by a deadly pandemic, a brutal recession and one of the steepest bear markets in history?

In contrast, 2021 is poised to be a critical turning point on several fronts — whether it’s the vaccine-assisted defeat of COVID-19, the resurgence of global economic growth, or the transformation of how we live and work in the digital age.

“At the start of the pandemic, who would have thought that nine months later markets would be making new highs?” says Capital Group portfolio manager Jody Jonsson. “We still have a long way to go and there is still a lot of suffering around the world, but I think we are at a point now where we can clearly see the end of this crisis and the foundations of a sustainable recovery.”

The world is turning the corner toward recovery

Equity markets have been predicting such an outcome for months, rallying in the face of government-imposed lockdowns and dire economic numbers. On a year-to-date basis, the MSCI World Index is up more than 11% in USD, as of mid-December, led by surging technology and e-commerce stocks. Emerging markets stocks have done even better, fueled by China’s first-in first-out recovery from the COVID crisis.

A critically important announcement came on December 11 when the U.S. Food and Drug Administration granted emergency use authorization for a COVID-19 vaccine developed by Pfizer and BioNTech, paving the way for mass inoculations to begin this week. Pfizer has said it plans to distribute 25 million doses in the U.S. by the end of the month.

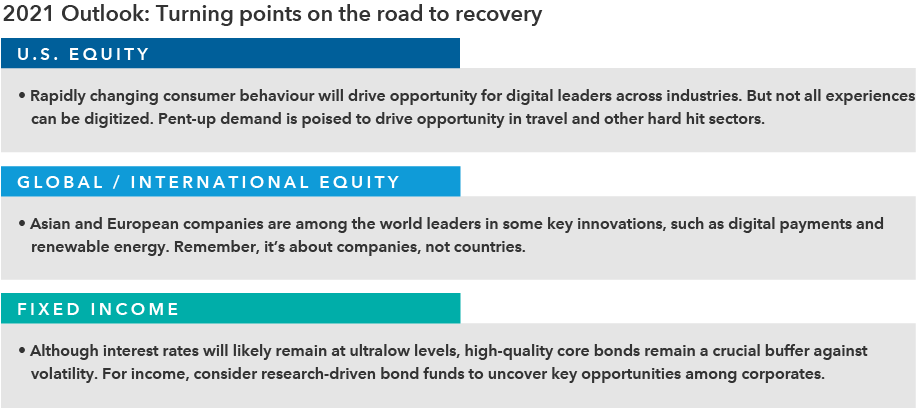

With these events in mind, the outlook for 2021 is coming into sharper focus. Many Capital Group investment professionals remain optimistic for the year ahead:

U.S. outlook: The future is here, and it’s digital

Every so often a crisis comes along that drives change at such velocity that investors can almost feel the ground shift beneath their feet. That happened in 2020 as the pandemic forced companies to prioritize and expand their online operations. Those without a digital advantage found themselves left behind.

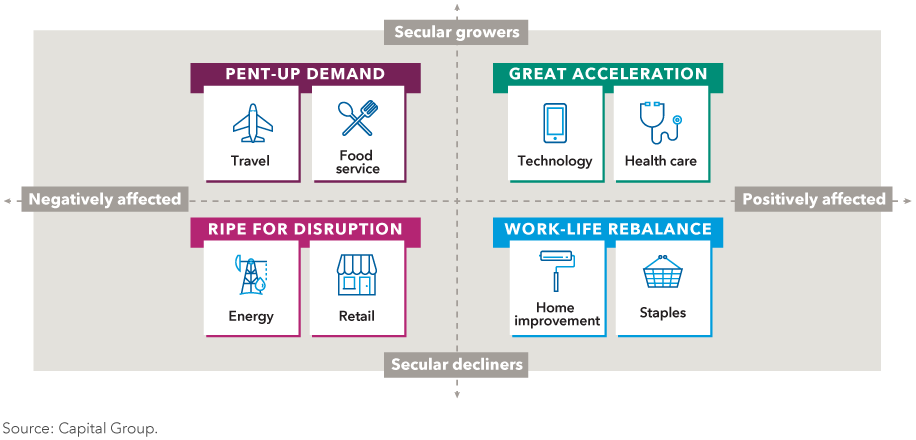

For restaurants, hotels, retailers, airlines and small businesses, it has literally been the worst of times. At the opposite end of the spectrum, the stay-at-home era has been a boon for e-commerce, cloud computing, video streaming, digital payment processors and home improvement stores. The key question now is: How much of that activity was purely COVID-driven, and how much of it will persist in the years ahead?

A framework for evaluating COVID winners and losers

“The post-pandemic economy is going to look very different than the one we had in February 2020,” says Capital Group economist Jared Franz. “It’s going to be more efficient and more dynamic, but there will be winners and losers. Our job as active investors is to identify them — finding the growing companies that have not only benefited from the pandemic but that also have the potential to continue generating solid growth in a post-pandemic world.”

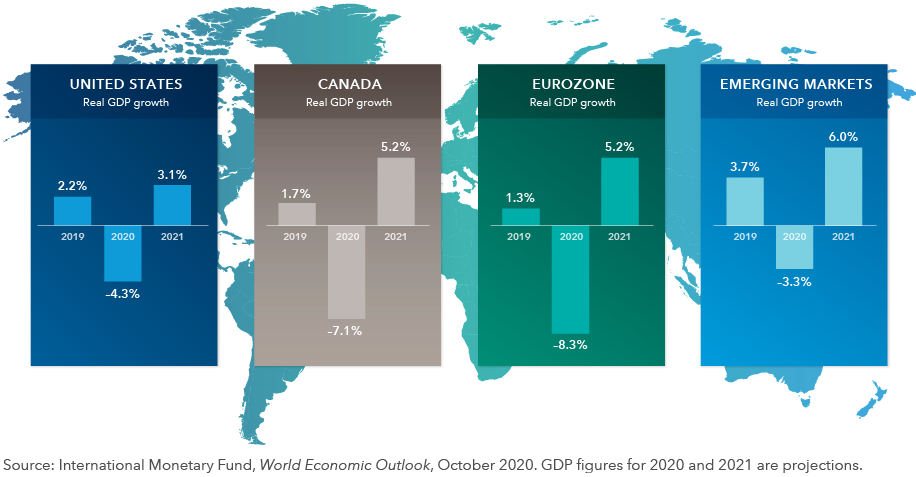

If the U.S. can swiftly administer millions of COVID vaccines by midyear, Franz believes U.S. economic growth could rise to roughly 3% on an annualized basis. That would be one of the strongest U.S. GDP readings of the past decade.

International outlook: Innovation isn’t just a U.S. story

Digital business models have certainly thrived in the U.S., but investors would do well to look beyond geographical borders to find some of the most innovative companies in the world.

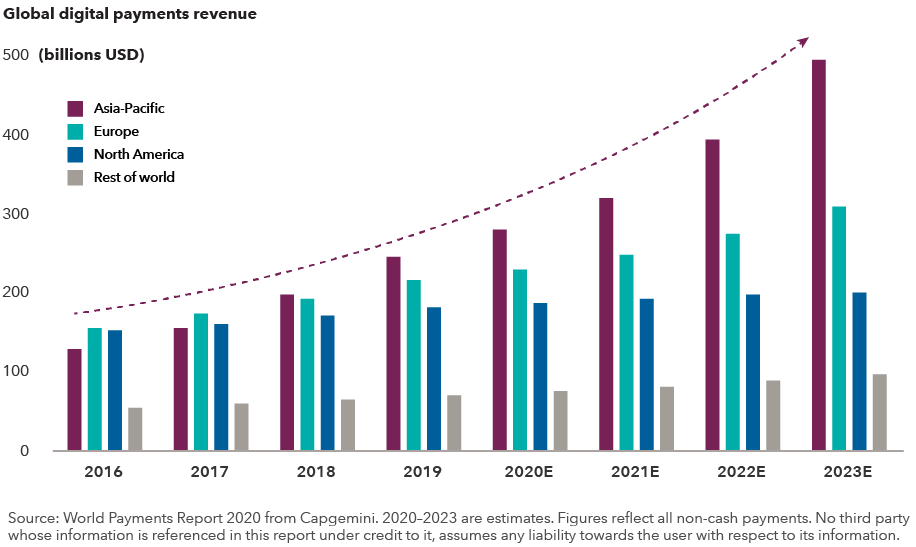

Asian companies, for instance, have rapidly adopted digital payment technologies on a wide scale and, in many respects, the U.S. is playing catch-up. Simply put, cash is no longer king in many non-U.S. markets.

In some emerging markets just a few years ago, many customers had no bank accounts but did have mobile phones — and that led to faster adoption of mobile payments. In China, Alipay (part of Ant Financial) and Tenpay (run by Tencent) are dominant players. Others also have grown rapidly, including Yeahka in China and PagSeguro and StoneCo in Brazil, which provide mobile payment platforms for merchants.

Asia has become the world leader in digital payments

This powerful trend is another reminder why investors shouldn’t ignore opportunities in international and emerging markets. While the U.S. is likely to remain a primary engine for innovation, it would be shortsighted to think of the U.S. as the sole province of inventive companies. What’s more important for investors is to seek out the world’s most innovative companies in growing industries wherever they are located.

Fixed income outlook: Bonds in a bumpy recovery

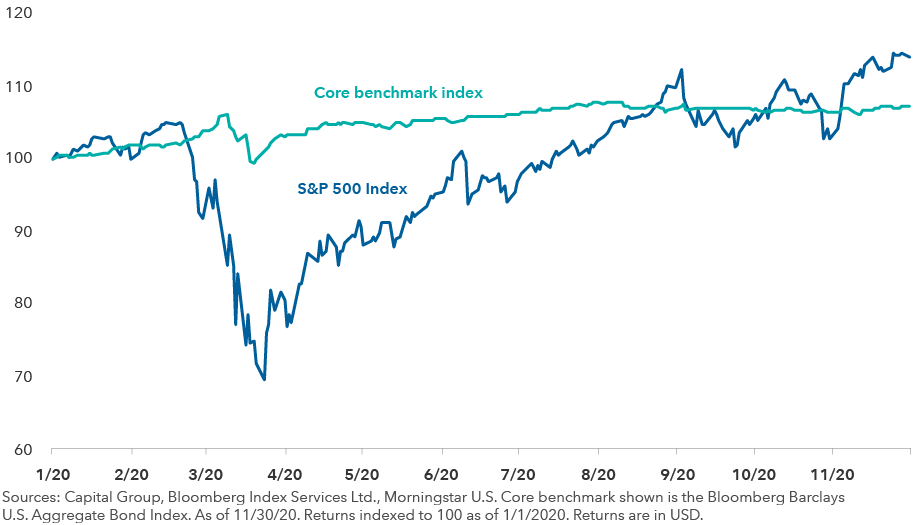

The unprecedented stock market turmoil of 2020 has made one thing abundantly clear: High-quality bonds are not just a potential source of steady and reliable income, they can also perform a crucial task during times of extreme crisis.

In the opening weeks of 2020, some bond bears argued that with most U.S. Treasury yields below 2%, fixed income investments offered little value and might no longer serve as an effective hedge against stocks. Once again, these predictions proved wrong.

In the depths of the bear market while U.S. stocks, as measured by the Standard & Poor’s 500 Composite Index, declined more than 30% in USD, the Bloomberg Barclays U.S. Aggregate Bond Index, a typical benchmark for core bond funds, did exactly what it was supposed to do. It zigged when stocks zagged, providing both diversification and capital preservation. And even as equities have recovered, bonds have held up. The benchmark was up 7.4% in USD as of November 2020.

The U.S. core bond benchmark held steady as stocks sank

“In this challenging market environment, high-quality fixed income has shined,” says Mike Gitlin, Capital Group’s head of fixed income. “Anyone who held a strong core fixed income allocation should be more convinced than ever of its value — and its role in a balanced portfolio.”

*****

About

Jared Franz, Economist

Jared Franz, Economist

Jared Franz is an economist covering the U.S. and Latin America. He has 14 years of investment industry experience. Prior to joining Capital in 2014, Jared was head of international macroeconomic research at Hartford Investment Management Company and an international and U.S. economist at T. Rowe Price. He holds a PhD in economics from the University of Illinois and a bachelor's from Northwestern.

Mike Gitlin, Head of fixed income

Mike Gitlin, Head of fixed income

Mike Gitlin is head of fixed income at Capital Group. He has 26 years of investment industry experience. Before joining Capital in 2015, Mike was head of fixed income and global head of trading for T. Rowe Price. He holds a bachelor's from Colgate University.

Jody Jonsson, Equity portfolio manager

Jody Jonsson, Equity portfolio manager

Jody Jonsson is an equity portfolio manager 31 with years of investment experience, 29 at Capital. She holds an MBA from Stanford and a bachelor's from Princeton. Jody is a CFA charter holder and a member of the CFA Institute.

Copyright © Capital International Asset Management