by Don Vialoux, EquityClock.com

The Bottom Line

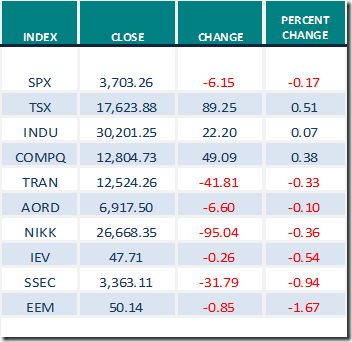

Most major equity indices around the world moved slightly higher or slightly lower last week. Greatest influences remain growing evidence of a second wave of the coronavirus (negative) and timing of distribution of a vaccine (positive)

Observations

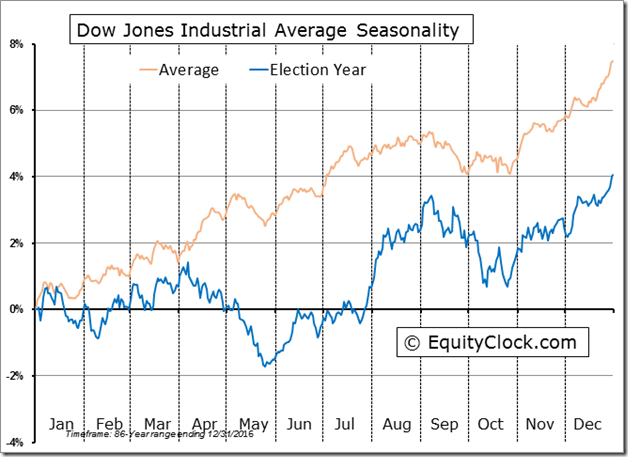

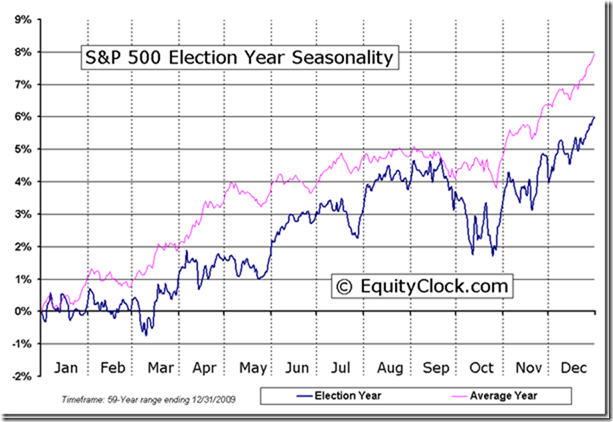

The Dow Jones Industrial Average and S&P 500 Index are following their historic trend after a U.S. Presidential Election. Indeed, the strongest 12 week period during the four year U.S. Presidential Cycle has occurred from U.S. Presidential Election Day to Inauguration Day on January 20th. Since Election Day this year, the S&P 500 Index has gained 9.9%% and the TSX Composite Index has increased.10.6%.

What about this time? Biden was confirmed as President, Republicans maintained control of the Senate with a smaller majority and Democrats maintained control of the House of Representatives with a smaller majority. Net result is political gridlock for the next two years, a scenario that historically has been mildly bullish for U.S. equity markets

A caveat to this observation! The run off Georgia Senate Elections for two seats on January 5th could have a significant impact on U.S. equity prices. After recent elections, the Republicans controlled 50 seats and the Democrats controlled 48 seats. Both Georgia seats currently are held by Republicans. However, recent polls suggest that the battle between the Republican and Democrat candidates is extremely tight with the Democrats leading in one of the two seats. Latest poll results are available at https://projects.fivethirtyeight.com/georgia-senate-polls/ If Democrats win both seats, the Republicans will control 50 seats, the Democrats will control 50 seats and Vice President Kamala Harris will have the power to break voting ties in the Senate. Effectively, the Democrats will gain control over the Senate and will be able to pursue a “progressive” agenda including higher personal and corporate taxes, more regulations, higher government spending and more control over the economy. U.S. equity markets initially will respond to Democrat control by moving lower and gold price will move higher. Meanwhile, look for higher than average volatility in U.S. equity markets between now and January 5th as various polls on the Georgia senate seats are released.

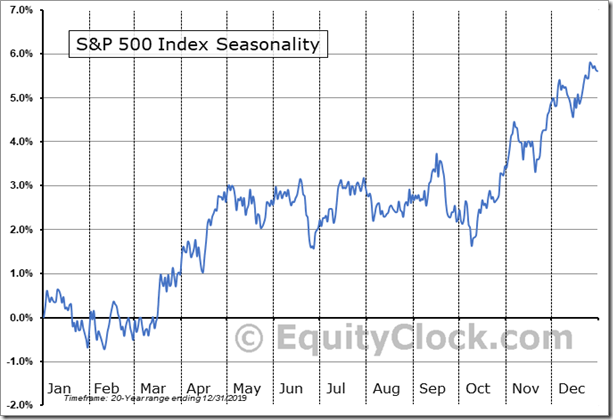

The “Santa Claus rally” is working so far. The rally period normally occurs from the close on December 14th to the close on January 6th. The S&P 500 Index has gained in 22 of the past 30 periods since 1990 for an average return per period of 1.53%. The TSX Composite has gained in 25 of the past 30 periods for an average return per period of 2.13%. This year, the S&P 500 Index has added 1.53% to date and the TSX Composite Index has gained 1.36% to date. Reasons for the Santa Claus rally include yearend “window dressing” by institutional investors, favourable comments by investment dealers about prospects for next year, the end of tax loss selling pressures by individual investors, start of investment of yearend bonuses received by individual investors (frequently placed into RRSPs in Canada and 401K accounts in the U.S.) and a buoyant investment attitude by all investors related to the Christmas/New Year season.

What about the “Santa Claus Hangover? Following is a link to a recent video by Larry Williams that explains the “Santa Claus Rally” as well as the “Santa Claus Hangover” in the U.S. equity market:

Santa Claus Rally Exposed | Larry Williams | Real Trading Special (12.07.20) – YouTube

On average, the S&P 500 Index during the past 20 periods from January 7th to February 14th has dropped 1.5% per period. Effectively, all of the gains recorded during the Santa Claus rally period were lost during the Santa Claus Hangover period. This is the time of year when U.S. consumers and investors are paying down debts accrued during the Santa Claus Rally period.

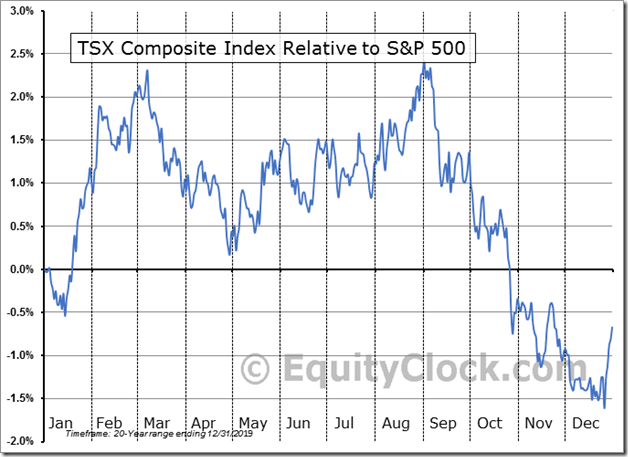

Note that the “Santa Claus Hangover” normally does not happen in the Canadian equity market. The main reason: Canadian investors focus on contributing to their RRSPs during the first 60 days in the New Year and subsequently invest more funds into the equity market. Strongest period in the year for the TSX Composite Index relative to the S&P 500 Index is from mid-December to the first week in March. As indicated in the chart below, average gain per period for the TSX Composite Index relative to the S&P 500 Index during the past 20 periods was 3.3%.

Medium term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 50 day moving average) moved slightly lower last week. It remained extremely intermediate overbought above 80.00%. See Barometer chart at the end of this report.

Medium term technical indicator for Canadian equity markets was virtually unchanged last week. It remained intermediate overbought. See Barometer chart at the end of this report.

Short term short term momentum indicators for U.S. markets/commodities/sectors (20 day moving averages, short term momentum indicators) moved lower last week from elevated levels.

Short term momentum indicators for Canadian markets/sectors remained virtually unchanged at elevated levels last week.

Economic News This Week

December Chicago Purchasing Managers Index to be released at 9:45 AM EST on Wednesday is expected to slip to 56.4 from 58.2 in November

Selective Earnings News This Week

Nil

Trader’s Corner

Equity Indices and Related ETFs

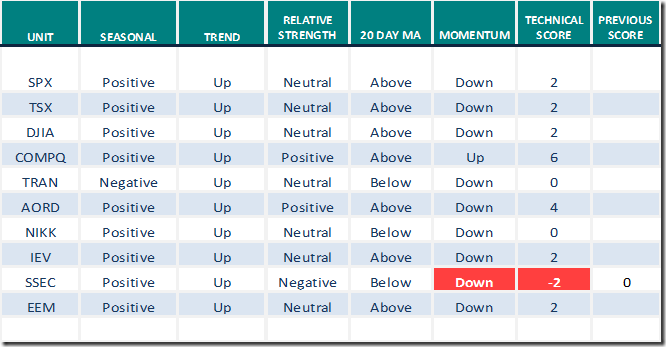

Daily Seasonal/Technical Equity Trends for December 24th 2020

Green: Increase from previous day

Red: Decrease from previous day

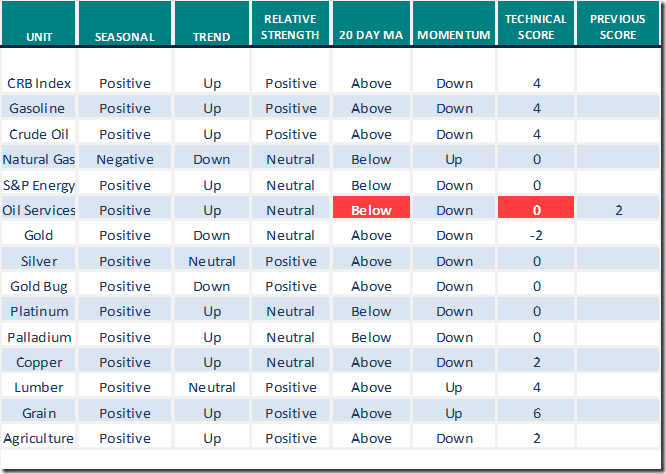

Commodities

Daily Seasonal/Technical Commodities Trends for December 24th 2020

Green: Increase from previous day

Red: Decrease from previous day

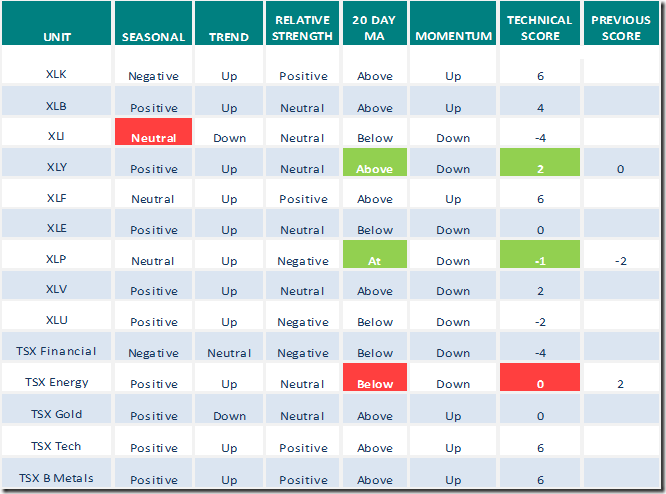

Sectors

Daily Seasonal/Technical Sector Trends for December 24th 2020

Green: Increase from previous day

Red: Decrease from previous day

The Canadian Technician

Greg Schnell offers “Three heart-warming wishes for 2021). Favourable comments are offered on Ballard Power (BLDP), Shopify (SHOP) and Lightspeed (LSPD). Following is a link:

https://stockcharts.com/articles/canada/2020/12/three-heart-warming-wishes-fro-928.html

Changes in Seasonality Ratings

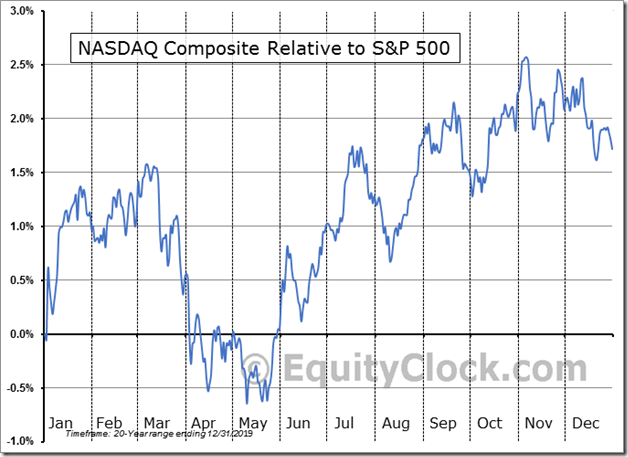

NASDAQ Composite Index and NASDAQ 100 Index change from Neutral to Positive.

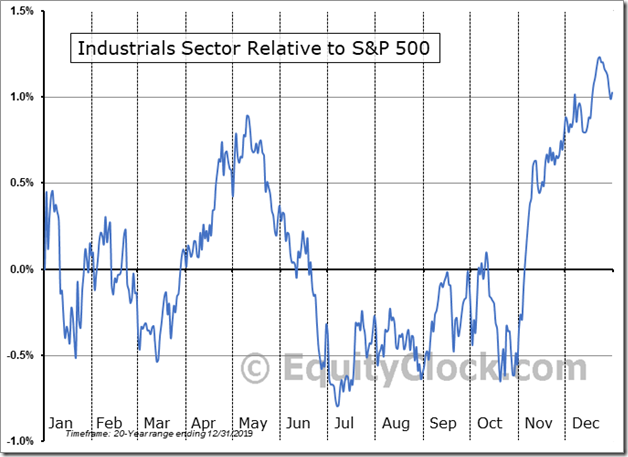

U.S. Industrial sector changes from Positive to Neutral.

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

S&P Momentum Barometer

The Barometer added 3.81 on Thursday, but slipped 1.41 last week to 81.76. It remains extremely intermediate overbought with a rating above 80.00.

TSX Momentum Barometer

The Barometer added 0.47 on Thursday and was unchanged last week at 72.43. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.