by Don Vialoux, EquityClock.com

Technical Notes for Monday December 21st

Kinder Morgan (KMI), an S&P 100 stock moved below $14.00 completing a double top pattern.

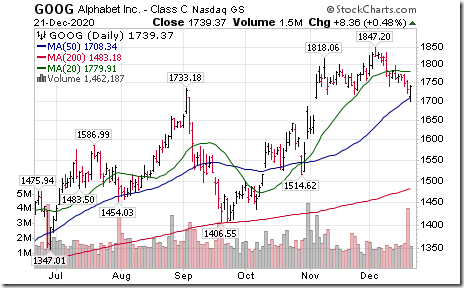

Alphabet (GOOG GOOGL) an S&P 100 stock moved below $1717.30 and $1710.18 respectively completing a double top pattern.

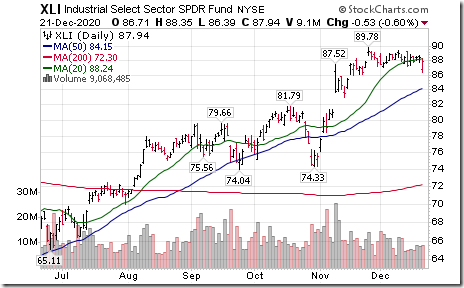

Industrial SPDRs (XLI) moved below $87.53 completing a double top pattern.

Southern Companies (SO), an S&P 100 stock moved below $59.46 completing a double top pattern.

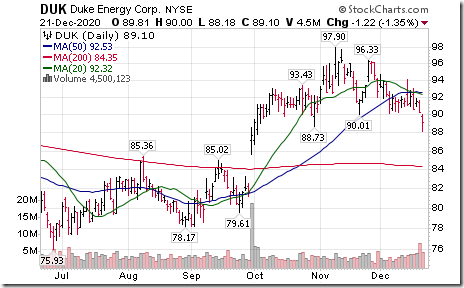

Duke Power (DUK), an S&P 100 stock moved below $87.53 completing a Head & Shoulders pattern.

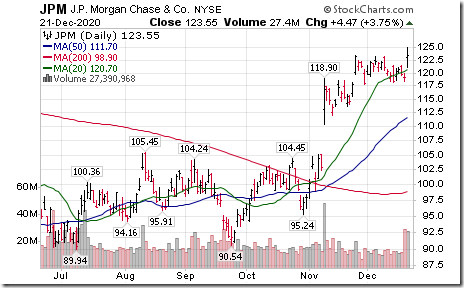

JP Morgan (JPM), a Dow Jones Industrial Average stock moved above $123.50 extending an intermediate uptrend. The company announced a new share buyback program.

TSX CapREIT ETF (XRE.TO) moved below $16.15 completing a double top pattern.

Power Corp (POW), a TSX 60 stock moved below $28.87 completing a double top pattern.

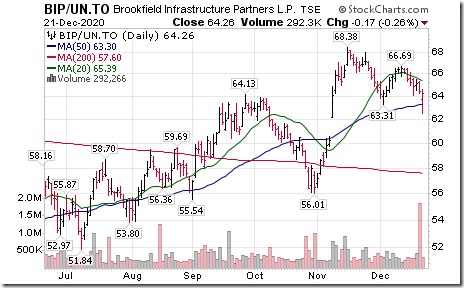

Brookfield Infrastructure (BIP/UN), a TSX 60 stock moved below $63.31 completing a double top pattern.

Waste Connection (WCN), a TSX 60 stock moved below $128.75 extending an intermediate downtrend.

Rogers Communications (RCI.B), a TSX 60 stock moved below $58.44 completing a double top pattern.

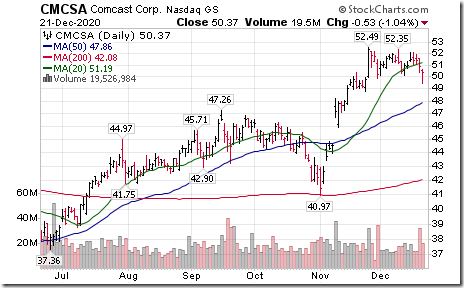

Comcast (CMCSA), an S&P 100 stock moved below $49.84 completing a double top pattern.

Grain ETN (JJGTF) moved above $24.15 extending an intermediate uptrend.

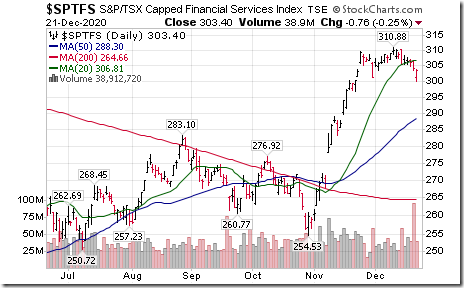

TSX Financials Index ($SPTFS) and its related ETF (XFN.TO) moved below 301.27 completing a double top pattern.

Iron Ore Prices

Demand for raw commodities by China (i.e. think iron ore, copper, zinc, nickel) is soaring as the Chinese economy moves beyond the COVID crisis. Following is a link to a recent report on iron ore: Iron ore price leaps to highest since 2011 – MINING.COM

‘Tis the season for strength in Rio Tinto (RIO) on a real and relative basis from mid-December to the end of February! Following is the link:

https://charts.equityclock.com/rio-tinto-plc-adr-nyserio-seasonal-chart

Trader’s Corner

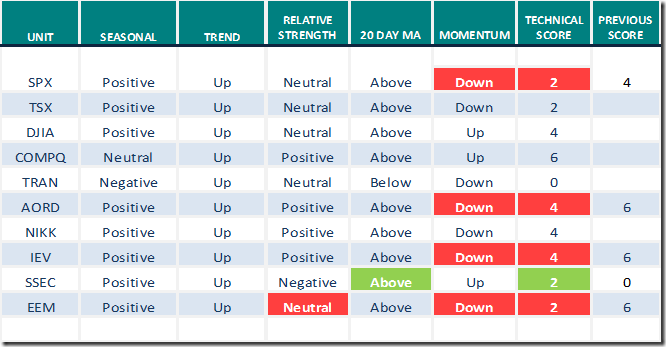

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for December 21st 2020

Green: Increase from previous day

Red: Decrease from previous day

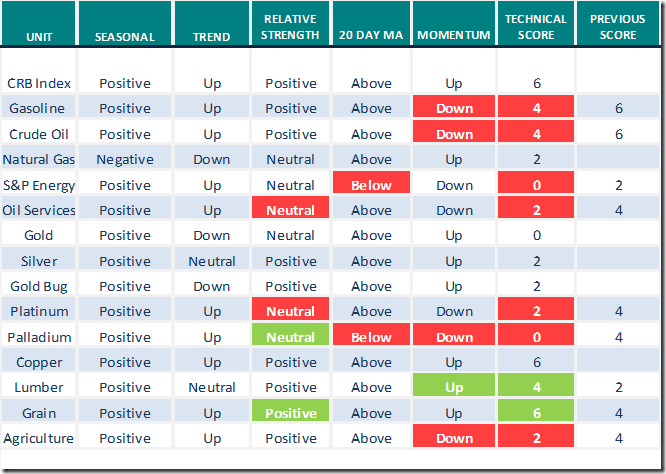

Commodities

Daily Seasonal/Technical Commodities Trends for December 21st 2020

Green: Increase from previous day

Red: Decrease from previous day

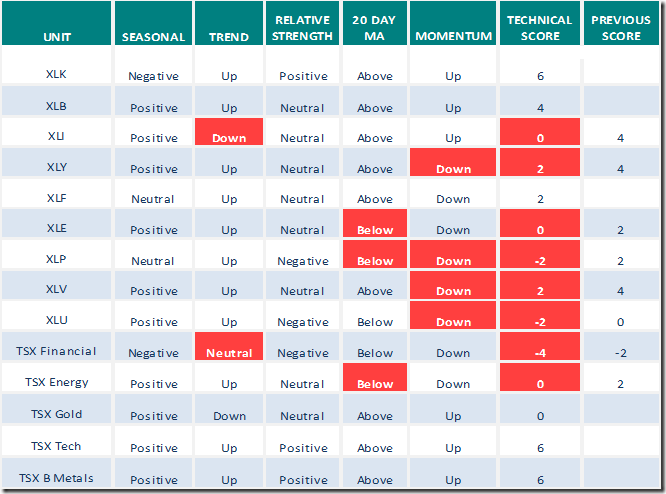

Sectors

Daily Seasonal/Technical Sector Trends for December 21st 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting.com for a link to their weekly comment. Headline reads,”Runaway possible like 1987, like 1998, Santa rally, January effect, Overvaluation stamina, gold seasonals”. Following is a link:

S&P 500 Momentum Barometer

The Barometer dropped 3.41 to 79.76 yesterday. It changed from extremely intermediate overbought to intermediate overbought.

TSX Momentum Barometer

The Barometer dropped 0.93 to 71.50 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.