by Don Vialoux, EquityClock.com

The Wolf on Bay Street

Don Vialoux appears on The Wolf on Bay Street at 7:00 PM tomorrow (Saturday) on Corus Radio 640. Topics include impact on equity market of COVID 19 and the U.S. Presidential election. Following is a link:

https://globalnews.ca/radio/640toronto/player/#/

Technical Notes for Thursday October 29th

Technical weakness in U.S equity markets continued in early trading yesterday. S&P 100 and NASDAQ 100 stocks that broke intermediate support by 10:00 AM included BKNG, MCD, ROST, CVS, KO, MNST, WBA, PFE, MMM, WLTW and VRSK. Selected ETFs that broke intermediate support included XOP, XLP, DIA, EWZ, GDXJ, UGA and USO.

After 10:00 AM EDT, additional equities and ETFs that moved below intermediate support included PICK, EA, FM.TO, SU.TO, YRI.TO and IPL.TO. No intermediate breakouts!

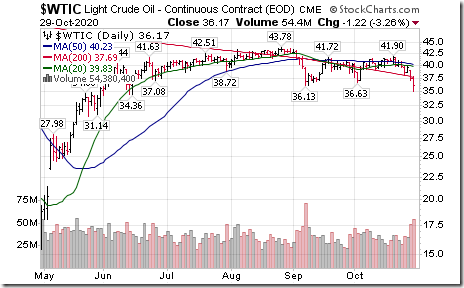

A clear breakdown in WTI crude oil prices:

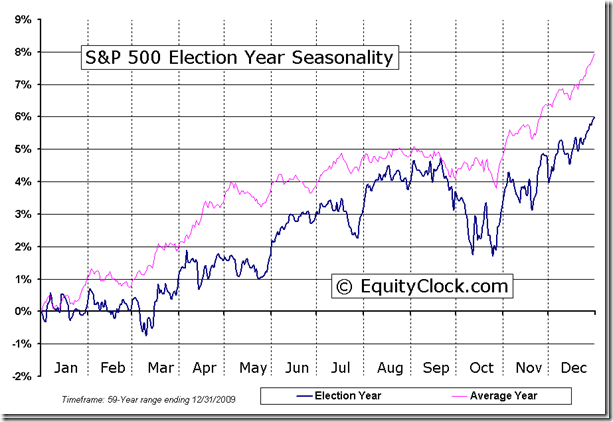

Seasonal influences turn positive for the S&P 500 Index just before U.S. Presidential Election Day. Historically, the Index has moved higher during the next 12 weeks to Inauguration Day

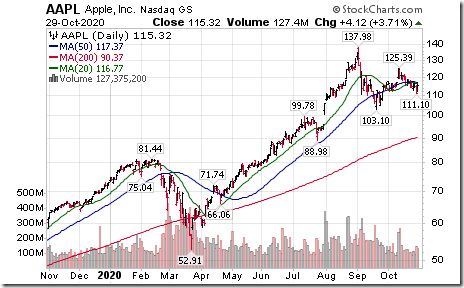

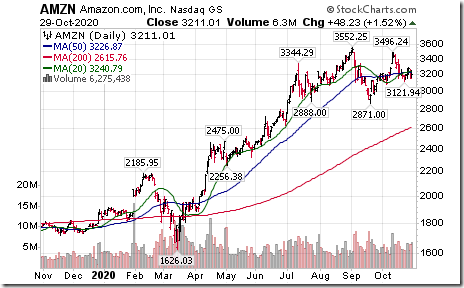

Responses to Quarterly Reports released by Tech Companies

Face Book, Alphabet, Amazon, Apple and Twitter reported higher than consensus third quarter results after the close last night. Responses were mixed:

Trader’s Corner

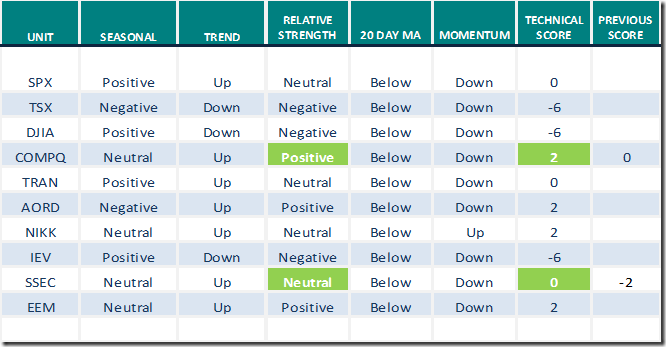

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for October 29th 2020

Green: Increase from previous day

Red: Decrease from previous day

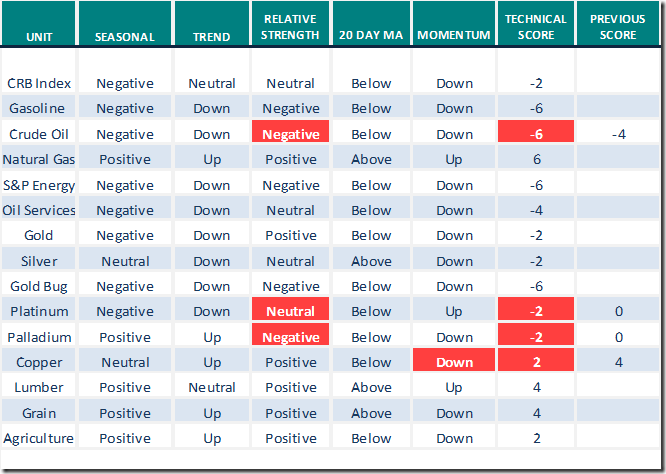

Commodities

Daily Seasonal/Technical Commodities Trends for October 29th 2020

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for October 29th 2020

Green: Increase from previous day

Red: Decrease from previous day

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

|

|

|

|

This post was originally publised at Vialoux's Tech Talk.

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2020/10/clip_image0025_thumb-10.png)

![clip_image002[7] clip_image002[7]](https://advisoranalyst.com/wp-content/uploads/2020/10/clip_image0027_thumb-6.png)