by Scott Brown, Ph.D., Chief Economist, Raymond James

Chief Economist Scott Brown discusses current economic conditions.

By now, it should be clear that COVID-19 is not going to go away anytime soon. Consumers and businesses are getting used to living and working under the pandemic and some changes, such as the tendency to work from home, will likely be long-lasting. The economy is always evolving. However, rapid changes can be destabilizing. There will be a number of challenges in the new year.

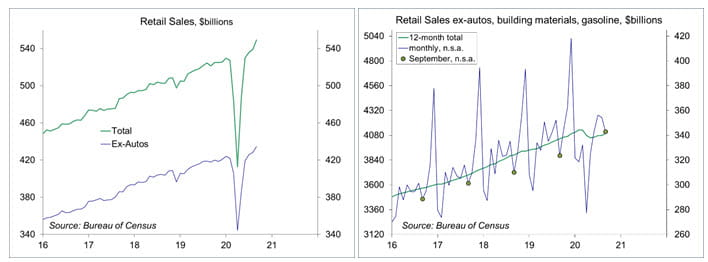

The mid-month economic reports added further to picture of a mixed recovery. Retail sales posted a stronger than expected gain in September, boosted partly by a seasonal quirk. Department store sales jumped 9.7% (-7.0% before seasonal adjustment, vs. -15.5% in September 2019) and clothing store sales surged 11.0% (-4.3% before seasonal adjustment, vs. -18.0% in September 2019). Consumers didn’t exactly “flock to the mall.” August (not September) is the month for back-to-school sales. Reduced strength this August led to a smaller seasonal decline into September – hence, a strong seasonally-adjusted gain. Still, there were gains in other areas. Motor vehicle sales rose 3.6% (-2.6% before seasonal adjustment), up 9.1% from February.

Overall retail sales were 4.2% higher than in February, although results are mixed across sectors. Auto dealerships, home furnishings, home improvement, sporting goods, and grocery stores are all doing better than before the pandemic. However, department stores, clothing stores, gasoline sales, and restaurants, while improved in the last few months, remain far below where they were in February. Moreover, the major hit from the pandemic has been in consumer services and it will be a long time before we get a full recovery in tourism, air travel, and spectator events.

Manufacturing output unexpectedly fell 0.3% in September (-5.7% y/y). Despite stronger retail auto sales, motor vehicle production fell 4.0%, down 5.5% from February (while consumer demand is strong, fleet sales to business are weak). Manufacturing has adapted to working under the pandemic, but that’s not been easy. Social distancing has slowed production to some extent, and supply chains are still not functioning smoothly. There were anecdotal reports of stockpiling in supplies and materials before strict social distancing guidelines this spring. Manufacturing inventories edged up in 2Q20, while wholesale and (especially) retail inventories fell. In contrast, manufacturing inventories fell in the first two months of 3Q20, while wholesale and retail inventories have risen.

Foreign trade has also been affected by the pandemic. U.S. exports fell further than imports into April, widening the trade deficit, while exports have been much slower to rebound than imports in recent months, adding further to the trade deficit.

Import prices have picked up amid increased demand, but mostly in industrial supplies and materials. Inflation in imported finished goods has increased some, but is still limited. The Producer Price Index rose 0.4% in September (+0.4% y/y). That report showed an increase in pipeline inflation pressures, likely reflecting supply chain issues and inventory rebuilding. The Consumer Price Index rose 0.2% in September (+1.4% y/y), also up 0.2% excluding food and energy (+1.7% y/y). A 6.7% increase in the price index for used vehicles (which followed a 5.4% rise in August) offset declines in car insurance, airfares, and apparel.

With the pandemic lasting longer than many anticipated, working from home is expected to be a long-lasting change. That has led to increased demand for housing, which is not typical in weak economy. A home has two functions. It provides shelter and it’s an asset, which can appreciate over time. In the Consumer Price Index, the Bureau of Labor Statistics seeks to measure the shelter price, not the asset, and (for homeowners) it considers what it would cost to rent the house. Owners’ equivalent rent, which accounts for nearly a quarter of the CPI, rose 0.1% in September, up 2.5% from a year ago (vs. +3.4% for the 12 months ending September 2019).

In the months ahead, economic activity is expected to expand further, but will remain mixed as consumers and businesses adapt to living under the pandemic. Unemployed workers will be reallocated, but these transitions are rarely smooth and quick. There will be a number of challenges in the new year, including increased pressures on state and local governments. The Fed will continue to ensure an adequate level of liquidity in the system, likely keeping short-term interest rates near 0% through 2023. Fiscal support is more effective in the current environment. Those at the lower end of the income spectrum have been hit harder during the pandemic and the transition to new employment will be long. Without further support, we are likely to see an increase in foreclosures and evictions, but nothing like the housing collapse a little more than a decade ago. Temporary layoffs are more likely to become permanent and softness in the overall economy may lead firms to trim payrolls to reduce costs.

Recent Economic Data

Retail sales rose 1.9% in the initial estimate for September, a stronger gain than expected, but partly reflecting seasonal quirks (clothing and department store sales were weaker than usual this summer, so a smaller seasonal decrease in the fall). Sales were generally stronger across categories (except electronics and appliance stores, down 1.6%). Motor vehicle sales rose 3.6% (up 9.1% from February and +10.9% y/y). Sales at department stores jumped 9.7% (-7.0% before seasonal adjustment, compared to -15.5% in September 2019). Clothing store sales rose 11.0% (-4.3% before seasonal adjustment, compared to -18.0% in September 2019).

Overall retail sales were 4.2% higher than in February, but results remained mixed across sectors. Auto dealerships, home furnishings, home improvement, sporting goods, and grocery stores are all doing better than before the pandemic. However, department stores, clothing stores, gasoline sales, and restaurants, while improved in the last few months, remain far below where they were in February.

Industrial production fell 0.6% in the initial estimate for September (-7.3% y/y), partly reflecting a 5.6% drop in the output of utilities (-6.1% y/y). Manufacturing output fell 0.3% (-5.7% y/y), with motor vehicle production down 4.0% (+0.4% y/y). Ex-vehicles, factory output was unchanged (-6.5% y/y), mixed across industries.

Manufacturing output fell sharply in February and March, especially in motor vehicles. All major industries are still below pre-pandemic levels, except for technology (likely all those laptops needed for working from home).

Gauging the Recovery

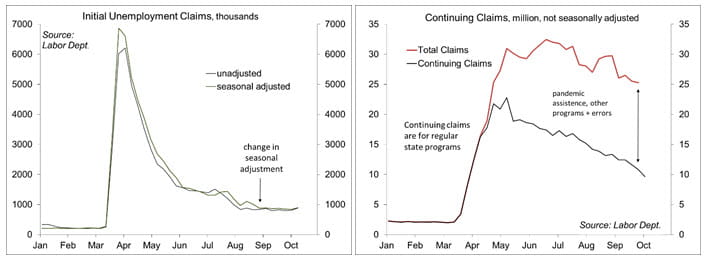

Jobless claims, a leading economic indicator, rose to 898,000 in the week ending October 10. However, California, which had accounted for around 30% of U.S. claims in September, remained in a pause in processing claims. The four-week average was 866,250 – still an extremely high trend (although less horrific than in March and April). Continuing claims (for regular state unemployment insurance programs), a coincident economic indicator, fell by 1,165,000 (week ending October 3) to 10.018 million.

The New York Fed’s Weekly Economic Index rose to -3.91% for the week of October 10, up from -4.57% a week earlier (revised from -4.18%) and a low of -11.45% at the end of April, consistent with a moderation in the pace of the recovery. The WEI is scaled to four-quarter GDP growth (for example, if the WEI reads -2% and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2% lower than a year previously). Note that the weekly figures are subject to revision

The University of Michigan’s Consumer Sentiment Index rose to 81.2 in the mid-month assessment for October (the survey covered September 30 to September 28), vs. 80.4 in September and 74.1 in August. Mid- October ratings remained sharply split by political affiliation (Republican: 100.6, vs. 98.9 in September, Democrat: 69.5, vs. 67.7, Independent: 75.7, vs. 76.6).