by Stephen H. Dover, CFA, Franklin Templeton Investments

The economic response to COVID-19 will continue to be the biggest uncertainty stalking global equity markets in 2021. It is likely to continue weighing on global economic activity and to keep pressure on policymakers to produce programmes that support economic activity until an effective vaccine is widely available. And while we have received positive news regarding effective vaccines, widespread inoculation, especially in emerging markets, remains some months off. The positive news on vaccines gives us comfort that COVID-19 will be contained, but the timeline remains uncertain.

For global equity investors, however, we see promise, not only in the sectors benefitting from the profound digital transformation the global pandemic has only pushed into overdrive, but also in several specific regional markets, like Japan and China, that may be beneficiaries of distinctive trends worth watching in the coming year.

COVID-19 Will Be the Main 2021 Story

Now that the US election is largely over, we believe the focus for global equity investors heading into 2021 will be primarily on the economic effects of the global pandemic’s progression. Outbreaks continue to flare up in parts of Europe, the United States and Latin America, while large parts of Asia look to us to be in much better control of the coronavirus.

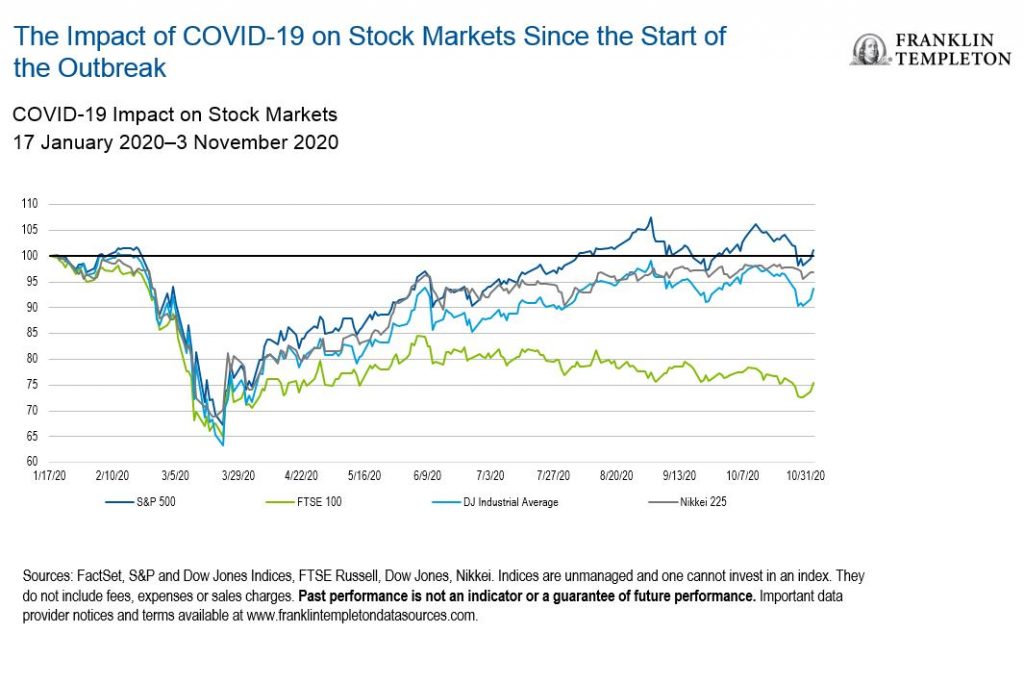

Until the spread of COVID-19 is reduced—probably once one or more vaccines become widely available later in 2021—the outlook for the world economy is likely to remain volatile. Certainly, we have been encouraged by the snapback in economic activity from the disruption the lockdowns caused in the spring of 2020, but the recovery may be stalling, and global gross domestic product remains well below where it was before the pandemic started. Many equity investors are trying to look past the current economic and earnings disruptions towards longer-term earnings growth.

The International Monetary Fund (IMF) expects the global economy to contract 4.4% in 2020, which is an improvement from its June forecasts following a strong rebound in activity in the United States and Europe in the third quarter.1 Next year, the IMF forecasts the global economy will grow 5.2%, with the uncertainty about COVID-19 outbreaks and the potential for renewed restrictions creating more risks to the forecasts, in our view.2 That puts greater pressure on policymakers in the United States and elsewhere to continue supporting their economies through fiscal stimulus.

Encouragingly, we believe the victory of US President-elect Joe Biden could pave the way for some form of stimulus deal to support short-term economic activity. A potentially split Congress, meanwhile, may create a positive backdrop for US markets more broadly over the coming year, as a likely divided Congress reduces the risk of major changes to the US tax code or to health care.

Focusing on Long-Term Themes

In a low growth, low interest-rate world, we believe investors will continue to look to global equity markets for attractive investment opportunities relative to other asset classes. And the trends that have driven equity markets higher since the start of the pandemic, such as digital transformation and innovation in the technology, health care and consumer sectors, are set to continue, in our view.

Technology stocks should remain a key beneficiary. The pandemic has only accelerated several long-term secular trends in how people work, shop and interact with others. We believe remote work and e-commerce will only become more entrenched over the coming decade, as technology companies continue to innovate and offer new tools to help manage this ongoing digital transformation. We would also expect any potential infrastructure bill from a new Congress and presidential administration to include some funds for areas of technology such as 5G and greater broadband access that could further underpin this digitisation story.

For those investors a bit squeamish about the high valuations found in many large technology stocks that have driven the US equity market higher over the past few years, we believe there are plenty of opportunities in overlooked companies all over the world that are benefitting from these same trends but trading at more attractive valuations.

Other sectors such as health care and consumer discretionary are also seeing some promising long-term secular growth drivers. Within health care, we expect an aging global population and growing middle class to support demand for a range of medical services and treatments over the longer term.

Consumer spending also may not completely return to its old patterns after the pandemic ends, with e-commerce, for instance, becoming more entrenched. Travel and leisure, meanwhile, is one area that is still under pressure during the pandemic, but we believe it could rebound strongly once travel is safe again.

Finding Opportunities in Asia

Regionally, we continue to see opportunities in China and other emerging markets, mostly in Asia. We expect they should rebound much more strongly from the economic weakness of 2020 than some of their developed market counterparts. Asian economies in general have been well prepared for both the pandemic and the accelerated shift towards a more digital economy, in our view.

The IMF forecasts that emerging and developing economies overall are likely to grow at 6.0% in 2021 after a 3.3% contraction in 2020.3 Emerging Asia is likely to pace the advance, according to the IMF, with the region growing 8.0% in 2021 and China posting an even faster 8.2% growth rate next year.4

Already, we have seen manufacturing and services in China return to near pre-COVID-19 levels as the government has largely controlled the spread of the coronavirus. We are aware of the host of political risks associated with investing in China but believe there are plenty of interesting Chinese companies in the technology and old economy sectors that are worthy of investment consideration. China’s latest five-year plan also puts an emphasis on self-sufficiency that may help boost domestic industries over time.

Japan too may hold some promise, in our opinion. The September 2020 election of a new prime minister, Yoshihide Suga, could bring structural reforms to the country in the areas of regional bank consolidation and digital transformation. Moreover, we believe Japanese corporations have done a better job of improving their balance sheets than investors have given them credit for, which should create opportunities for fundamentally focused investors.

Within Europe, we are seeing a leadership change out of the United Kingdom, given the market’s large exposure to the financial and energy sectors, and toward Switzerland, with the latter market’s emphasis on the health care and pharmaceutical companies that are in greater demand during the global pandemic. According to MSCI data as of September 30, 2020, financial and energy companies made up about a quarter of the UK index, while health care was 40% of the Swiss market.5 A combination of low interest rates and weak oil prices has turned investors away from industries like banks and oil firms and toward those more defensive growth areas such as pharmaceuticals, in our view. We believe this is a trend that is likely to persist in 2021.

Regardless of how the coronavirus progresses and what the broader economic environment over the coming year looks like, we think global investors should keenly focus on individual company fundamentals when making long-term investment decisions.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in fast-growing industries, including the technology and health care sectors (which have historically been volatile), could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasising scientific or technological advancement or regulatory approval for new drugs and medical instruments. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging market countries are subject to all of the risks of foreign investing generally and have additional heightened risks due to a lack of established legal, political, business and social frameworks to support securities markets.

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

_____________

1.Source: International Monetary Fund, World Economic Outlook, October 2020.There is no assurance that any forecast, estimate or projection will be realised.

2. Ibid.

3. Ibid.

4. Ibid.

5. Source: FactSet, MSCI. Indices are unmanaged and one cannot invest in an index. They do not include fees, expenses or sales charges. MSCI makes no warranties and shall have no liability with respect to any MSCI data reproduced herein. No further redistribution or use is permitted. This report is not prepared or endorsed by MSCI. Important data provider notices and terms available at www.franklintempletondatasources.com.

This post was first published at the official blog of Franklin Templeton Investments.