by Don Vialoux, EquityClock.com

Technical Notes for Wednesday September 23rd

Twitter (TWTR), a NASDAQ 100 stock moved above $48.42 extending an intermediate uptrend.

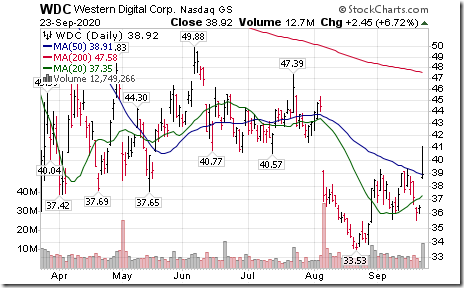

Western Digital (WDC), a NASDAQ 100 stock moved above $39.26 setting an intermediate uptrend.

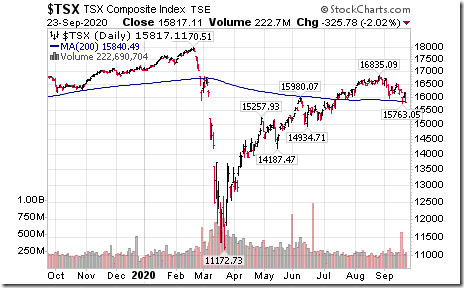

TSX Composite Index moved below its 200 day moving average at 15,840.49 implying a long term negative change in momentum by the Canadian equity market.

AMEX Gold Bug Index moved below 318.84 completing a double top pattern.

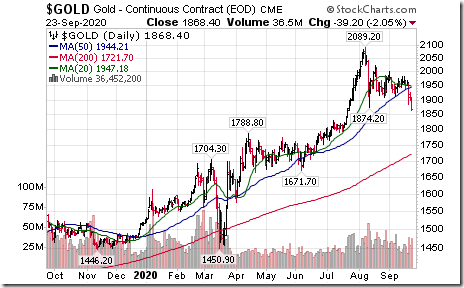

Spot Gold futures moved below $1874.20 completing a double top pattern.

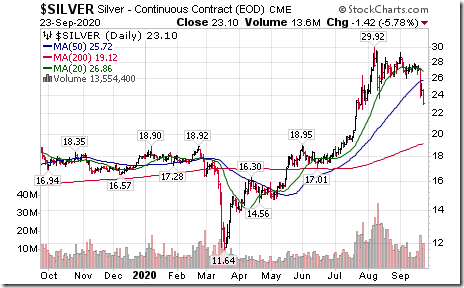

Silver futures moved below US$23.58 completing a double top pattern.

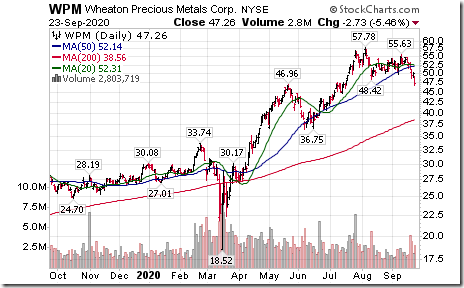

Wheaton Precious Metals (WPM), a TSX 60 stock moved below US$48.42 completing a double top pattern.

Ditto for another silver stock! Pan American Silver (PAAS) moved below US$31.79 completing a double top pattern.

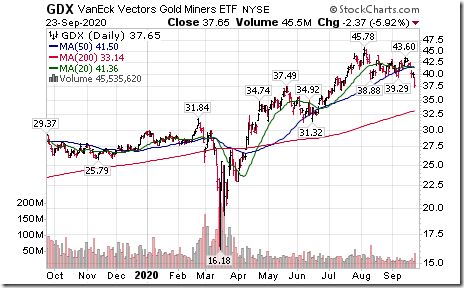

U.S. Gold Equity ETF (GDX) moved below $43.60 completing a double top pattern

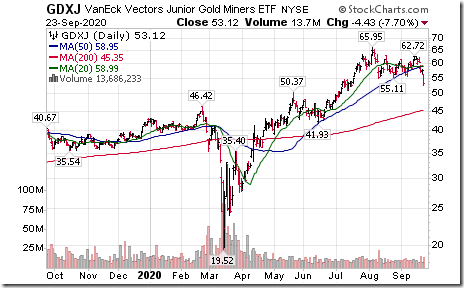

U.S. Junior Gold Equity ETF (GDXJ) moved below $55.11 completing a double top pattern.

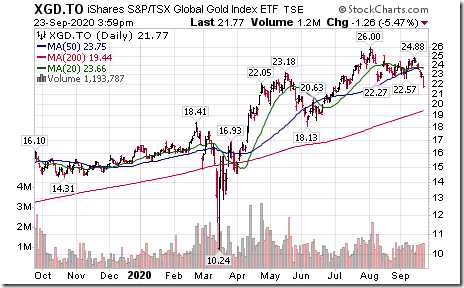

TSX Gold iShares (XGD) moved below Cdn$22.27 completing a double top pattern.

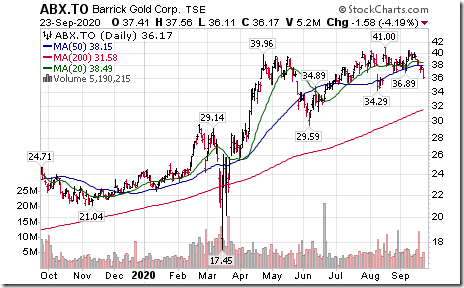

Barrick Gold (ABX), a TSX 60 stock moved below Cdn$36.89 completing a double top pattern.

Yamana Gold (YRI), a TSX 60 stock moved belowCdn$7.58 completing a double top pattern.

Agnico Eagle (AEM), a TSX 60 stock move below US$75.68 and Cdn$99.91 completing a double top pattern.

Kinross Gold (KGC), a TSX 60 stock moved below US$8.24 completing a double top pattern.

Invesco Base Metals ETN (DBB) owning a 1/3 weight each in copper, zinc and aluminum futures moved below $15.05 completing a double top pattern.

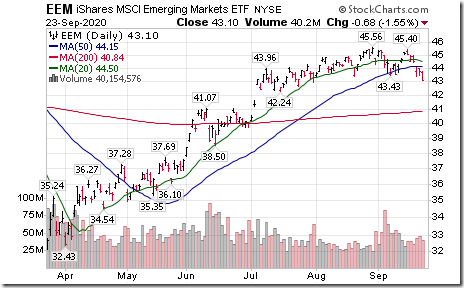

Emerging Markets ETF (EEM) moved below $43.43 completing a Head & Shoulders pattern.

TSX REIT iShares (XRE) moved below $14.40 setting an intermediate downtrend.

Boeing (BA), a Dow Jones Industrial Average stock moved below $153.41 extending an intermediate downtrend.

Russia iShares (RSX) moved below $21.18 extending an intermediate downtrend.

Abbott Labs (ABT), an S&P 100 stock moved below $102.42 setting an intermediate downtrend.

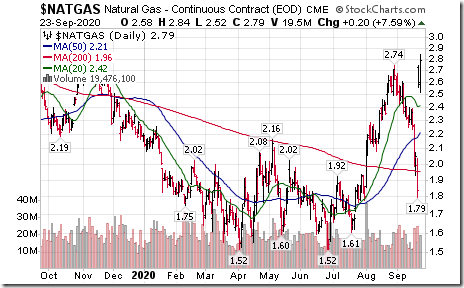

Natural Gas futures moved above $2.74 per MMCF re-establishing an intermediate uptrend. (Note that most of the change was related to a move to a later futures contract)

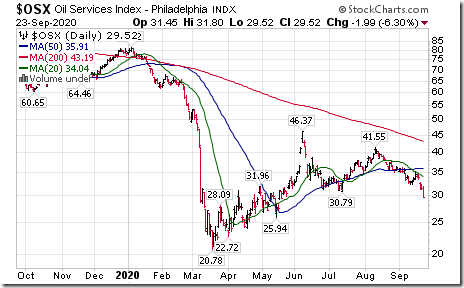

Philadelphia Oil Services ETF moved below $30.79 setting an intermediate downtrend.

Trader’s Corner

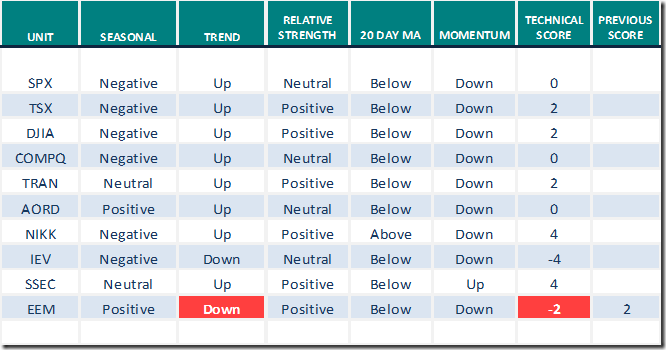

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for September 23rd 2020

Green: Increase from previous day

Red: Decrease from previous day

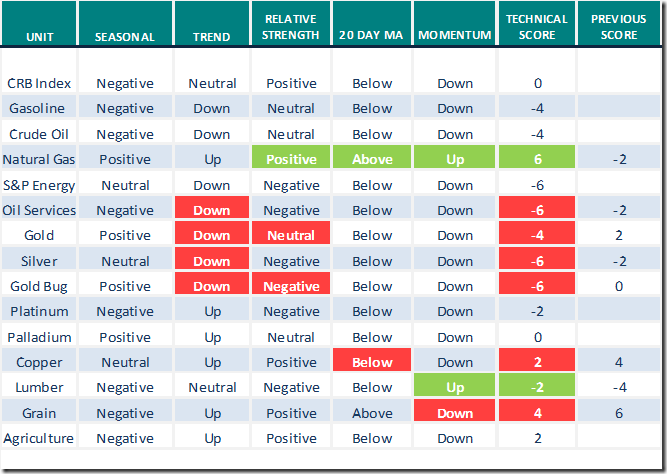

Commodities

Seasonal/Technical Commodities Trends for September 23rd 2020

Green: Increase from previous day

Red: Decrease from previous day

* See chart and comment on natural gas below

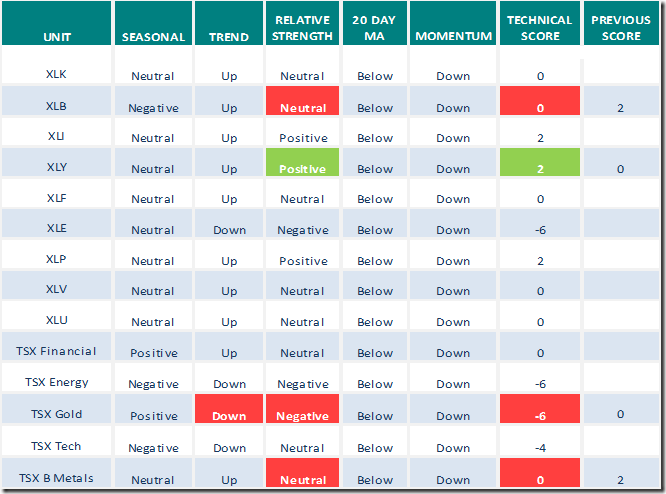

Sectors

Daily Seasonal/Technical Sector Trends for September 23rd 2020

Green: Increase from previous day

Red: Decrease from previous day

Market Buzz

Greg Schnell comments on “Financials under pressure”. Following is a link:

https://www.youtube.com/watch?v=4Qo1x23hdiw&feature=youtu.be

Excerpts from Josef Schachter’s latest energy outlook

Top energy analyst Josef Schachter remains cautious/bearish on the short/medium term outlook for North American energy prices and energy stocks. As noted above, the technical picture for the sector remains negative. Breakdown by the oil services ETF yesterday provided additional evidence for the bearish technical call. Josef continues to look for an important low for the sector sometime during the fourth quarter. His service is well worth following for timing of the next important inflection point for the sector. Services are available by subscription at www.schachterenergyreport.ca

Following is an excerpt from his recent comments:

Conclusion:

As we write this, WTI for October is up modestly over US$40/b. We don’t see this as lasting as inventories will start to build again once all US production returns on the Gulf and other places shut-in last week. In addition the increase in production by OPEC will at some point depress prices. It is likely with the rise in coronavirus cases and more business closures that energy demand will wane and OPEC may be forced to cut production once again. The psychological level of US$40/b is being tested and if we breach support at US$36.13/b then it is likely that any bad news on the vaccine or the US moving into a Wave Two situation would trigger WTI crude prices falling below US$30/b during Q4/20.

We see most energy stocks have significant downside risk. The most vulnerable companies are energy and energy service companies with high debt loads, high operating costs, declining production, current balance sheet debt maturities of some materiality within the next 12 months and those that produce heavier crude barrels. Results for Q3 and likely Q4/20 for most energy and energy service companies should be short of the prior year’s level, which when reported will also add to the downside pressure.

Hold cash and remain patient for the next low risk BUY window expected during Q4/20.

The S&P/TSX Energy Index is now at the 69 level today. From the June high at 96 when we recommended profit taking, the index is down by 28%. We see much more downside over the coming months. The support is now at 66.99. When this is breached the next downside target for the index is around the 50 level. Further lows are likely in Q4/20 as tax loss selling is sizing up to be very nasty this year.

Our subscriber September SER Monthly will be out tomorrow and we cover the breakdown in the FAANG momentum stocks and why we see significant downside for the general markets. In the issue we also have a review of insider trading in the energy sector and which companies are seeing purchases by their key insiders.

Subscribe to the Schachter Energy Report and receive access to all archived Webinars, Action Alerts, TOP PICK recommendations when the next BUY signal occurs, as well as our Quality Scoring System review of the 27 companies that we cover. We go over the markets in much more detail and highlight individual companies in our two monthly reports. If you are interested in the energy industry this should be of interest to you.

S&P 500 Momentum Barometer

The Barometer dropped another 12.22 to 25.65 yesterday. It remains intermediate oversold, but continues to trend down.

TSX Momentum Barometer

The Barometer plunged 16.75 to 27.27 yesterday. It returned once again from intermediate neutral to intermediate oversold on a move below 40.00 and continues to trend down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.